MI Northern Ireland Market Report

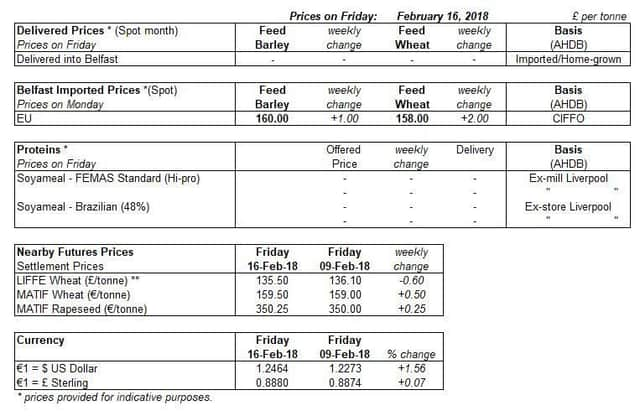

Movements were once again mixed for global grain markets last week (Fri–Fri).

UK and Paris wheat markets saw marginal declines but US wheat and maize futures increased on the back of the continued concern for the Argenrtine maize crop.

Advertisement

Advertisement

Concern over how the continued dry weather in Argentina could affect the country’s maize crop remained. The proportion of the crop which had started the yield influencing silking stage, as at 31 January, was 10 percentage points below the five year average (Buenos Aires Grain Exchange, BAGE).

EU wheat export forecasts were cut for the fourth month running with 21.4Mt now expected to be exported from the EU in 2017/18, according to Strategie Grains. This is a decline of 300Kt from the previous projection in January and is now 11% lower year on year. In addition, French common wheat ending stocks and exports were revised up by FranceAgriMer, due to lower exports. The latest February revision saw a 12.9% increase in stock closing levels from January, exceeding 2016/17 levels by 10.4%.

The price of French wheat will likely influence UK prices. However, with the UK currently a net importer of wheat, and currency causing much of the price variation observed at the moment, the exact effect is yet unclear.

Soyabean prices rose again last week (Fri-Fri) due to concerns about the impact of dry weather in Argentina on soyabean yields.

Advertisement

Advertisement

Buying activity by speculative traders was also reported to have contributed to the rise. However, currency movements meant these gains did not filter through to European rapeseed prices. New crop UK delivered rapeseed (harvest, Erith) prices gained £1/t between 9 and 16 February.

The centre and south of the soyabean growing regions of Argentina are still affected by water stress despite recent rainfall, according to the BAGE. As a result, the yield potential of the crops is said to be at risk and 56% of the crop is rated to be in a poor/very poor condition. The BAGE currently forecasts the crop at 50Mt (vs 57.5Mt last year). Oil World reduced its forecast on Friday 16 February and the Rosario Grain Exchange indicates it could reduce its forecast from the current 52Mt later this week.

The Brazilian soyabean harvest is lagging behind last year’s pace following persistent rainfall (AgRural). If the harvest pace continues to lag, any delays in bringing the 2017/18 Brazilian crop to market could boost US soyabean export sales and so potentially support Chicago soyabean prices.

However, a larger impact could be felt in the maize market, if planting of the safrinha maize crop is delayed.