The NI weekly market report

and live on Freeview channel 276

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat - Ukraine exports continue to add pressure, with wheat also being weighed on by maize with improved US weather. Longer term, harvest 2022 continues to be a watch point with demand remaining strong.

Advertisement

Advertisement

Maize - In the short term, welcome rains across parts of the US Midwest has alleviated some concerns over this season’s crop, pressuring markets. In the longer term, the global maize picture remains tight.

Barley - Barley remains tight both domestically and globally, with markets following movements across the wider grains complex.

Global markets - Global grain markets felt the pressure last week from improved US weather conditions, continued exports from Ukraine as well as Chinese demand concerns.

Hot dry conditions across key US maize growing states, had been supporting markets of late. However, over the last week, welcome showers have eased some of the concerns around this year’s crop, in turn weighing on markets. Dry conditions have continued to persist across parts of the US maize belt, but rains have been spreading across the upper Midwest benefiting late-planted maize, according to a USDA weather report. Thinking back to planting, rain delayed a large proportion of the US maize area. Going forward, whether the recent rainfall has alleviated concerns completely is unclear. Later today, the USDA will be releasing its latest weekly crop conditions report, with the condition of the maize crop a watch point for markets.

Advertisement

Advertisement

Exports of grains and oilseeds continue to leave Ukraine. Last week, three vessels carrying maize, sunflower seed and wheat left the port of Chornomorsk. This takes the total number of shipments to leave Ukraine since the ‘grain corridor’ opened to 27 (Refinitiv). On Friday it was reported that eight more ships were being loaded with agricultural products at the ports of Odesa, Chronmorsk and Pivdennyi. Ukrainian exports will continue to add pressure to markets, or act as a ceiling to any gains. However, with a cut in production due to the war and continued attacks on ports, the volume able to leave the country is uncertain.

Last week, concerns over China’s economic growth were sparked as its central bank cut interest rates again to try and support the economy following COVID. With China a major importer of agricultural commodities, a fall in Chinese demand remains a watch point for markets.

Russian wheat output has been revised up by 3.8Mt from previous estimates to 94.7Mt, by consultancy SovEcon. This is down to record yields, and an improved spring wheat outlook due to recent rain. While Russia is expecting a bumper crop, exports have been reportedly slower than expected with insurers and shippers remaining wary. Russian wheat exports will remain a watch point going forward.

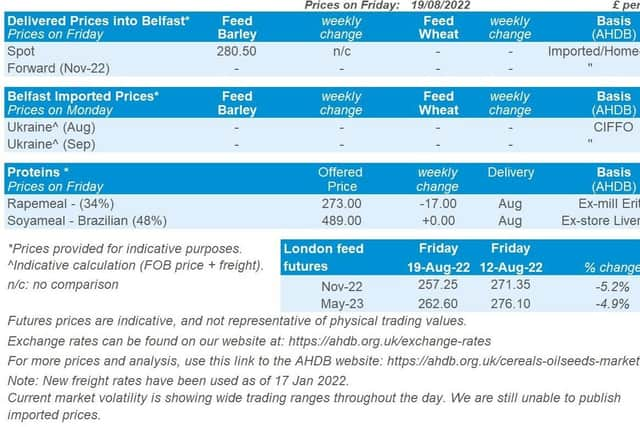

UK focus - On Friday, UK feed wheat futures (Nov-22) closed at £257.25/t, down £14.10/t from the previous week. The Nov-23 contract closed at £241.00/t, down £4.60/t Friday to Friday. UK futures tracked global markets as Ukrainian exports continued to put pressure on global futures prices, with 27 vessels in total having left Ukraine as of Saturday (20 Aug).

Advertisement

Advertisement

Domestic delivered prices followed futures price movement to Thursday. Feed wheat delivered into East Anglia, for November, was quoted at £250.00/t down £20.00/t on the week.

Bread wheat delivered into Northamptonshire for harvest delivery was quoted at £295.50/t, down £14.00/t Thursday to Thursday.

The fourth GB harvest progress report was released on Friday. In data up to 16 August, 89% of GB harvest 2022 was complete. This is well ahead of the 52% five-year average for harvest progress by this point in the season (week 6).

GB winter wheat harvest is estimated to be 92% complete, with the majority of crop left to be cut in the North East and Scotland. GB spring barley is estimated to be 73% complete and oat harvest 79% complete, with winter barley and winter oilseed rape both complete entirely.

Oilseeds

Advertisement

Advertisement

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Rapeseed -Ukrainian shipments leaving port pressures prices short term. Longer term, rain for US soyabean development and wider oilseed demand will be something to watch. Though the supply and demand balance for wider vegetable oils remains tight.

Soyabeans - Rain arriving in the US pressures price short term and boosts the longer-term outlook for US supply. Demand remains something to watch. How much will China want and for when?

Global markets - Global oilseed prices saw pressure last week from Ukrainian exports, rain falling in the US, and recessionary concerns for wider oilseed demand.

Advertisement

Advertisement

US soyabean futures (Nov-22) continue to react to weather news, as soyabeans are in a critical development stage. More rain is due this week, across key US soyabean producing areas. Though, only a small percentage of normal. Overall, a large US soyabean crop is still expected.

Chinese demand remains something to watch for US soyabean price direction. In July, Chinese imports from Brazil fell 12% year on year to 7.0Mt. The US picked up some of the slack, shipping 377.6Kt to China, up from 42.3Kt in July 2021. July is usually a month dominated by South American sales. Though overall, Chinese soyabean imports were the lowest for July since 2016, as high prices and China’s economic concerns curb appetite.

Malaysian palm oil (Nov-22) fell 7% Friday to Friday, on falling crude oil prices and poor economic data for major global economies creating demand worries. Last week, Malaysia said the export tax for crude palm oil would be maintained at 8% into September and lowered its reference price. Export demand going forward will be something to watch, especially with the recent pressure on price levels and a weakening currency.

Brent crude oil also felt pressure last week, with increased recessionary concerns on demand. On Tuesday the nearby contract closed at $92.34/barrel. Though recovered some gains later in the week.

Advertisement

Advertisement

Rapeseed focus - Nov-22 Paris rapeseed futures dropped sharply over the week, closing at €601.50/t on Friday, down €54.75/t from Friday to Friday. The Nov-23 contract lost €42.50/t week on week, closing at €600.25/t on Friday.

The drop in prices over the week was largely driven by pressure from exports continuing to leave Ukraine. Rapeseed markets were also weighed on by downward movements in soyabean markets, as a result of improved US weather and lower Chinese demand prospects.

GB winter oilseed rape harvest was completed in week ending 16 August, with this year’s pace ahead of the five-year average, but in line with the 2018 progress, according to the latest AHDB harvest progress report. The GB average yield is 3.2-3.6t/ha with the highest yielding crops established well in autumn in moisture retentive soil and had minimal pest/disease damage. See Friday’s harvest report for more information.

Friday’s delivered oilseed rape prices for August delivery were quoted at £502.50/t for Erith and £500.00/t for East Anglia/London.