NI Weekly report for December 19, 2022

and live on Freeview channel 276

19 December 2022

Grains

The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Competitive Black Sea supplies and large Australian crops remain bearish factors short-term. Though the ongoing conflict in Ukraine keeps some support levels in prices. Long-term, recessionary concerns remain a watchpoint.

Maize

Advertisement

Advertisement

Global maize markets have felt some support from demand optimism short term, though COVID-19 cases and global economic performance remain key factors to watch. Longer term, Argentinian weather remains a key watchpoint for production.

Barley

Barley markets continue to track the wider grain complex, with prices supported by a tight grain supply and demand balance.

Global markets

Global grain contracts were mixed last week, with Paris wheat weighed on by competitive Black Sea supplies picking up global demand, and a strengthening Euro against the US dollar.Whereas some gains were seen for Chicago wheat and maize on positive reported US export sales in week ending 08 December, as well as further trims to the Argentinian wheat crop and concerns of what current dryness may mean for their maize crop.Competitive Russian wheat on the global market continues to add pressure to European wheat prices.

Last week, Algeria’s state grains agency OAIC is believed to have purchased around 480-540Kt of milling wheat (Refinitiv). Origins are expected by traders to be Bulgaria, Romania, Russia, and France.Syria too is expected to have imported just over 500Kt of wheat this year from the Black Sea peninsula of Crimea, in which Russia annexed from Ukraine in 2014.

Advertisement

Advertisement

Wheat leaving the Black Sea port of Sevastopol in Crimea, on sanctioned Syrian ships, increased by 17-fold this year according to Refinitiv. Ukrainian officials also report some of this grain to be stolen from occupied areas.

Ukrainian grain continues to move from Ukraine, shown in the latest export data released by UkrAgoConsult. In November 2.53Mt of maize was exported (up from 2.21Mt in October).

However, 1.77Mt of wheat was exported in November, down from 1.96Mt in October. Season-to-date, total wheat exports are 54% behind last season (Jul- Nov).

Though an escalating conflict in Ukraine continues to support global price levels, particularly for wheat considering how much is still expected to leave Ukraine for this marketing year.

Advertisement

Advertisement

On Friday, Russia fired more than 70 missiles during a rush hour attack, one of the biggest since the start of the war. The result saw emergency power cuts nationwide.

Colder temperatures across parts of Europe are not expected to cause much harm to winter grains and may even benefit ‘sturdiness’ of some French crops (Refinitiv).

Though -10°C to -14°C temperatures in central and east Germany remains a watchpoint for barley due to little snow cover.

UK focus

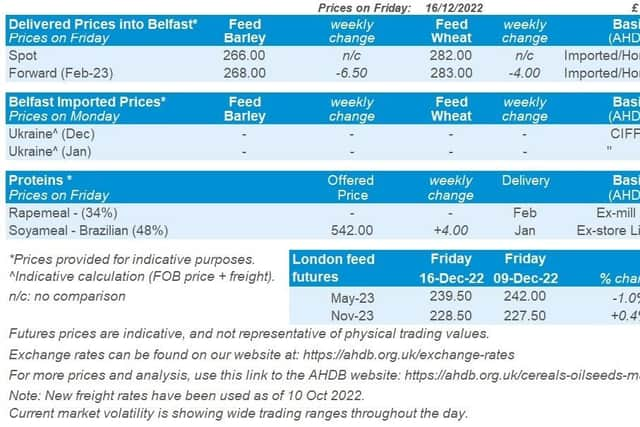

UK feed wheat futures (May-23) fell £2.50/t last week (Friday to Friday), to close on Friday at £239.50/t. Whereas, new crop futures (Nov-23) gained £1.00/t over the same period, to close at £228.50/t.

Advertisement

Advertisement

Domestic delivered prices followed UK feed wheat futures price movement last week (Thursday to Thursday).

Feed wheat delivered into East Anglia (December delivery) was quoted on Thursday at £235.00/t, down £4.50/t.

North-west bread wheat was quoted at £315.50/t for December delivery on Thursday, down £4.00/t.

Last week saw the release of Defra’s final estimates for 2022 UK cereal and oilseed production. Despite the hot and dry conditions experienced this summer impacting some crops on lighter land, wheat, barley, oat and oilseed rape yields are up on the year. UK production is estimated for wheat at 15.540Mt (up 11% year-on-year), total barley production at 7.385Mt (up 6%) and oat production at 1.007Mt (down 10%).

Advertisement

Advertisement

The Bank of England also confirmed another interest rate rise last week, increased by 0.5 percentage points to take the base rate to 3.5%. Important for interest earned on money in the bank as well as loans.

Oilseeds

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing.

Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Rapeseed

In the short-term, the wider oilseed complex continues to influence rapeseed prices. Longer term, the large supply from Canada and pressure on soyabean prices will weigh on rapeseed markets.

Soyabeans

Advertisement

Advertisement

Soyabean markets remain mixed in the short-term, influenced by Chinese demand and Argentina’s dry conditions. Long-term large South American crops are forecasted, but Argentina’s weather remains a watchpoint.

Global markets

Chicago soyabean futures (May-23) felt overall pressure across last week, falling $2.39/t Friday-Friday to close at $546.32/t on Friday.

Volatility remains in soyabean markets as on Tuesday, prices were supported by strong US export demand and bargain buying.

Yet towards the end of the week rising COVID-19 cases in China increased concerns for reduced US export demand going forward. Worries of a weakened global economy and recession also weighed on prices after the UK, EU and US central banks signalled further interest rate rises to tackle inflation.

Advertisement

Advertisement

Across the week soyameal and soy oil price movement diverged, as Chicago soyameal (May-23) lost $12.90/t across the week closing on Friday at $498.43/t.

Feeling pressure from soyabeans on demand concerns. Whilst Chicago soy oil gained $57.76/t to close at $1,364.43/t on Friday. Soyabean oil tracked crude oil upwards at the start of the week, where gains were made, boosted by a weaker dollar. Though dropped lower as the week progressed, on recessionary concerns.

Crude oil was supported across the week due to reduced supplies following the shutdown of the Keystone pipeline running from Canada to the US, due to a leak. It is unclear when this pipeline will be back in operation.