NI weekly market report

and live on Freeview channel 276

Grains

Wheat - Prospects for European and Black Sea production remain positive as harvest gets underway. This, and the rain for US maize, is weighing on prices. The outlook for prices beyond the next few weeks depends on the harvest results.

Maize - Rainfall in the US Midwest is reducing concern for 2021/22 supplies and pushing prices lower in the short term. Unless the weather turns hot, or Chinese purchases pick up, this more bearish tone could persist beyond the next few weeks.

Advertisement

Advertisement

Barley - Harvest is starting to replenish global barley supplies, weighing on global barley prices. For now, the smaller UK area is keeping feed barley at a reduced discount to feed wheat than last season.

Global markets - Rain in the US and harvest progress in Europe and the Black Sea pushed grain prices down last week. Selling by speculative traders, ahead of the USDA report on world supply and demand, also likely added to the price falls.

Rainfall over the past week has benefited US maize crops, which are in their critical growth stage. With more rain forecast, especially in the heart of the Midwest, confidence seems to be growing in US 2021/22 supplies. Meanwhile, China has remained quiet in export markets. If this continues, it could point to lower import demand in 2021/22.

The winter barley harvest remains slow in France due to wet weather. FranceAgriMer report that 10% of the crop was cut by 5 July, up from 2% on 29 June, but well behind last year (61% complete). Wheat harvesting is also now underway in France, Ukraine and Russia, where the pace is also slower than last year. However, the start of harvest is weighing on prices, as supplies will soon be replenished.

Advertisement

Advertisement

Conab now estimates the Brazilian maize crop in 2020/21 at 93.4Mt, 3.1Mt less than in June. This is sharply lower than the 98.5Mt the USDA forecast in June, but it is still above many industry forecasts. However, the market reaction was limited, suggesting a smaller crop maybe already factored into prices.

UK focus

AHDB’s annual Planting and Variety survey estimates the GB wheat area at 1.74Mha, up 26% from last year’s low level. Spring barley lost out as winter planting recovered in England and Wales, but the Scottish spring barley area also fell. The GB oat area is broadly stable.

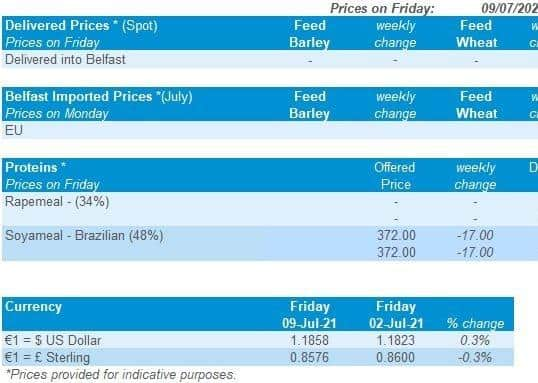

Timing of harvest will be important for UK prices. UK delivered prices for July were virtually unchanged last week (Thurs-Thurs). But, harvest prices fell in line with futures markets. In East Anglia, feed wheat delivered in July was reported at £198.00/t, down £0.50/t from 1 July. Meanwhile, harvest delivery was down £7.00/t to £163.00/t.

The UK imported 222Kt of wheat in May. This takes the 2020/21 season total to 2.22Mt, with one month to go. We imported another 201Kt of maize, taking the total for 2020/21 to 2.57Mt so far and 16% more than the same period in 2019/20.

Advertisement

Advertisement

The UK has signed a trade agreement with Canada, but is starting negotiations to “better” it. As it stands, the deal is most likely to affect wheat. Canadian wheat could potentially displace some German E wheat imports into the UK.

Oilseeds

Rapeseed - Hot and dry weather across the Canadian Prairies is currently stressing the canola crop, potentially having implications for the production outlook. This could have further effects on exports, currently forecast at 10Mt for 2021/22 (AAFC).

Soyabeans - Widespread rain across the U.S. Midwest is aiding crop development of soyabeans, posing an optimistic production outlook, which is lending a bearish tone for the 2021/22 marketing year.

Global markets - Chicago soyabean futures (Nov-21) fell 5% across the past week. A large degree of this pressure is due to welcome rains across the U.S. Midwest. Over the last week, all key soyabean producing states received rain, with the exception of parts of North Dakota, Minnesota, and pockets of Kansas.

Advertisement

Advertisement

Despite this rain, there are still ongoing droughts in parts of the U.S. Midwest. Most notably in Iowa and Minnesota (as at 6 July), 67% and 93% respectively of the area is still cited in “drought condition”.

This could have implications for soyabeans as they enter their pod filling stages in August. However, the 7-day forecasts predict more rain across the U.S., which will help alleviate some of this drought concern.

In line with pressure on soyabeans, the Chicago soybean oil (Dec-21) contract dropped 2.2% across the week.

There was also a volatile week for Brent crude oil. The nearby contract closed down 0.8% across the week, at $75.55/barrel.

Advertisement

Advertisement

Rapeseed focus - Paris rapeseed futures (Nov-21) closed Friday at €523.35/t, down €11.75/t. This pressure was captured in our domestic market, with delivered rapeseed (into Erith, Nov-21) quoted at £457.50/t on Friday, down £13.00/t from 2 July.

Slightly more pressure was encapsulated on our domestic market than in Paris futures, as sterling strengthened (+0.40%) against the euro to close Friday at £1 = €1.1692.

Hot and dry weather across the Canadian Prairies is having negative impacts on the planted canola crop and has implications on the production outlook. Over the next two weeks, parts of the Prairies are forecast to be over 30°C, which is abnormally high for the time of year.