MI Northern Ireland Market Report

Grains

(Week ending 10 May):

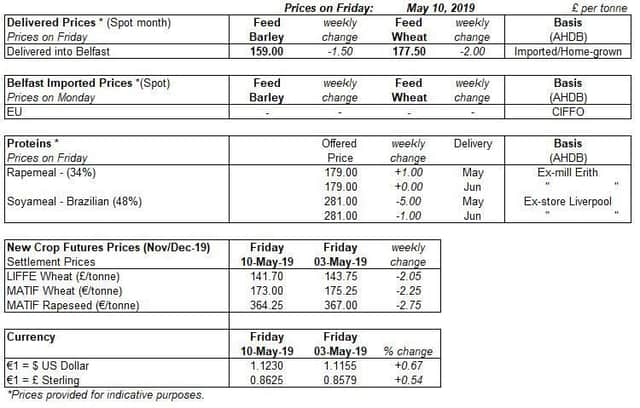

Feed Barley, delivered to Belfast (spot) down £1.50/t, at £159.00/t

Feed Wheat, delivered to Belfast (spot) down £2.00/t, at £177.50/t

Advertisement

Advertisement

New-crop Wheat (Bearish) – Global wheat production is set to rise for 2019/20, up 45.9Mt to a record 777.5Mt.

EU wheat production is projected to be 153.8Mt, a four year high.

Ukrainian wheat production at 29Mt would be the largest in nearly 30 years.

Russian production is projected to be the second highest on record at 77Mt, although other agencies are forecasting an even larger Russian wheat crop.

Advertisement

Advertisement

US production is forecast up slightly year on year, outweighing a reduced area.

New-crop Barley (Bearish) – Global barley production in 2019/20 is projected by the USDA to rise to an 11 year high. This is mainly driven by increases in EU production, up 6Mt year on year to 62Mt.

Ukraine, Turkey, Russia and Canada are all also forecast year on year increases in production. A better supplied Europe, Black Sea and Canada is projected to outweigh higher import demand from the likes of Saudi Arabia and lead to increased ending stocks.

With larger Black Sea crops forecast, this may increase export competition into the Middle Eastern and North African markets. As 2019/20 is likely to see an increased domestic exportable surplus, this could further pressure UK barley markets.

Advertisement

Advertisement

UK Old Crop - Wheat prices have continued to fall week on week amid reduced demand and new crop expectations. Old crop feed barley has fallen further, as East Anglia has now moved to an export competitive price level.

Oilseeds

(Week ending 10 May):

Oilseed Rape, delivered to Erith (May-19) down £1.50/t, at £315.00/t

Rapemeal (34%), ex-mill Erith (May-19) up £1.00/t, at £179.00/t

Please note: In last week’s report the May-19 delivered rapeseed price was incorrectly quoted at £313.00/t. For the week ending 3 May rapeseed (delivered, Erith) for May-19, was worth £316.50/t.

Advertisement

Advertisement

Bearish – New crop oilseed markets have continued to fall due to ongoing bearish news. Chicago soyabean futures (Nov-19) reached a contract low on Monday (13 May), primarily due to an increased supply outlook.

Paris rapeseed futures (Nov-19) have also followed suit, dropping €2.75/t from Friday (3 May) to Friday (10 May). Rapeseed prices fell further on Monday reaching their lowest point since early March, at €361.75/t.

• Bearish - As at 31 March 2019 Canadian canola stocks sat at 10.02Mt, a year on year increase of 956Kt. Soyabean stocks were also up by 119Kt year on year to reach 2.91Mt (Statistics Canada).

• Neutral - USDA have reduced the EU rapeseed forecast for 2019/20. Rapeseed production is now estimated 400Kt down on last year, at 19.7Mt, well above that of the Stratégie Grains forecast of 18.9Mt.

Advertisement

Advertisement

• One to watch – Global weather is still one to watch. European dryness has been slightly alleviated, but this could still have an impact on 2019 crops. Rainfall in some parts of South America is causing concerns for harvest progress, quality and yield.