MI Northern Ireland Market Report

Mixed movements for global wheat prices were observed last week (Friday 25 January – Friday 1 February).

US old-crop wheat markets strengthened slightly, with increased anticipation that US wheat exports will pick up as supplies tighten elsewhere; however proof of this trade shift is yet to appear.

Advertisement

Advertisement

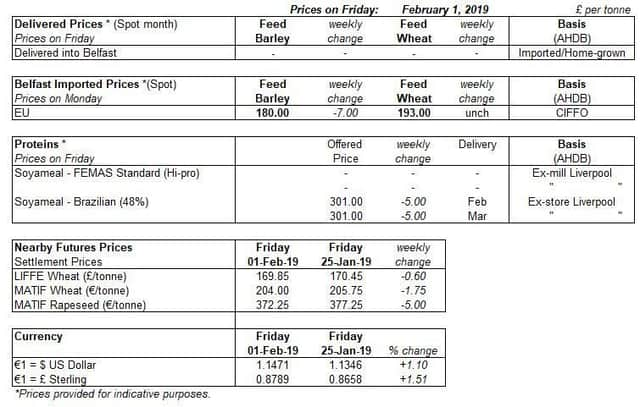

UK markets showed little movement last week, with weakening sterling negated by falling Paris wheat futures as EU exports remain sluggish despite the latest Egyptian tender. Old crop UK wheat futures (May-19) closed down £0.25/t Friday-Friday and new crop (Nov-19) up £0.15/t.

Divergent movement was observed in international wheat markets last week on the back of the latest Egyptian wheat tender, by state buyer GASC. The tender initially requesting bids for 120Kt of soft/milling wheat evolved into a 360Kt purchase, split between French and Romanian origins. The purchase of European wheat was bullish for European markets in mid-week and bearish for US markets.

US markets rose later in the week with anticipation growing that exports will pick-up at the expense of tightening Black Sea supplies. However, with US export sales data slow to come forward since the US government shutdown ended, the market is no clearer on official US export levels.

The European Commission cut their 2018/19 soft wheat export estimate by 2Mt last week to 18Mt following a slow export pace so far this season. Following the recent successful French wheat tender, signalling that European wheat is becoming more competitive on the global market. It will be interesting to see how EU wheat exports progress in the coming months, and if French and German exports can continually compete with Eastern Europe origins.

Advertisement

Advertisement

Little changed in the oilseeds markets last week; US soyabean markets eased lower before experiencing a slight pickup on Friday, as reports emerged of China purchasing US soyabeans. In rapeseed markets, Paris futures (May-19) fell over the week, largely due to a strengthening euro and pressure feeding through from the soyabean markets.

UK delivered rapeseed prices gained slightly on the week with a weaker sterling offering support. Feb delivered Erith was quoted up £1.00 on the week (Fri-Fri) at £334.00/t with harvest delivered prices to Erith also up £1.00/t at £322.50/t.