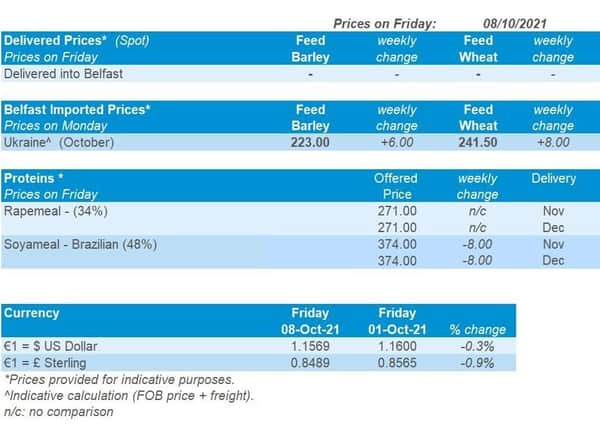

Northern Ireland weekly market report

Grains

Wheat - The global market is supported by importer demand. Further ahead, there could be some softening if we get large Southern Hemisphere grain crops, plus larger winter wheat areas for 2022/23.

Maize - The ongoing US harvest is currently keeping the market subdued, but all eyes are on tomorrow’s USDA report. Longer-term, a record Brazilian crop is expected, though good weather is required to make this happen.

Advertisement

Advertisement

Barley - The global barley markets remain firm. In the UK, the price gap between feed barley and other grains will be critical to reducing animal feed to compensate for the smaller crop.

Global markets - European wheat prices rose last week, which in turn pushed up UK prices. Prices gained due to buying by importing countries and speculation that Russia could extend its export curbs. Also, EU exports are off to a rapid start. The EU-27 exported 8.1Mt by 3 October 2021, up from 5.6Mt by the same date in 2020/21 (EU Commission).

In contrast, US prices eased Friday-Friday. US wheat prices fell as the export pace remains the slowest since 2015/16. Meanwhile, favourable weather for the ongoing harvest pushed US maize prices down.

The market is now awaiting the USDA report on global supply and demand. The expectation is that the USDA will trim the US maize yield but raise US stocks, according to a poll by Refinitiv. US and global wheat stocks are expected to be cut.

Advertisement

Advertisement

The first forecast for the Brazilian 2021/22 maize crop from Conab showed a crop of 116.3Mt, up 34% from last year’s drought-affected crop. This relies on a 5% area expansion and 28% rise in yields. The crop is slightly less than the USDA forecast in September (118.0Mt) but still a record.

In Ukraine, 46% of winter wheat was planted by 7 October, where the area is set to expand after dry weather last autumn (Ag Ministry). In France, the areas are expected to hold steady (Refintiv). Winter wheat planting was 4% complete and winter barley was 9% done by 4 October.

UK focus - Defra estimated the 2021 UK wheat crop at 14.0Mt. This is a marked increase from the 9.7Mt harvested in 2020. This is below what many in industry, including AHDB, had expected. Looking at the provisional English area, yields would need to have fallen below the five-year average to give a crop of this size. This differs from industry information and AHDB’s harvest reports.

The barley crop is provisionally 7.1Mt, down from the 8.1Mt harvested last year.

Advertisement

Advertisement

Only the UK production numbers are currently available. Details of the UK area and yields, plus the size of the oat and rapeseed crops will be published on Thursday morning.

Bread wheat prices continued to rise last week. Full specification bread wheat (≥ 13% protein, 250s & 76kg/hl) delivered to the North West in November 2021 was quoted at £255.50/t, up £3.50/t from a week earlier. The latest price equates to a £53.00/t premium over Nov-21 futures. It is also the highest UK bread wheat price reported since late 2012.

Feed barley (delivered E. Anglia, Nov-21) was £188.50/t last week, up £4.50/t. This was £13.00/t below feed wheat (same delivery), compared to a £16.50/t discount on 30 September.

Oilseeds

Rapeseed - Strong vegetable oil demand and a tight rapeseed market offer short term support. Beyond that, attention turns to an expected large Australian crop, and area increases for 2022/23 because of high prices.

Advertisement

Advertisement

Soyabeans - In the short term, the US harvest and this week’s WASDE could add pressure. Longer term, Brazilian production is still forecast at record levels, despite the outlook from Conab being lower than that of the USDA.

Global markets - Soyabean markets ended lower once more last week. The Nov-21 contract closed on Friday at $456.68/t, down $1.28/t on the week. US harvest has been a key pressuring factor for prices in recent weeks.

As of 3 October, the soyabean harvest in the US was 34% complete, 8 percentage points ahead of the five-year average (2016-2020).

With a raft of data releases, Tuesday is key day for prices of all agricultural commodities. Pre-WASDE trade estimates are for increased stocks of soyabeans on the month, at both the US and world level. US soyabean production is also seen increasing on the month, owing to an improved yield outlook.

Advertisement

Advertisement

Last week, Conab released its first forecasts for the 2021/22 Brazilian soyabean crop. Production is forecast to rise 2.5% year-on-year, to a record 140.8Mt, following an increase in area by the same degree. The forecast production level is 3.2Mt lower than the September USDA forecast. It is worth noting that despite the forecast of a record crop, Conab flags the continued effects of La Niña and high input costs as a concern.

Rapeseed focus - Rapeseed prices continued to surge last week, supported by strong demand and the continued tight outlook. Paris rapeseed futures (Nov-21) gained €23.25/t, Friday to Friday, closing on 8 October at €676.50/t.

UK markets followed the trends seen in the European market, although trade remains exceedingly thin once more. Rapeseed delivered Erith (May-22) was quoted at £578.00/t, up £25.00/t on the previous week.

Strong fundamental support in vegetable oil market, is a key underlying feature of the rapeseed market.

Advertisement

Advertisement

With Northern Hemisphere crops tight, attention is on developments in the Southern Hemisphere. In the week to 6 October, conditions in Australia were positive with improved rainfall. Australia is forecast for a 5.0Mt crop, an 11% increase on the year.

For 2022/23, Stratégie Grains, estimate a 7% rise in planted area for the EU, to 5.6Mha. It is worth noting that this would be in line with the five-year average (5.6Mha).