The NI weekly market report

and live on Freeview channel 276

Wheat - Global harvest pressure has started, though can we find demand at lower price levels? Longer term, supply and demand fundamentals for next season remain tight.

Maize - Maize prices remain volatile on Ukrainian export news and global demand questions.

Advertisement

Advertisement

Fundamentally supply remains tight, and the market awaits news of the US crop size. Though demand from bioethanol remains a watchpoint.

Barley - Barley prices follow pressure in global wheat. Though the global and domestic balance remains tight heading into next season.

Global markets - Global grain contracts saw pressure through last week. Factors contributing to this include harvest pressure, news around establishing a Ukrainian grain export corridor, and mounting concerns around global demand. Global contracts remain very volatile, reacting to ‘new’ news.

Harvest is underway in the US and EU, with the EU especially seeing an accelerated harvest progression due to the recent heatwave.

Advertisement

Advertisement

Harvest pressure is expected to continue as combines roll in the Northern Hemisphere.

Increasing concerns around reduced demand from recession concerns also added pressure to prices last week.

This is something to watch for the UK specifically too, as livestock margins are squeezed, and consumer disposable income strained.

It is reported the UK and Germany are to propose a temporary waiver on biofuel mandates to the G7 conference, but this is likely to face resistance from the US and Canada according to a German government source (Refinitiv). As the conference proceeds, any news on this is something to watch from a demand perspective.

Advertisement

Advertisement

With prices pressured, markets saw several wheat tenders including from Saudi Arabia, Jordan, Taiwan today.

Maize markets were pressured last week, especially as the outlook for US Midwest forecasts rain in maize growing regions.

The US acreage report is due on Thursday (30 June), which may shed light on area for the world’s largest maize exporter (US). The UK lifted the tariff on US maize imports from 1 June 2022.

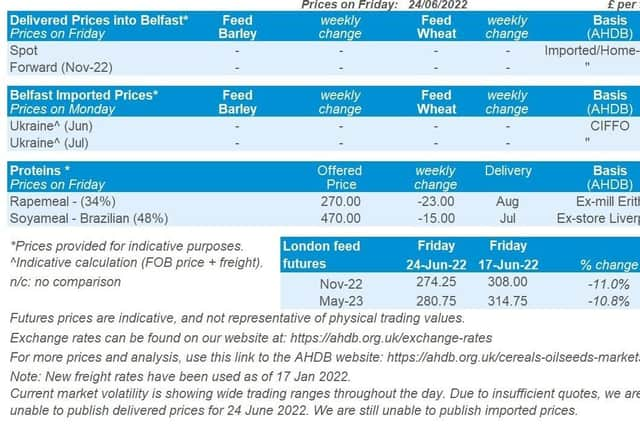

UK focus - In the domestic market UK feed wheat futures fell sharply last week, reflecting the bearish trend in the wider global market. The Nov-22 UK futures contract closed at £274.25/t on Friday, down by £33.75/t on last Friday’s close. Similarly, the May-23 contract closed at £280.75/t on Friday, down by £34.00/t on the week.

Advertisement

Advertisement

Physical prices moved in line with the futures contract, with East Anglian feed wheat being quoted at £281.50/t for Nov-22, down by £29.00/t on last week. Yorkshire feed wheat fell by £30.00/t Thursday to Thursday, being quoted at £290.50/t for Nov-22.

In the latest crop condition report to 21 June, 82% of UK winter wheat remained rated as “good-to-excellent” condition.

This is unchanged on last month’s estimates. Though, growers have some concerns about crop yield prospects, following persistent hot and dry weather conditions across June.

Winter barley conditions marginally deteriorated on the month, with some movement to “fair”.

Oilseeds

Advertisement

Advertisement

Rapeseed - Despite significant price pressure last week, global tightness remains, keeping prices historically high. EU harvests will start soon, which could cap gains. Going forward, focus will be on Canada and Australia’s output at the end of 2022.

Soyabeans - Improved weather outlook in the US calms yield concerns short-term. Long-term focus will be on US harvest prospects. South American planting intentions and progression will be something to watch considering input costs.

Global markets - A week of pressure for the oilseed complex, as Chicago soyabean futures (Nov-22) closed Friday at $523.27/t. This is down $41.61/t across the week. On Friday, the soyabean market did see a slight uptick on the back of bargain buying and short covering. However, commodity funders were net-sellers of Chicago soyabeans futures contracts across the week.

US temperatures started to ease over last week, following a heatwave. Focus is now on how much rain will reach key soyabean growing regions with the approaching key summer growth stages. Over the next week rain is forecast. However, it is patchy in northern parts of the U.S. Midwest.

Advertisement

Advertisement

Vegetable oil markets also felt the pressure as Chicago soyoil (Dec-22) and Malaysian palm oil futures (Dec-22) were pressured by 8.6% and 13.7%, respectively across the week.

Chicago soyoil prices were pressured on the concerns that a slowing global economy could limit demand. This filtered into palm oil prices too, but further pressure was felt from the Malaysian Palm Oil Association estimating production during 1-20 June was likely up 15.9% on the month before (Refinitiv).

All eyes are on Thursday USDA reports, which will have U.S. quarterly grain stocks (as at 1 June 22) and the US acreage report for 2022/23 marketing year (harvest 2022).

Rapeseed focus - Paris rapeseed futures (Nov-22) continued to soften last week, and closed at €691.75/t on Friday, down by €66.75/t across the week. Based on last Friday’s close €100.00/t has been shaved off the Nov-22 contract since 1 June.

Advertisement

Advertisement

In the UK domestic prices followed the same on-week trend as the Paris contracts, with delivered prices into Erith (Hvst-22) quoted at £566.00/t. This is down by £90.50/t on the previous week.

Further supporting this pressure was the upward revisions to EU rapeseed output estimates, with Stratégie Grains projecting 18.3Mt of production for the 2022/23 marketing year, up from 18.2Mt projected last month. This follows improved yield prospects in Baltic states as well as larger area projections for French and Swedish crop.