Current exchange rate is supporting lamb prices

With approximately 60% of lambs slaughtered in Northern Ireland being marketed in continental Europe and 45% of the lambs produced in Northern Ireland exported live to the Republic of Ireland, the exchange rate plays a crucial role in determining how competitive our lamb is in the market place.

Over the past 12 months farmers have experienced the Euro being at a 5 year low against Sterling when €1 was worth just £0.69 in July 2015. As the year went on the Euro strengthened against Sterling (€1 = £0.73 at Christmas) and by early July 2016 the Euro was back into territory it had not been in since mid-2013 when €1 equated to £0.85.

Advertisement

Advertisement

The fallout and economic uncertainty which has been caused by the EU referendum decision has been a major contributor to this occurrence and while long term there are a lot of unknowns surrounding the future of UK agriculture policy, the current exchange rate has provided some welcome support to Northern Ireland’s lamb price.

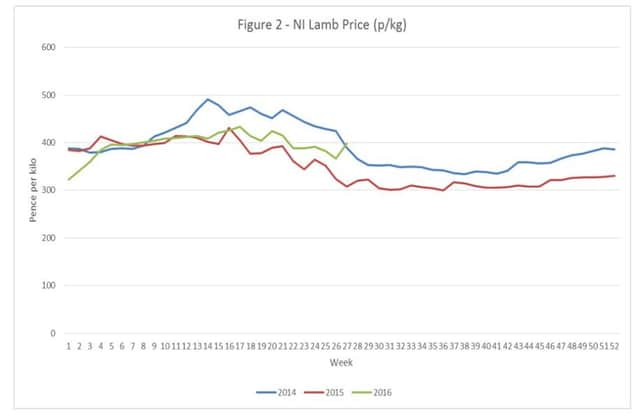

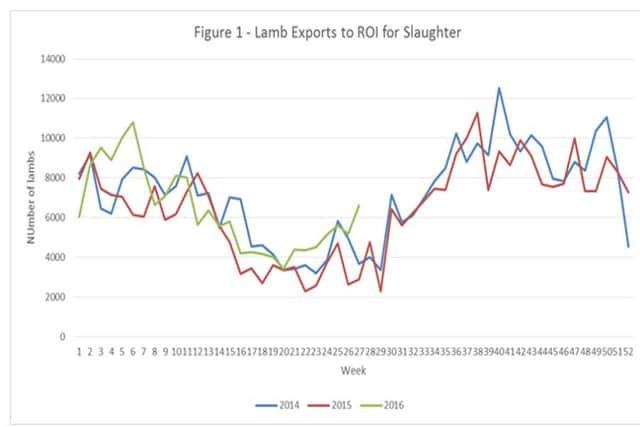

Figure 1 presents an overview of the number of lambs exported to the Republic of Ireland for slaughter between January 2014 and July 2016. With the Euro in a weaker position in 2015, it is clear that this reduced the buying power of ROI processors sourcing lambs from Northern Ireland, particularly between April and August when the Euro was at its weakest. With less competition for lambs, this left NI processors in a stronger position and this is reflected in Figure 2 when deadweight prices dropped as low as 301p/kg in late July 2015. While prices improved marginally going into the autumn, for most sheep producers this was a year to forget.

While difficulties with weather have added cost to lamb production this spring, by and large prices for new season lamb have shown reasonable improvement in 2016. Between late April 2016 and July 2016 deadweight lamb prices have on average been 397p/kg compared with 359p/kg during the same period in 2015. This difference of 38p/kg has put an extra £8 on a 21kg lamb.

While the run-up to the Muslim festivals of Ramadan in early June and Eid-al- Fitr in early July have injected some much needed demand into the market place for sheep meat, what has also been noticeable throughout the new season has been the significant increase in demand from ROI for Northern Ireland lambs.

Advertisement

Advertisement

Between late April and July 2016 47,000 lambs were exported to ROI for slaughter. This compares against 32,000 and 41,000 in 2015 and 2014. In percentage terms this equates to 40% (2016), 27% (2015) and 32% (2014) of the total lambs produced in Northern Ireland during this period being exported to Republic of Ireland for slaughter.

While we cannot ignore the trade distortions caused by the introduction of EU sheep meat labelling laws in April 2015, this is an unusually high level of exports to ROI during this period of months when we compare against previous years. Normally this level of export trade does not kick in until August.

Other factors to take into account this year are the slower supplies of new season lambs to date. From late April to date, supplies are running about 9% behind last year and 14% behind 2014. With lamb numbers not expected to be much different to 2015, these lambs will appear on the market at some stage, but obviously the hard spring has taken its toll on lamb performance.

Looking at the trade from a UK perspective, supplies right across the regions are slower to come forward this year. With around a third of UK sheep meat exported to the EU, weak Sterling against the Euro should make UK lamb more competitive in the Eurozone.

Advertisement

Advertisement

In terms of imports into the UK a stronger Euro is likely to make imports of lamb from the EU less attractive. As Republic of Ireland is the main EU exporter of lamb into the UK this isn’t all good news for Northern Ireland sheep producers given our dependency on Republic of Ireland processors to inject competition into our local market.

Also worth taking into account is that Sterling has plunged to a three year low in terms of value against the New Zealand dollar. With New Zealand lamb supplies lower than last year, China increasing their purchase of New Zealand lamb and the Sterling-Dollar exchange rate against them, this potentially will mean less New Zealand lamb being imported into the UK this year.

Overall, the fundamentals in the new season sheep trade have been better this year. Hopefully stronger market returns can be sustained throughout 2016, however unfortunately no one has the good fortune of being able to read the future market with any great certainty and there will undoubtedly be some twists and turns as the year goes on.

Market demand for lambs is obviously another key consideration and in order to maximise demand for local lamb it is crucial that we make our product as attractive to as many markets as possible.

Advertisement

Advertisement

In this respect, producers are encouraged to take into account the end market specification. Lamb carcases carrying too much weight and fat will do little to attract consumers to pick lamb for the weekly shop in most major outlets.