Northern Ireland weekly market report

Global markets

Chicago wheat prices fell at the beginning of last week, with hopes that the latest round of Russia/Ukraine peace talks were making progress.

However, attacks continued, and markets firmed mid-week. This move was more subdued, on anticipation of the USDA quarterly stocks and prospective planting reports (released Thursday 31 March).

Advertisement

Advertisement

The May-22 contract ended the week $43.26/t lower, at $361.71/t.

Wheat estimates were largely in line with trade expectations, although a trim to expected stock figures leant a little support. Moving into the new week, markets are once again showing their nervousness.

The limited rail exports moving from Ukraine are struggling with backlogs, exacerbating an already tight situation. Additionally, Kazakhstan is considering limiting their grain and flour exports, following Russia’s ban on their shipments.

Global new-crop maize markets witnessed more of an upward bounce from the USDA prospective plantings report. At an estimated 36.22Mha, this was 2.7% back on the average trade estimate. With rising input costs seemingly pushing growers to soy acres over maize, the reduced area exacerbated new crop availability concerns.

Advertisement

Advertisement

While Ukraine has announced spring planting is underway, it is still unclear how much of this will be dedicated to maize, rather than oats, peas, and barley.

Bioethanol demand for maize also remains strong. The US administration is considering allowing summertime sales of E15 and news also came on 23 March that Brazil was lifting it’s 18% tariff on US ethanol imports until the end of the year.

UK focus

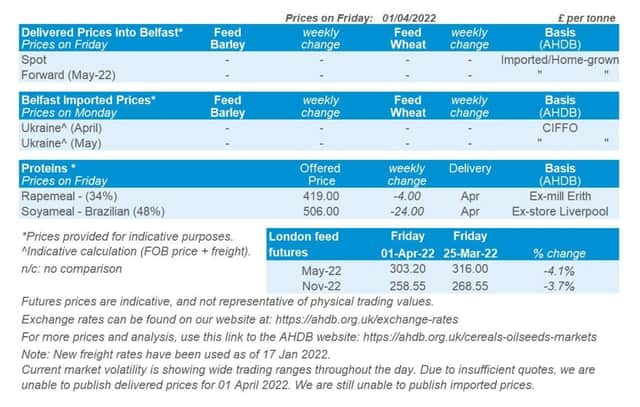

UK feed wheat futures slipped last week. The May-22 contract ended the week back £12.80/t, to £303.20/t. Nov-22 also slid, down £10.00/t, to £258.55/t (Fri 25 Mar – Fri 01 Apr).

Physical domestic prices followed this move down, with delivered feed wheat (Avonmouth, May-22 delivery) back £4.00/t on the week, to £312.00/t. However, trading is reportedly muted as we head into the last quarter of the season. Concerns remain for the end of the season, should the UK new crop be delayed coming online. Trading remains very thin for feed barley too, with no prices being able to be published last week.

Advertisement

Advertisement

Price declines were more subtle for bread wheat deliveries, with April delivery into the North West back £2.50/t on the week, to £362.00/t.

Rapeseed

As the rapeseed supply and demand picture remains tight, underlying support will remain for the market. Particularly if Ukrainian sunflower plantings are reduced, oil demand may shift to rape oil on a longer-term basis.

Soyabeans

Despite relatively bearish USDA reports for soyabeans, concerns surrounding Black Sea oil/oilseed supplies could offer underlying support.

Global markets

Global oilseed markets remain relatively volatile. Last week saw the awaited US quarterly stocks data and prospective plantings figures released.

Advertisement

Advertisement

For soyabeans, the reports had a bearish tone and subsequently Chicago futures fell on Thursday and Friday. This said, the fall is from historically elevated positions, so prices remain relatively high from earlier in the year. March stocks were pegged at 52.56Mt, 1.5% above trade estimates from a Refinitiv poll. Prospective plantings were estimated at 36.81Mha, some 2.5% higher than the average trade estimate.

The 2021/22 Brazilian soyabean harvest was 75.8% complete by 26 March, versus 69.8% last year (Conab). However in Argentina, harvest is just 4.4% complete and recent frosts may have hampered yield prospects reducing the 2021/22 crop prospects.

Export sales from the US seemed to slow with only 132.0Kt of 2021/22 soyabeans sold (to China) last week, versus 690.2Kt the week before. There were also new-crop sales to Mexico last week. This said, if export volumes pick up again, we could see US stocks tighten further as we approach the end of the year.

Oil markets experienced downwards moves last week. Brent crude oil (nearby) lost $16.26/barrel from Friday-Friday dragging with it Malaysian palm oil. The benchmark contract (nearby+3) closed Friday at $1,322.72/t, the lowest since 18 February.

Advertisement

Advertisement

However, in the EU, shortages to sunoil supply could offer support to other vegetable oils.

Despite bearish US soyabean planting data, there remains concerns for the wider global oilseed complex. Ukrainian farmers are said to be planting spring crops and were ahead of spring 2021 last week.

However, it is unclear as to which crops are currently being prioritised. Sunflower plantings are an influencer in global oilseed markets due to their relative importance. Ukrainian sunflower production accounts for c.30% of global production but is primarily grown in the central and Eastern parts of the country.

Updates on sunflower planting could aid market direction as sunoil supply from Ukraine will also influence vegetable oil markets.

Rapeseed focus

Advertisement

Advertisement

Old-crop Paris rapeseed futures followed wider oil/oilseed markets down last week. However, the global supply

picture remains tight for 2021/22. Stratégie Grains have reduced its estimate for EU27 rapeseed closing stocks in its latest report to 0.7Mt.

Despite slipping oil prices (mentioned above), potential sunoil shortages are likely to shift EU demand to rape oil. Rape oil is already in demand by the industrial sector and further demand by the food industry will support rape oil prices and in turn seed prices.The latest AHDB crop development report shows that oilseed rape for harvest-22 is mostly (64%) in good-excellent condition. However, conditions have deteriorated somewhat since November when 78% of the crop was deemed good-excellent.

New-crop rapeseed prices have seen some support. The Nov-22 Paris rapeseed futures contract gained €15.25/t from Friday-Friday.

Advertisement

Advertisement

There is no week-on-week comparison for delivered rapeseed into Erith (November delivery) but quoted at £669.50/t, it is up £38.00/t from the fortnight before. This is also up 71% (£278.50/t) year-on-year.