Northern Ireland weekly market report

and live on Freeview channel 276

Global markets

Global wheat prices softened over the course of last week. Optimism over talks with Russia to open “grain corridors” drove much of this movement. The Chicago wheat (Dec-22) contract fell $2.12/t Fri-Fri, closing at $431.14/t. Paris wheat (Dec-22) followed the same trend, down €6.25/t over the same period, closing Friday at €407.75/t. However, both contracts bounced back on Friday, reversing some of the week’s losses. US markets were consolidating some of their positions ahead of today’s Memorial Day public holiday in the US, and further bullish news was added following the latest French wheat condition scores.

Data from FranceAgriMer on Friday showed a deterioration of the French wheat crop for the third successive week. Spring’s dry conditions, coupled with the recent hot weather, has resulted in 69% of the crop being rated good to excellent, down from 73% the week before.

Advertisement

Advertisement

Last year at this point, 80% of the wheat crop was rated good to excellent.

The Ukrainian Agricultural Ministry reported on Friday that spring sowing was almost complete, but with the area 22% down on the year earlier. Official data showed growers had drilled 189Kha of spring wheat, 928Kha of spring barley and 4.4Mha of maize.

The ministry stated earlier in the season that planned spring cropping area was 14.2Mha this year, down from 16.9Mha in 2021.

Concerns in the US remain over the planting of the last 5-10% of the maize crop. The weather forecast for these regions is not currently favourable, and there are fears that the crop won’t be planted until June, if at all. If realised, this could have a significant impact on US maize supply.

UK focus

Advertisement

Advertisement

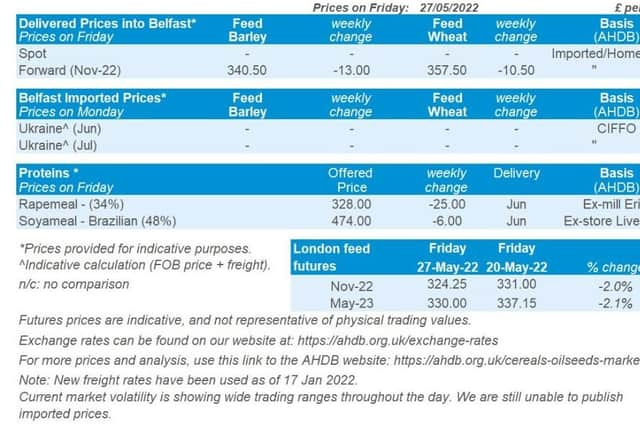

Nearby UK feed wheat futures (Jul-22) closed Friday at £314.75/t, a drop of £19.95/t on the previous week. The new crop contract (Nov-22) was down £6.75/t over the same period, closing at £324.25/t on Friday.

Both contracts followed global grain prices down, on the news that a deal could be struck with Russia to allow grain exports out of Ukraine.

UK delivered prices followed suit. Feed wheat into East Anglia (Nov-22 delivery) fell £9.50/t last week (Thurs-Thurs) to £321.50/t. Bread wheat prices into the North West, for November delivery were pegged at £389.00/t, with no weekly comparison available.

Last week’s latest UK supply and demand estimates pointed to closing wheat stocks revised upwards, following stronger import pace, coupled with relatively stable demand and exports.

Advertisement

Advertisement

However, carry out stocks for barley are set to be the lowest level for nearly a decade, with tight domestic availability, combined with stronger domestic consumption and exports factoring.

The latest AHDB crop condition report, released on Friday, showed promising yield prospects for winter crops, following welcome rains in May. Spring cropping prospects remain weather dependant, although May rains have facilitated nitrogen uptake.

Futures prices are indicative, and not representative of physical trading values. If you need any help please contact [email protected]

Rapeseed

Short-term, old crop rapeseed prices will remain supported until Northern Hemisphere harvests. It’s reported that there is satisfactory flower of oilseed rape crops in the EU despite lack of rainfall (Stratégie Grains). Longer-term sentiment is dependant on export capacity out of the Black Sea for the 2022/23 marketing year.

Soyabeans

Advertisement

Advertisement

Constrained exports of other oilseeds in the short term will increase demand for soyabeans. Long-term focus is currently on US plantings, which over the next week may be delayed from forecast rains in key regions.

Global markets

Support was felt across the week for Chicago soyabean futures (Nov-22), the contract closing at $567.27/t. This was a gain of 1.5% across the week, closing at a contract high on Thursday (26 May).

The main supporting factor this week are the forecast rains in the U.S, which are expected to pose delays on the tail end of U.S. soyabean plantings. Rains are forecast over the next seven days over much of the U.S. Midwest and Northern Plains.

Malaysian palm oil futures (Aug-22) posed a weekly gain of near 4%. Although exports of Indonesian palm oil have been allowed to resume, there is a clause that domestic obligation has to be fulfilled. The sales volumes will be based on refining capacity and local demand (Refinitiv).

Advertisement

Advertisement

Russia will not be removing its ban on exports of sunflower seeds at the end of August (Interfax). The ban was supposed start on April 1 and expire on August 31. However, there are plans to raise sunflower oil export quota by 400Kt up until 31 August (Refinitiv).

However, the latest Stratégie Grains oilseeds report has raised its monthly forecast for this year’s EU sunflower seed harvest to 10.9Mt, up from 10.7Mt reported in the previous month. An increase in production is a reflection of the increase in area, which is up 8.9% year-on-year.

Rapeseed focus

Paris rapeseed futures (Nov-22) closed at €821.50/t on Friday, up €0.50/t from the week before.

Delivered rapeseed into Erith (Hvst-22) was quoted at £707.50/t on Friday, up £6.00/t across the week.

Advertisement

Advertisement

Although continental prices remain relatively unchanged, domestic prices gained slightly more across the week.

Currency changes drove much of this, as sterling weakened against the Euro (-0.4%) across the week, to close Friday at £1 = €1.1768.

Results of the latest AHDB crop condition report show that 70% of winter oilseed rape is rated good to excellent, a slight decrease from the 71% estimated in April.

The report cited that while cleavers, thistles and wild oats are present in the crop, the thick crop canopy is providing effective competition.