The NI weekly Market Report

and live on Freeview channel 276

Grains

Wheat – With tight global supply, markets continue to react to news from Ukraine. ‘Bargain buying’ supports market price, short term. Longer term, a recession will be important for price direction.

Maize – Short term, tight global supply and demand keeps prices supported at elevated levels. Longer term price direction will be influenced by South American crop sizes and global demand. Argentinian maize plantings continue slowly.

Advertisement

Advertisement

Barley – Barley markets continue to follow the wider grain complex, supported by tight global supply and demand.

Global markets – Global wheat futures saw overall pressure last week, on the renewal of the Black Sea export corridor. Though Paris milling wheat did see some strength towards the end of last week on strong global demand.

Last week, the UN Black Sea export corridor was renewed for another 120 days (from 18 November), with exports extended from three Ukrainian ports.

During discussions, Russia is expected to have made progress removing obstacles to grain and fertiliser exports, according to Refinitiv.

Advertisement

Advertisement

Russia too have donated 260Kt of fertiliser stored in European ports to developing countries, with the first ship leaving today from the Netherlands to Mozambique, to then travel by land to Malawi.

As prices saw pressure on the renewal of the corridor, we saw global demand buoy European prices. Demand from Morocco and China for French wheat supported prices on Friday.

Chinese volume purchased was originally thought to be two cargoes (c.60Kt each), though now traders suspect this number to be four or more cargoes. Also there were rumours of the US wanting high-protein north European wheat.

Strong demand continued as on Thursday last week, a government agency from Pakistan tendered for 500Kt wheat. Today, Jordan’s state buyer has tendered for 120Kt of milling wheat.

Advertisement

Advertisement

Whereas US wheat export sales data for the week ending 10 November show slow demand continues for US origin. Net sales totalled 290.3Kt for 2022/23, for primarily Mexico, Japan, Chile. For maize, US net sales totalled 1.17Mt to 10 November.

Overall, Chicago maize futures felt strength last week, despite the Black Sea deal renewal. Concerns rise that significant areas of Ukrainian maize might be left over winter in fields due to fuel shortages and difficulty harvesting.

Weather in Argentina has seen improvements, with more rain falling. Though maize plantings remain slow compared to previous years.

As at 16 November, 23.6% of the maize crop had been planted, according to Buenos Aires Grain Exchange. Compared to this time last year at 29.2% and 5-year average at 35.8%.

Advertisement

Advertisement

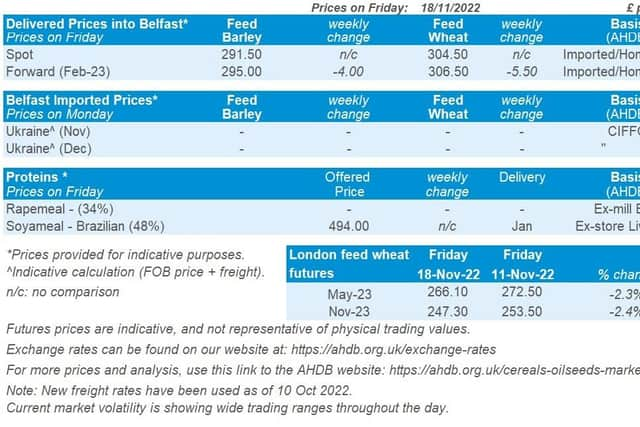

UK focus – UK feed wheat futures tracked global markets down last week.

The May-23 contract fell 2.3% over the week (Friday – Friday). New crop futures (Nov-23) were down 2.4% over the same period.

Domestic delivered prices followed futures price direction down. Feed wheat into East Anglia for November delivery was quoted at £257.50/t on Thursday, down £7.00/t on the week.

Bread wheat prices for December delivery into the North West were quoted at £329.00/t, down £7.50/t over the week.

Advertisement

Advertisement

The UK government’s tax and spending plan announcement on Thursday was said to be as expected by the market, and as a result there was little market reaction.

The pound sterling strengthened slightly (up 1.1%) against the dollar on the week, ending the session at £1 = $1.1906 on Friday.

Last Tuesday saw the provisional release of the AHDB Early Bird Survey for plantings and planting intentions for harvest 2023. The key message within the survey data shows that favourable autumn conditions see winter cropping rise further despite rising fertiliser costs.

Oilseeds

Rapeseed – Renewal of the Black Sea corridor will weigh on the market, along with the pressure from crude oil. Long-term sentiment will continue to follow soyabean markets as we go into 2023.

Advertisement

Advertisement

Soyabeans – Short-term pressure is expected, as questions remain over Chinese demand with the rise in COVID-19 cases. Long-term large South American soyabean crops expected – drought in Argentina a critical watchpoint though.

Global markets – There was pressure across the oilseed complex last week. Chicago soyabean futures (May-23) were down (-1.3%) closing at $528.96/t on Friday.

Despite bargain buying on Friday, which supported oilseed markets, the pressure was in large due to questions over Chinese demand.

Currently there are increases in COVID-19 infections which have led to lockdowns in certain districts, and as of today, Beijing has urged residents to stay at home. This is a large bear on the market as China is a large consumer of global food and energy.

Advertisement

Advertisement

Despite this, US soyabean weekly export sales (up until 10 Nov) were pegged at over 3.0Mt, of the 1.85Mt ‘known’ China purchased 1.16Mt.

Other factors pressuring the market were energy prices as nearby Brent crude oil closed at $87.62/barrel on Friday, down 8.7% across the week. There were a number of factors why crude oil (read more here) felt pressure, but the main one being geo-political tensions easing in the Black Sea with the renewal of the export corridor. This pressure filtered into both vegetable oil and oilseed markets.

Supply focus is currently on South America, notably Argentina. Buenos Aires Grain Exchange said last week that the soyabean planted area could be reduced if more rain doesn’t bring relief to drought areas soon. Plantings are currently delayed with the consultancy estimating plantings at 12% complete, vs 29% at the same point last year.

Rains were welcomed last week, which will help dry conditions and rains are expected in the next day. However, after that are minimal. This is a critical watchpoint as large revisions down to this crop could change market sentiment.

Rapeseed focus

Advertisement

Advertisement

Rapeseed prices followed the wider oilseed complex down last week. Paris rapeseed futures (May-23) closed at €610.00/t on Friday, down €24.50/t across the week.

Delivered rapeseed into Erith (Dec-22) was quoted at £530.00/t on Friday, down £29.00/t across the week. Harvest-23 delivered into Erith, was also down £29.00/t Friday to Friday, quoted at £528.00/t.

Sterling strengthened 0.61% against the euro across the week to close at £1=€1.151 on Friday.

This would have further pressured domestic rapeseed prices Friday to Friday.