NI weekly market report

and live on Freeview channel 276

03 January 2023

Grains

Wheat – The possible impact of the extreme conditions in the US on this year’s crop remains a watchpoint for markets.

However, competitively priced Russian exports will continue to add pressure to global wheat markets.

Maize

Advertisement

Advertisement

Dryness in Argentina acts as the bullish factor for maize markets at the moment.

However, gains will likely be capped by good Brazilian crop prospects as well as concerns over Chinese demand.

Barley

Barley markets continue to track the wider sentiment in global grain markets.

Global markets

From 23 December to 30 December, May-23 Chicago wheat futures gained $5.97/t, to close at a four week high of $293.46/t.

Advertisement

Advertisement

Earlier in the week, US wheat markets were supported by the possible impact of the extreme cold and dry conditions on this year’s crop, before coming back down on the back of pressure from Russian exports.

However, prices rallied again towards the end of the week, driven by stronger than expected US export sales. In the week ending 22 December, US wheat export sales came in at 511.1Kt, according to latest data from the USDA.

This is higher than the trade estimate range of 200Kt – 450Kt (Refinitiv).

Looking closer to home and Paris milling wheat futures (May-23) lost €2.00/t from 23 December to settle at €306.25/t on 30 December.

Advertisement

Advertisement

Unlike UK and US markets, Paris futures were trading yesterday, with the May-23 contract remaining unchanged from Friday, but the Dec-23 contract lost €1.00/t to settle at €288.75/t.

EU markets have been under pressure from the prospects of increased Russian wheat exports.

In its latest estimates on Friday, Sovecon raised its full season Russian wheat export forecast by 200Kt to 44.1Mt. Russian wheat continues to price aggressively on the export market.

Just last week, Egypt’s state grain buyer GASC, bought 200Kt of Russian wheat on a World Bank funded tender.

Advertisement

Advertisement

US maize markets have also been supported over the Christmas period, with Chicago maize futures (May-23) closing at $266.93/t on Friday (30 December), up $5.12/t from 23 December.

While markets closed up over the week, driven by the impact of dryness in Argentina, the May-23 contract dipped from Wednesday’s seven week high of $268.31/t.

This was driven by good crop prospects from Brazil, as well as concerns over Chinese demand and the continued trade flow from Ukraine.

UK focus

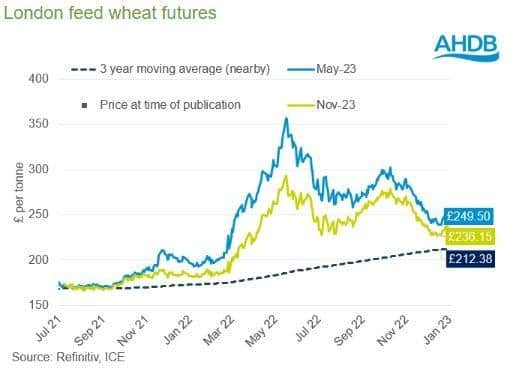

UK markets followed the upward trend seen in US markets last week. May-23 UK feed wheat futures closed at £251.00/t on Friday, up £4.00/t from 23 December. The Nov-23 contract rose by £3.15/t over the same period, to close at £236.15/t.

Advertisement

Advertisement

On 20 December, AHDB published the final results of the 2022 Early Bird Survey of cropping intentions. For harvest 2023, the wheat area is expected to remain relatively unchanged at 1,821Kha, while the total barley area is expected to be down by 2% at 1,082Kha, driven by a reduction in spring planting intentions.

Oilseeds

Rapeseed

Rapeseed prices are tracking market movements in the wider oilseed complex.

Longer-term, the large Canadian canola crop and bumper soyabean crops could weigh on rapeseed markets.

Soyabeans

Short-term, the ongoing drought in Argentina will continue to influence market movements, while there remains a question mark around Chinese demand.

Advertisement

Advertisement

Longer-term, despite the drought in Argentina, the overall bumper south American crops will likely limit any major gains.

Global markets

South American weather remains a key concern for southern hemisphere supply of soyabeans, as harvest of the anticipated bumper crop approaches. Over the Christmas period, the ongoing drought in Argentina, combined with strong export demand, gave some support to global soyabean markets.

Tight Indonesian supply of palm oil also strengthened the oilseeds complex.

Between Friday (23 December) and Friday (30 December) Chicago soyabean futures (May-23) gained 2.7%, closing at $562.12/t. The Nov-23 contract gained 1.7% over the same period.

Advertisement

Advertisement

As at 28 December, soyabean plantings in Argentina were 72.2% complete, still far behind the five-year average of 86.1% for this point in the season, according to latest data from Buenos Aires Grain Exchange.

With higher-than-average temperatures and little rain forecast over the next week, planting progression and crop development will remain a watchpoint.

While concerns remain over southern hemisphere supply, it had been expected that Chinese demand would recover slightly as the country eased its strict COVID-19 restrictions.

However, after the relaxation of restrictions, an increase in cases followed. Therefore, demand from the nation remains uncertain and is something to monitor for the soyabean outlook.

Advertisement

Advertisement

Expectations of slowing production and a tighter supply outlook in Indonesia are also adding some support to palm oil markets.

Officials in Indonesia said on Friday that export rules would be tightened in the country in order to ensure enough affordable cooking oil domestically, putting pressure on global supply.

Rapeseed focus

Paris rapeseed futures (May-23) closed yesterday (02 Jan) at €587.50/t, up 2.6% from 23 December.

The Nov-23 contract saw a 2.8% rise over the same period, also closing at €587.50/t.

Advertisement

Advertisement

These price increases follow the gains made in the wider oilseed complex, as well as rapeseed markets continuing to react to any news on Ukrainian and Russian exports.

In the same period over Christmas, the sterling weakened against the euro by 0.56%.

The final results of this year’s Early Bird Survey showed another yearly climb in the UK’s rapeseed area is expected.

High rapeseed prices, combined with favourable conditions, played a part in a greater planting campaign this autumn.

Advertisement

Advertisement

The planted area is estimated to be up 52Kha on the year, at 416Kha.

Futures prices are indicative, and not representative of physical trading values.

The latest daily futures settlement prices are available on the AHDB website.

You can view the full data series and download your own customised report by selecting the commodity, timescale and currency.

If you need any help please contact [email protected]

Delivered prices will be collected and published again on 06 January 2023.