NI weekly market report

and live on Freeview channel 276

Grains

Wheat - Old crop wheat needs to hold a premium over maize to avoid attracting too much animal feed demand. A rebound in wheat crops in 2022/23 could mean softer prices longer-term, albeit from current high levels.

Maize - Recent rain benefited crops in South America, but there’s still a long way to go. Any reductions beyond current market expectations are likely to support prices, while better than expected yields could bring pressure.

Advertisement

Advertisement

Barley - Global barley supplies remain tight until at least the northern hemisphere harvests. This will keep prices at a narrow discount to wheat until more is known about the 2022/23 barley crop.

Global markets - There were some big fluctuations in wheat prices last week. Prices rose on continuing tensions between Russia and Ukraine. The importance of exports from the region were bought home as Egypt again bought solely Black Sea wheat last week. Freight costs made French wheat uncompetitive.

Meanwhile, maize prices continue to find support from less-than-ideal weather in South America.

In Argentina, rain in mid-January provided relief, but there is little rain in the forecast for this week. February rainfall is critical to the final yields according to the Rosario Grain Exchange. On Friday, the local USDA office forecast the Argentine crop at 51.0Mt, but cautioned the forecast may fall if conditions remain dry. This is already 3.0Mt below the official USDA figure.

Advertisement

Advertisement

Over half of early maize crops in Brazil are flowering and at grain fill, so weather conditions in the next few weeks will have a big influence on yields. The earliest crops are already being harvested (Conab). Meanwhile, the crucial Safrinha crop, which is expected to account for 76% of Brazilian output, is starting to be planted.

From a 2022/23 perspective, winter crops in Europe and the Black Sea are looking good. However, the crops have limited tolerance to low temperatures. This leaves them exposed to damage if temperatures drop, but this week at least, temperatures are likely to be above normal. Meanwhile, winter wheat in the US is showing negative effects from dry weather. It’s still early but this is something to watch as we move forward.

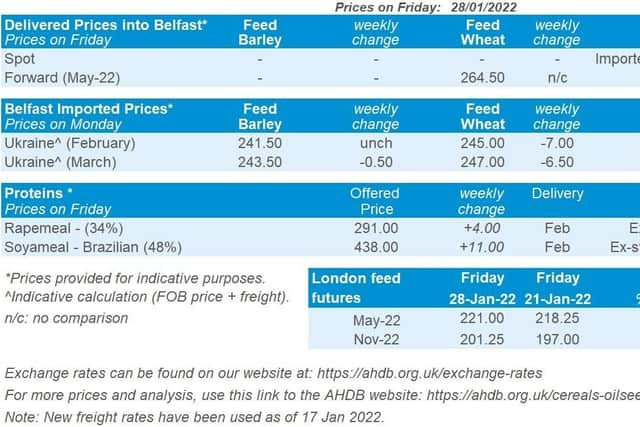

UK focus - Old crop (May-22) UK feed wheat futures followed global prices last week. Overall, the May-22 contract gained £2.75/t Friday-Friday. However, prices were volatile. The May-22 contract closed as high as £228.00/t on Tuesday, before dropping back to £219.00/t on Thursday and ending Friday at £221.00/t.

On a delivered basis, bread wheat continues to hold very high premiums over the May-22 futures. North West bread wheat was reported at £70.00/t over the May-22 futures last week. A year ago, May-21 delivery was £37.50/t over the May-21 futures and two years ago, the May-20 delivered premium to May-20 futures was £33.05/t.

Advertisement

Advertisement

Volatility in the global market reportedly held back traded volumes for all wheat again.

Oilseeds

Rapeseed - Old-crop rapeseed remains tight until the Northern hemisphere harvest. Due to price incentive, global production for 2022/23 should increase. However, longer-term sentiment in soyabeans will influence new crop price direction.

Soyabeans - Soyabean prices, short-term, are finding support from the South American drought, but conditions are looking to improve slightly. Insight into yields when harvest fully commences will drive longer-term price direction.

Global markets - It was a strong week for Chicago soyabeans as commodity funds were net-buyers. The May-22 futures contract gained 3.7% across the week, to close at a contract high of $542.01/t.

Advertisement

Advertisement

Several factors caused this weekly gain. Firstly, there are still worries about the scale of damage to the drought hit crops in Argentina and Southern Brazil. Despite the worst of Argentina’s drought being now past, the risk from dry weather remains (Rosario Grain Exchange). Over the next 14 days Argentina is expecting rains. However, it’s still abnormally dry.

Another supporting factor across the week was Indonesia announcing export curbs on palm oil, and mandating domestic sales. This provided a bullish spur to Malaysian palm oil futures (Apr-22), which gained 5.7% across the week (Fri-Fri). Chicago soyoil futures (May-22) followed suit by gaining 3.4% across the week.

Potential implications of the Russian-Ukrainian situation are further providing support to commodity markets. Nearby Brent crude oil gained 2.4% across the week, closing on Friday at $90.03/barrel. This is the first time oil has hit $90 per barrel since 2014.

Rapeseed focus - All the support for soyabeans and palm oil filtered into rapeseed prices. Paris rapeseed futures (Aug-22) closed Friday at €615.75/t, gaining €7.25/t across the week. The domestic delivered market followed. Rapeseed delivered (into Erith, hvst-22) was quoted at £510.50/t last Friday, gaining £8.00/t from 21 January.

The latest Stratégie Grains oilseed report revised up EU-27 rapeseed output by 200Kt on last month’s report. EU production for 2022 is now estimated at 18.2Mt, a 7.4% increase on 2021.