Where is the security tag for milk volumes?

and live on Freeview channel 276

Dairy is on the front pages once again, with one headline last week proclaiming that ‘the cost of living crisis has come for dairy’, with ‘shoppers dismayed’ at butter prices.

The ink was not dry on the newsprint when only two days ago the headlines proclaimed, ‘UK on the edge of dairy shortages’.

Advertisement

Advertisement

One well known tabloid newspaper wrote that a high-end premium brand of spreadable butter is being sold ‘for an insane £9’. The press go on to point out that butter is so expensive that several of the big retailers have started putting security

tags on the products. This practice is usually reserved for ‘high-risk from theft’ items such as razor blades or bottles of spirits.

What is interesting to note is that the price for this brand is ranging from £7 to 9.35/kg in the shops, that’s a difference of £2.35/kg between the highest and the lowest. 1kg of butter is a very large quantity so bringing this discussion back into perspective, we should focus on the more popular size of butter packet, the 500g pack. The average price of a 500g of the same brand has risen by 33 percent compared with June last year, according to data analyst Trolley.co.uk. Just a few weeks ago, a 500g tub could be bought for £3.65 in a discount retailer now that same tub costs around £5.

Commodity prices are currently trading at £6000/tonne which is the same level as this time in 2017. Retail butter prices did rise five years ago on the back of these increased commodity prices, but not at the same rate as today. Looking at current data in closer detail, own brand butter has been rising at unprecedented rates but nowhere near the same rate as the brand highlighted in the news headlines. It gives some credibility to the accusation being made by media outlets of ‘hawking’ by

some.

Advertisement

Advertisement

That aside, members of public would assume from these headlines that the dairy farmer is going to be well-off on the back of these record prices, but this could not be further from the truth.

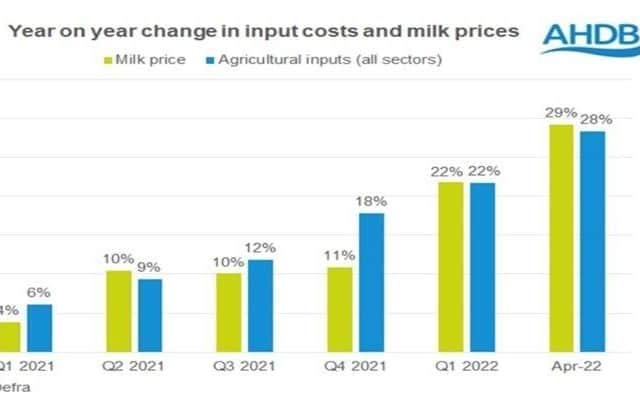

Recent AHDB data shows there has been no ‘net’ benefit to farm finances from what appear to be record high milk prices, as they have increased at roughly the same rate as agricultural input costs so far in 2022. This is shown in the graph;

This brings us back to the likelihood of a scarcity of milk.

Milk production typically responds positively to higher farmgate milk prices, under the assumption that production costs remain relatively stable. However, with the rapid increase in input cost inflation since summer 2021, milk production has started to lag

behind year earlier levels.

Advertisement

Advertisement

Despite the average Northern Ireland base milk price increasing by almost 10 ppl from January to June 2022, we have not yet seen any significant improvement in production. May is usually the month we see peak milk production, yet May 2022 (compared to May 2021) there was a 0.65 percent drop in milk volumes, according to the most recent DAERA figures.

Apart from a blip in July 2020 (a one-off fall attributed to the impact of the price shock generated by the first covid lockdown), we saw a period of five and a half years of rising production. Prior to this from March to December 2016, milk production volumes contracted on the back of record low farmgate milk prices.

For as long as the non-existent ‘net benefit’ seen in graph persists, milk production deficit will persist into 2022 (and possibly beyond), the impact of high input prices will slow down any increase in volumes.

Arla have pledged to ensure that ‘dairy farmers get a fair deal’ which is to be commended, and we would urge that all of those in the dairy supply chain to do the same. Paying the best possible farmgate price is the only way to maintain product availability and this the most logical and readily available security tag for milk volumes.