MI Northern Ireland Market Report

Grain markets continued to have a bearish tone last week (29 October to 02 November).

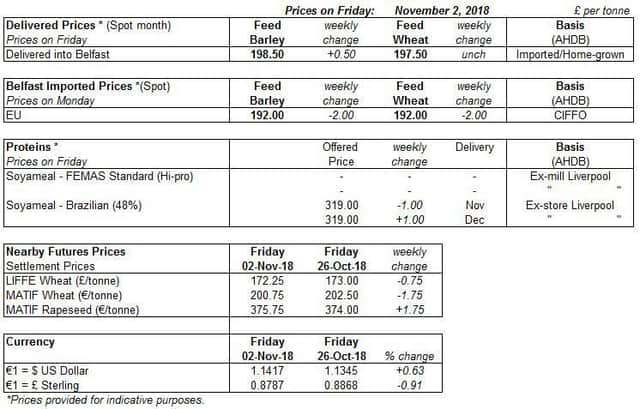

Paris wheat futures fell slightly Friday-Friday as did UK feed wheat futures. Grain futures were partially influenced by upward revisions to global wheat production figures. However, the impacts from the drought in Australia are beginning to be quantified.

Advertisement

Advertisement

Global wheat production and stocks forecasts for 2018/19 have been revised up by 9.2Mt and 8.9Mt respectively. This is stated by the FAO in their latest supply and demand brief (released on 1 November). Yet despite the upward revisions, the wheat stocks figure of 264.4Mt is 12.4Mt lower than 2017.

The drought impact in Australia is beginning to be quantified. The Australian government organisation ABARES expect that wheat and barley production will be 13% and 17% lower than their previous September report. The expected change places wheat production at 16.6Mt and barley at 6.9Mt, 1.9Mt and 0.8Mt higher than the current USDA estimate, an update to which will be released on Thursday 8 November.

Hopes for a resolution in the ongoing US/China trade dispute resurfaced towards the end of last week following tweets by the US President.

The dispute has limited US soyabean exports to China and so weighed heavily on US soyabean prices. Resolution could support US soyabean prices and potentially boost European rapeseed values, but this is far from certain and so remains an area to watch for now.

Advertisement

Advertisement

Chicago soyabean futures rose last week on hopes for a resolution in the ongoing US/China trade dispute. This resulted in a slight uplift to Paris rapeseed values. UK rapeseed delivered prices also rose between 26 October and 2 November.