The NI weekly market report

and live on Freeview channel 276

Wheat - In the short term, volatility remains as Ukrainian exports continue to trickle out. Wheat markets are also currently being supported by upward movements in maize. In the longer term, strong demand continues to add support, with harvest 2022 remaining a watch point.

Maize - Hot dry weather across the US and EU tightens the supply outlook for maize. Weather and its effect on yields will continue to be a watch point going forward. However, gains may be capped somewhat by Ukrainian exports.

Advertisement

Advertisement

Barley - The barley market both domestically and globally remains tight, with markets following the wider complex.

Global markets - With hot dry conditions in the US and Europe impacting the quality of maize crops, global grain markets were supported last week. However, gains were somewhat capped by grain shipments continuing to leave Ukraine.

On Friday the USDA released its latest USDA World Agricultural Supply and Demand Estimates (WASDE). Global wheat output for 2022/23 has been revised up from previous estimates by 7.96Mt to 779.60Mt, on the back of higher output from Russia, Australia, and China. Despite production being revised higher, global ending stocks are expected to be marginally lower at 267.34Mt (267.52Mt in July), on the back of stronger domestic and export demand.

For maize, the latest WASDE now pegs 2022/23 maize production at 1179.61Mt, down from 1185.90Mt, in July, driven by cuts to US and EU output. With demand expected to remain relatively stable and exports forecast to increase slightly, ending stocks are now forecast at 306.68Mt (312.94Mt in July). This is currently the second-lowest end-season stock level in eight years, behind 2020/21.

Advertisement

Advertisement

In last week’s crop conditions report, the USDA dropped its crop condition scores for spring wheat and maize on the back of hot dry weather. As at 7 August, 58% of the US maize crop was rated good to excellent, down 3 percentage points (pp) on the week and 6pp behind the same week in 2021. With the hot dry conditions persisting last week, this week’s crop condition report will likely be a watch point.

As well as weather concerns in the US, there are worries about the effect of hot dry conditions on the EU maize crop too. As at 8 August, an estimated 53% of the French maize crop was rated in good/excellent condition, down from 62% in the previous week, according to FranceAgriMer. This is lowest good/excellent score for French maize on records going back to 2011. There are also concerns over the conditions of crops in other European nations, such as Romania and Hungary due to the weather. In its latest report released on Thursday, Stratégie Grains cut its EU maize output forecast by 10Mt from July to 55.40Mt.

Ukraine grain exports continue, with reports of two more vessels leaving the war-torn country last Tuesday. This brings the total of ships leaving Ukraine since the ‘grain corridor’ opened to 12. The first ship that left Ukraine carrying wheat following the deal, arrived at Istanbul on Sunday according to Refinitiv.

UK focus

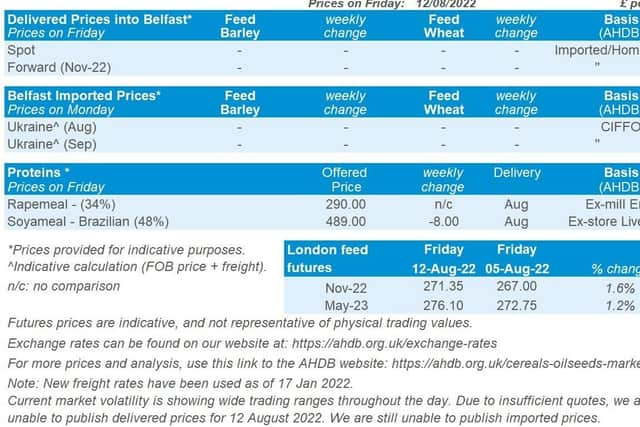

Following trends in the wider global wheat market, UK feed wheat futures (Nov-22) closed at £271.35/t on Friday, up £4.35/t from the previous Friday. The Nov-23 contract gained £3.90/t on the week, to settle at £245.60 on Friday.

Advertisement

Advertisement

East Anglia delivered feed wheat prices (for September delivery) were quoted at £267.50/t on Thursday, up £6.50/t from the previous week. As well as mirroring UK feed wheat futures movements, some of the price increase is likely due to haulage issues. With harvest progressing at a rapid pace and some farmers believed to still have old crop in store, there is currently anecdotal reports of shortages of haulage in some areas to move the volume of grain required.

Bread wheat delivered into the North West for September was quoted at £331.50/t on Thursday, up £5.00/t on the week. September delivery to Northamptonshire was up £6.00/t on the week, quoted at £312.50/t, again following wider feed wheat market movement.

GB harvest 2022 was 63% complete as at 9 August, according to the latest AHDB harvest report. The current pace far exceeds the five-year average of this point in the season of 40% complete by week 5. It is estimated that 65% of the total GB winter wheat area has been harvested and the winter barley harvest was complete by 9 August. Click here to read the full report.

The latest cereals Agri Market Outlook, released on Friday by AHDB, projected an increase in wheat production for 2022/23, driven by a slightly larger planted area. While the hot, dry conditions are expected to have some impact on yields, this is regional, with crops on heavier land yielding better than crops on lighter land, due to moisture retention. For barley, output is expected to be slightly lower on the year, driven by a smaller planted area, and slightly lower spring barley yields. In terms of demand, animal feed production is expected to be down on the year, mainly due to tighter margins for poultry and pig producers. Milling and malting demand is expected to remain relatively stable this season but consumer demand is a watch point with ‘the cost of living crisis’, as discussed in a recent analyst insight.

Oilseeds -

Advertisement

Advertisement

Rapeseed - Rapeseed prices continue to track the wider oilseed complex, with a continued floor of support from the limited exports out of Ukraine. Longer term, U.S weather will remain a watchpoint as oilseed prices react to soyabean crop development.

Soyabeans - Soyabean prices remain reactive to US weather in the short term as the crop enters its pod-filling phase. Longer term, large South American crops are likely to weigh down on the market.

Global markets

The hot and dry weather across the U.S Midwest gave some support to global soyabean markets last week. Chicago soyabean futures (Nov-22) closed at $534.29/t on Friday having gained $16.72/t over the week (Friday-Friday).

However, prices have been under pressure since the latest USDA WASDE release on Friday, with Nov-22 Chicago soyabean futures down $15.71/t from Friday’s close, at $518.64/t early this afternoon. Analysts had been expecting US soyabean production to be revised down in the latest report, due to unfavourable weather conditions. However, the USDA pegged US soyabean production at 123.30Mt, up 0.69Mt from their July estimate, adding that higher-than-expected yields should make up for the year-on-year cut in acreage.

Advertisement

Advertisement

It’s important to consider that Friday’s WASDE report is based on U.S crop conditions as at August 1, meaning the dry weather experienced over the last couple of weeks may not have been factored in to production estimates. As the crop enters the critical pod-filling stage over the next few weeks, the weather will be an important watchpoint.

Malaysian palm oil followed a similar trend last week, trading up 13.6% over the week, as the wider oilseed complex reacted to the extreme weather in the U.S. However, palm oil futures dropped over 2% today as weaker soya oil prices weighed down on the sentiment.

Winnipeg canola futures (Nov-22) also lost support following the revised U.S soyabean production figure, down C$3.90/t in Friday’s session to close at C$863.00/t. However, hot and dry weather is forecast across Canada in the coming week, meaning canola yields could be compromised as the crop continues its pod-filling phase.

Rapeseed focus

Paris rapeseed futures (Nov-22) increased by €3.00/t on the week, closing at €656.25/t on Friday. The Nov-23 contract closed at €642.75/t, gaining €4.25/t from Friday to Friday partly due to dry weather delaying new crop planting as well as following trends across the wider oilseed complex.

Advertisement

Advertisement

Friday’s harvest report indicated oilseed rape harvest is 95% complete as at 9 August, ahead of the five year average of 85% completion by week 5, with just the North East, East Midlands, Wales and Scotland with area still to harvest.

Production of rapeseed is estimated to increase by 981Kt compared to 2021, to total 1.1Mt.The production increase is explained by the estimated increase in oilseed rape area of 336Kha. Imports are expected to be slightly reduced due to this and that is expected to balance domestic consumption due to relatively stable demand. Since Hull’s Cargill crushing plant may only close in December and the demand loss could be absorbed into other crushing plants not currently working at 100% capacity, crushing demand may not be impacted substantially. On the other hand, estimates forecast the sow herd to decline and the dairy herd to shrink due to inflation and recessional fears, which could lead to reduced demand for rape meal in livestock feed.

Last Friday we were unable to publish delivered oilseed prices due to insufficient quotes to calculate the published average.