Northern Ireland weekly market report

and live on Freeview channel 276

Grains -

Wheat - Tight global supply keeps prices volatile, reacting to Black Sea conflict news and following maize market movement. Demand is a watchpoint currently, due to global recessionary concerns but at low prices, will we find demand?

Maize - Tight global supply keeps the short-term and long-term price relatively supported. Though US harvest is underway on dry weather. Demand too remains key for price direction with mounting global recession concerns.

Advertisement

Advertisement

Barley - Barley markets continue follow wider grain movement, with supply outlooks remaining tight.

Global markets -Global wheat markets felt overall support last week, as concerns of escalation of the conflict between Russia and Ukraine mount. This provides an underlying support in global wheat markets. Russia have announced troop mobilisation across the country and some referendums in parts of Ukraine to join Russia, causing concerns this may disrupt the supply of grain leaving Black Sea ports. The current Istanbul Agreement was signed between Russia, Ukraine, Turkey, and the UN on 22 July for 120 days.

However, late last week markets saw a broad sell off on fears of a global economic downturn grow. This is a factor to watch going forward, as rising inflation and recessionary concerns remain a watchpoint for demand. Should demand rationing start to happen, this could alter the outlook for longer-term grain prices.

US maize harvest is seeing progress on favourable weather, leading to some harvest pressure and risk taken out of maize prices. Though historically, remaining relatively supported. Last Monday, the USDA reported 7% of maize had been harvested as at 18 September, slightly behind last year and the 5-year average. This coming week looks relatively dry across the Midwest, so expect to see further progress. French maize harvest too is seeing progress, with 26% harvested as at 19 September (FrenchAgriMer).

Advertisement

Advertisement

Something to watch going forward, central, and southern Russia is seeing heavy rains currently which could impact sowing campaign for 2023 crops. According to Sovecon, 8.6Mha has currently been sown for winter grains, 1.5Mha behind this time last year.

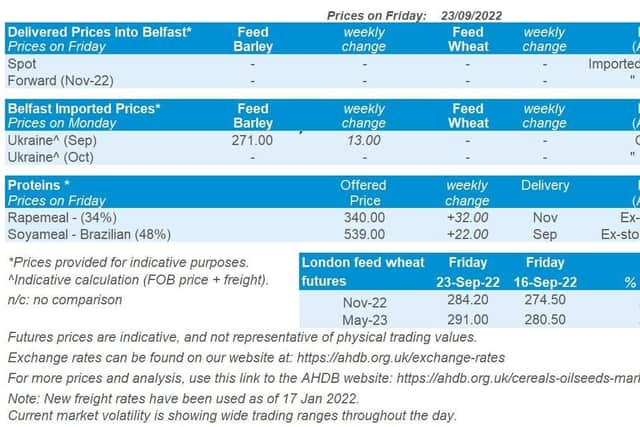

UK focus - UK feed wheat (Nov-22) futures gained £9.70/t last week, to close on Friday at £284.20/t. The new-crop contract Nov-23 closed up £5.95/t over the same period, to close on Friday at £269.00/t. UK futures followed global markets, with rising prices from Black Sea concerns capped by recession concerns and an accelerating maize harvest.

UK delivered prices followed futures contract movement Thursday to Thursday. On Thursday, feed wheat delivered into East Anglia (September delivery) was up £9.50/t to be quoted at £279.00/t.

Bread wheat delivered into the North West (September delivery) was quoted on Thursday at £345.50/t.

Advertisement

Advertisement

Following on from UK government economic announcements last week, the pound sterling dropped to a record low this morning. On Friday, the pound sterling closed at £1 = $1.0856 (Refinitiv). This morning, early Asian trading saw the pound fall to even lower levels (£1=$1.0327), but the opening of the European markets saw the pound recover slightly on bargain buying. Today at 13:00, the pound was trading at £1 = $1.0879.

In order for Defra and the Fertiliser Industry Taskforce to better understand the fertiliser use of farmers in 2022, and what is likely to be used and imported for the 2023 harvest, AHDB have created a short informal survey to gather information.

Oilseeds

Rapeseed - In the short-term rapeseed markets react to news around Ukrainian exports and the impacts of Canadian weather. Longer term, the market will likely be pressured by the wider oilseed complex and a large Canadian canola crop.

Soyabeans - Harvest pressure is expected over the next few weeks in the US. Recessional fears also add pressure in the long term, as well as competition from South American markets with increased production of soyabeans forecasted this season.

Advertisement

Advertisement

Global markets - Chicago soyabean futures (Nov-22) lost $8.36/t across last week, closing at $532.82/t on Friday. The US soyabean market continues to feel pressure from increased Argentinian supply, with farmers marketing their soyabean 2021/22 stocks largely due to favourable exchange rates. Ongoing global recessionary fears also continued to weigh in on the US soyabean market last week, which filtered into Chicago soyabean oil. The fall in Brent crude oil further added to this.

Looking further ahead, for the first time since 2015 the area of soyabean plantings in Argentina is expected to increase nationally for 2022/23. According to the Buenos Aires Grain Exchange, soyabean plantings could grow to 17Mha, compared with 16.3Mha the year before. As global fertiliser prices have spiked, maize production has become less profitable and so farmers are switching to soyabeans as a cheaper alternative. As plantings progress across South America, weather and the effect of the current advisory La Niña will remain a watchpoint going forward.

While US soyabean markets have been under pressure, Chinese soymeal futures (Nov-22) hit record high levels last week, up 5.2% Friday to Friday. Over the last few months, China has experienced limited soyabean imports due to high global prices and poor demand for animal feed. However, as hog prices rally, rising animal feed demand has meant that crush margins have turned positive for the first time in months. However, soyameal prices are expected to stay high, as soyabean imports are to remain at low levels of around 6Mt this month and next (Refinitiv).

Rapeseed focus - Rapeseed markets headed in the opposite direction to soyabeans last week.

Advertisement

Advertisement

The Nov-22 Paris rapeseed contract gained €29.50/t over the week, closing at €606.75/t on Friday.

Domestic prices followed global futures markets last week. Delivered rapeseed into Erith (Nov-22) was quoted at £522.00/t on Friday, up £19.00/t over the week.

Recent unfavourable rains across Canada have seen their 2022/23 rapeseed production figure trimmed to 20.1Mt in a Refinitv analysis. However, this estimate still sits above USDA (20.0Mt) and StatCan (19.1Mt) estimates. The weather outlook across the Prairies in the coming week also looks mostly drier and more favourable for harvest progress.

The unwelcomed rains, combined with continuing concerns over future exports from the Black Sea region, likely added support to rapeseed markets last week.