MI Northern Ireland Market Report

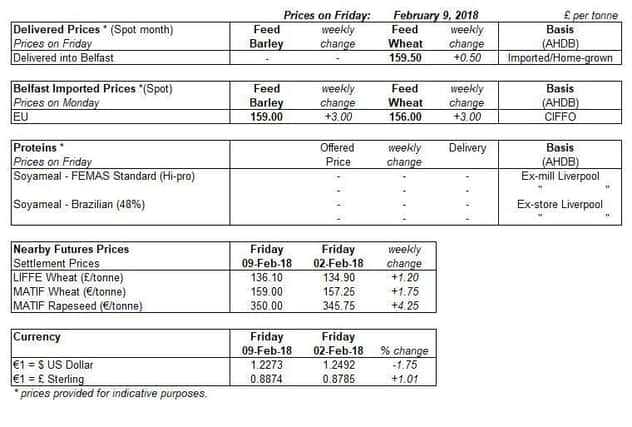

Global grain markets again recorded mixed movements last week (Friday-Friday).

UK markets climbed over the week, mainly led by currency movements. Meanwhile, Chicago futures hit mid-week highs before falling back due to an improved US moisture outlook. Published trade data and projections highlighted the rise of Indonesia as a wheat importer and the continued lack of EU exports.

Advertisement

Advertisement

Meanwhile, oilseed prices closed higher week-on-week as at last Friday (9 February). Although the supply and demand balance remains fundamentally comfortable, prospects for this season’s Argentine soyabean crop continue to grab the market’s attention.

The latest USDA World Agricultural Supply and Demand Estimates (WASDE) report on 8 February revised 2017/18 world wheat production up by 1.24Mt from January, mainly driven by increased production figures for Ukraine (up 481Kt) and Argentina (up 500Kt). However, due to an increased projection for total use, up by 3.09Mt, world ending stocks are forecast lower, but still up on 2016/17 levels.

The pace of EU soft wheat exports has continued to languish. Since 15 December, the EU has exported just 2.6Mt of wheat, the lowest amount exported over this period since 2011/12. Additionally as at 28 January, 2017/18 EU soft wheat exports for the season to date stand at 12.2Mt, 2.8Mt lower year on year and the lowest volume since 2012/13.

In the latest WASDE, the USDA reduced the 2017/18 forecast for US soyabean exports for the third consecutive month. US soyabean exports this season are now estimated at 57.15Mt (down 1.64Mt from the previous forecast and 3.4% lower year on year).

Advertisement

Advertisement

Meanwhile, Brazilian soyabean exports have been revised up by 2Mt from last month’s WASDE to a record 69Mt. The devaluation of the Brazilian real and a lower US soyabean protein content this year has helped Brazil capture some of the US market share.

Concerns for the Argentine soyabean crop due to hot and dry weather continued to provide support for prices during much of last week. The USDA reduced its forecast for Argentina 2017/18 soyabean production by 2Mt to 54Mt in the latest WASDE. The Buenos Aires Grain Exchange also cut its expectations of this year’s soyabean crop by 1Mt to 50Mt. Rain arrived in the Pampas at the end of last week, applying downward pressure on soyabean futures, and further showers are expected this month. However, whether or not this is enough to avert a hit to yields remains to be seen.

Canadian canola (rapeseed) stocks were a record 14.1Mt (5.7% higher year on year) as at 31 December 2017 according to data released by Statistics Canada last week. The high stock levels were not surprising given that Canadian canola production in 2017 reached record levels.