MI Northern Ireland Market Report

Global markets gained last week (8 March - 15 March), following the bearish tone seen so far for the month.

Chicago wheat futures recorded the highest rises, with investment funds (managed money) unwinding short positions and extreme weather currently threatening the Midwestern feedlot cattle and wheat states.

Advertisement

Advertisement

UK feed wheat futures gained on the back of the rises in Paris milling wheat futures markets, although this rise was capped by the strengthened sterling.

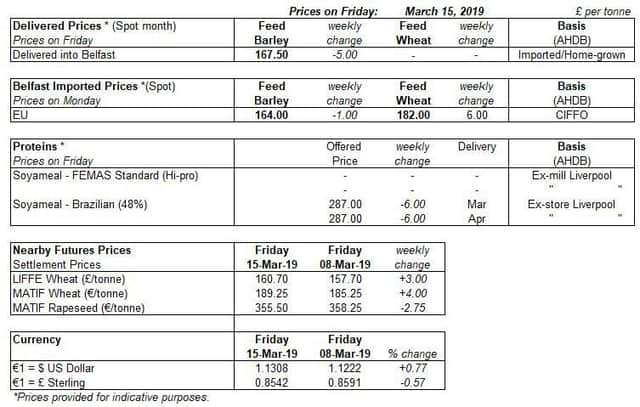

May-19 UK feed wheat futures rose £3.00/t Friday-Friday to close at £162.55. Similarly, Nov-19 futures gained £2.35/t to close at £148.35/t. In the physical markets, East Anglian delivered feed wheat prices for May-19 rose £3.00/t week on week, quoted at £169.00/t.

Despite gains last week driven by adjustments in Chicago futures markets, there is no clear direction for markets this week. Looking further ahead there is still likely to be abundant end of season US wheat supplies. This, combined with the slow export pace will act as a ceiling to prices.

Global wheat markets moved lower again upon opening on Monday (18 March). However, a significant devaluation of sterling has pushed domestic prices higher. As the Brexit uncertainty continues, deviation in sterling will continue to be crucial to domestic markets.

Advertisement

Advertisement

UK delivered oilseed markets were unchanged on the week. Oilseed rape delivered into Erith (spot) was quoted at £310.00/t. Oilseed rape for Harvest and November delivery to Erith was quoted at £304.50/t and £312.50/t respectively. Lacking demand for domestic seed is being met by a lack of domestic selling, this is keeping the market flat.

Paris rapeseed futures (May-19) closed on Friday at €355.50/t, down €2.75/t on the week. Crude rapeseed oil was also pricing lower, Friday-Friday.

The picture for old-crop rapeseed is unchanged this week, with no fundamental changes. Reports of increased imports of Canadian rapeseed, with prices at a significant discount to EU rapeseed, may add pressure to prices.

The direction of old-crop rapeseed is being also driven by the ongoing dispute between Canada and China. China continues to impose restrictions on imports of Canadian canola (oilseed rape) .

Advertisement

Advertisement

The picture for new crop is heavily dictated by weather patterns at this moment in time. The planted area figures and planting expectations for key producers will have been factored in. There is a reduced area in Western Europe, and expansions in Eastern Europe, Australia and Canada.