The NI weekly market report

Grains

Wheat - With concerns for new crop production in many key exporting nations, the longer-term supply and demand picture looks more supportive. As global harvests progress, yield reports will be crucial.

Maize - Global maize supply and demand looked improved in last week’s USDA supply and demand estimates. Further, funds trimmed their long positions further last week. While some maize regions in the US are experiencing drought, the top producing states are largely ok at present.

Advertisement

Advertisement

Barley - Barley supply and demand still looks well balanced domestically. With feed demand likely reduced year-on-year in 2021/22, that said the premium of feed wheat to feed barley is growing.

Global markets

There were significant gains in prices across the grains complex, with weather once again a key influencer. Dryness in the Northern Plains of the US and the Prairies in Canada continues to drive concerns.

Many key wheat growing states in the north of the US were experiencing some form of drought, as of 13 July. You arguably must go back to 2012/13 to find a worse looking drought map for the US, although the 2012 drought affected a very different regions, affecting different grades of wheat. Forecast rainfall in the US may offer some relief but it will be very dependent on volume and whether it falls in the regions needing rain most.

There is also concern for other key grain nations, including Russia and some areas of the EU. Crop production figures in Russia are being walked lower by several key forecasters. For the EU, the forecast remains wet over the next fortnight. This will cause concern for both harvest quality and progress.

Advertisement

Advertisement

Last Monday’s USDA world supply and demand estimates also added to price support. Global wheat stocks were cut by more than 5Mt, to 291.7Mt in 2021/22. Smaller crops are seen for the US, Canada, and Kazakhstan. Strong export forecasts trimmed 900Kt of EU wheat stocks.

Support for prices was arguably checked last week by weak US maize export sales, a more bearish outlook for global maize S&D and reports of strong wheat crops in Ukraine. Although, in the latter, poor weather has supported cash prices.

uK focus

UK grain markets followed the global rally last week. UK feed wheat futures (Nov-21) gained £12.55/t (7.5%), to close at £176.85/t. This was a significant rally with the market closing on Friday ahead of the most recent high (£172.80/t on 1 July 2021). Having made five days of gains, futures could now take a breather.

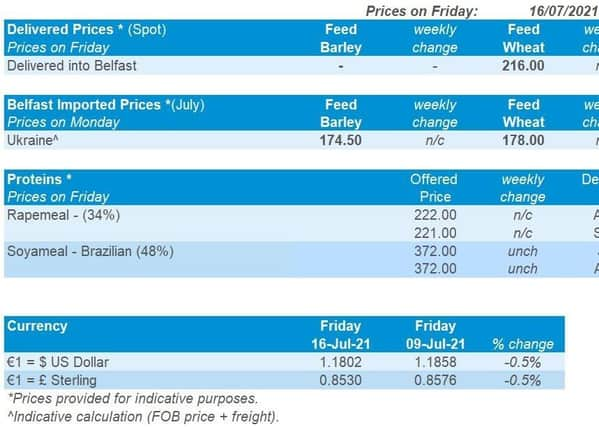

The UK physical market followed the futures rally. Feed wheat, delivered East Anglia (Nov-21) gained £6.50/t Thursday to Thursday, quoted at £173.00/t. Feed barley prices rose by less. The premium of wheat over barley was £19.50/t in East Anglia and £18.50/t at Avonmouth. Delivered milling wheat premiums to Nov-21 futures were quoted marginally higher in the Northwest and Northants (+£0.50/t).

Oilseeds

Advertisement

Advertisement

Rapeseed - Hot and dry weather in Canada continues to stress canola (rapeseed) crops, supporting global prices. EU supply and demand, while improved, remains tight, with added concern around Canadian exports.

Soyabeans - 2021/22 supply currently looks adequate for global soyabeans. US dry weather continues to be a watchpoint for soyabean yields, though any impact is not yet quantified.

Global markets - Chicago soyabean futures (Nov-21) gained $22.96/t on the week, closing at $511.33/t on Friday.

Soyabean prices joined US spring wheat in rising in response to hot and dry US weather. In key producing areas Iowa, the Dakotas and Minnesota, drought conditions remain (as at 13 July). Forecasts for these areas show below average rain for the next few weeks, causing concerns for potential yield loss.

Advertisement

Advertisement

The latest USDA crop progress report was released last Monday. Soyabean conditions were unchanged on the week, with 59% of the crop rated ‘good’ or ‘excellent’. Crops are looking good, though the end of July to August is arguably the most crucial time for soyabean crops. Condition scores could fall further if rainfall is not sufficient in key producing areas. The next US crop progress report is due tonight.

The USDA also released its world supply and demand estimates for July last Monday. World 2021/22 oilseed supply increased by 6.08Mt this month to 740.4Mt, increasing ending stocks by 2.31Mt. Global 2021/22 soyabean ending stocks increased 1.94Mt to 94.49Mt, on reduced Chinese imports and global domestic crush for 2020/21.

US soyabean crush figures fell to a two-year low in June at 4.15Mt, according to the National Oilseed Processors Association (NOPA), which cover around 95% of US soyabean crushed. This was down 6.8% from May and behind June 2020 by 8.9%. Soyabean oil stocks were the lowest since October 2020.

Contributing to rising oilseed values last week was a rise in vegetable oil prices. Malaysian palm oil futures climbed for the fourth week, due to labour shortages curbing production capacity.

Advertisement

Advertisement

Though looking longer term, last week Argentina’s Senate approved a reduction in blending requirements for biodiesel and ethanol from 10% to 5%. Argentina also introduced powers with the energy secretariat to cut the blending mandate further should this be required, to 3%. The full impact this may have is not yet understood.

Rapeseed focus

Paris rapeseed futures (Nov-21) climbed €20.00/t to close at €543.25/t on Friday. Paris rapeseed prices strengthened on the back of gains in Canadian canola futures.

Canadian canola supply continues to be a large concern due to extremely hot and dry weather across the Prairies. To the 12 July, just 18% of rapeseed crops were rated ‘good’ or ‘excellent’ according to the Saskatchewan Government, down from 77% the same week last year.

UK delivered prices followed the trends in global prices. Rapeseed delivered into Erith (Nov-21) was quoted at £479.50/t on Friday, up £22.00/t from 9 July.