Northern Ireland Weekly Market Report

and live on Freeview channel 276

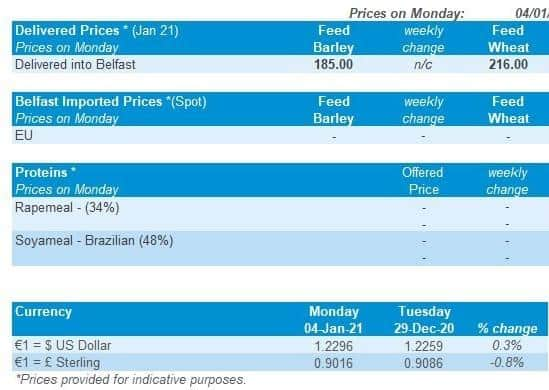

Grains

Wheat

The maize market is currently a key influence on wheat prices because the global wheat market is well supplied in 2020/21. Early insights into 2021/22 wheat crops will be increasingly important in the weeks ahead.

Maize

Suspended exports from Argentina increases demand for maize from Brazil and the US, pushing up global prices. Weather across South America will be a key factor for prices over the coming months.

Barley

Advertisement

Advertisement

Barley prices continue to take their lead from wheat. The UK-EU trade deal supports the potential for continued UK barley exports to the bloc in the second half of 2020/21.

Global markets

Maize prices are far higher than they were before the Christmas holidays. The biggest gains were in the final days of 2020 on Argentine export restrictions and strong US export sales.

Nearby Chicago maize prices hit a six and half year high on 31 December.

Argentina has suspended exports of maize until 28 February to protect domestic supplies.

Advertisement

Advertisement

The country is battling food price inflation and a shrinking economy, partly due to the coronavirus pandemic. Argentina accounted for 22% of global maize exports in 2019/20 (USDA).

Dry weather is also forecast across much of South America for the next two weeks. Recent rainfall supported crop development and planting. A return to drier weather could slow planting in Argentina and adversely impact developing crops. Earlier planted crops have started their pollination stage; this is critical for yields but very vulnerable to drought stress.

Global demand for maize is already expected to exceed supply this season. Any South American crop losses are likely to widen this deficit.

If this happens, more wheat may need to be used as animal feed globally in place of maize. This possibility is helping wheat prices to rise. Chicago wheat prices rose more than European prices due to short covering by speculative traders.

UK focus

Advertisement

Advertisement

May-21 UK feed wheat futures gained £4.10/t between 18 and 31 December. Yet, UK prices rose less than global prices, in part because sterling strengthened against both the euro and US dollar.

The UK 2020 wheat crop was even smaller than estimated last October. Defra’s final estimate is 9.658Mt, down 475Kt from October. Against 2019, this is a 40.5% decrease in production and the lowest UK wheat production figure since 1981. Most the decline is from lower yield estimates, but the area was also trimmed.

UK barley production was also cut by 246Kt from October to 8.117Mt.

The smaller crops confirm the UK’s dependence on imported grain in the 2020/21 season.

Advertisement

Advertisement

The UK’s free trade deal with the EU-27 means imports from this key trading partner continue without tariffs.

But there will still be additional costs and AHDB analysis estimates these at 2% to 5% for crops.

Regional 2021 UK area intentions are now available after our Early Bird Survey was updated with the final 2020 Defra data. In all regions there is an estimated increase in wheat areas.