MI Northern Ireland Market Report

Grains

(Week ending 7 June):

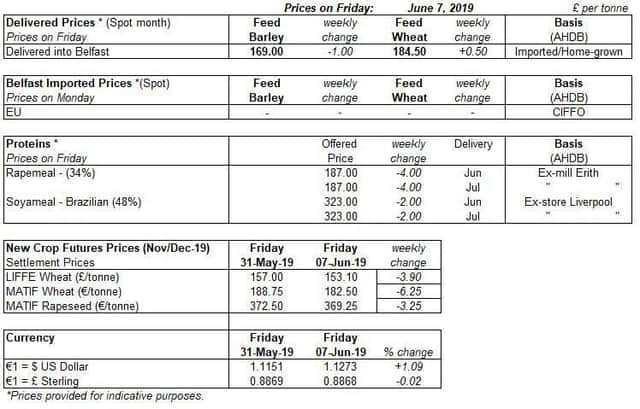

Feed Barley, delivered to Belfast (spot) down £1.00/t, at £169.00/t

Feed Wheat, delivered to Belfast (spot) up £0.50/t, at £184.50

Advertisement

Advertisement

Neutral to Bearish - A lack of fresh bullish news, and continued beneficial weather across much of Europe has paused the recent grain rally. With favourable weather across Europe, and good yields forecast there is still a potentially bearish outlook for new crop wheat.

Wheat

One to watch - 2019/20 Russian wheat production forecasts by SovEcon were lowered by 0.8Mt to 82.6Mt following limited rainfall in key wheat regions. However, at 82.6Mt, this is still 4.6Mt higher than the USDA estimate.

Neutral – Managed Money funds remained in a net-short position last week as the pace of buying slowed. With a near neutral position now in Chicago wheat futures, this technical support factor may well diminish, and US wheat markets drift lower.

Bearish - Conditions across Europe have been favourable for crop development. The latest EU Commission forecast upped wheat production by 2.5Mt from the previous month to 143.6Mt. German farmers association DRV forecast wheat production at 24.7Mt, up 21.9% year on year.

UK Focus

Advertisement

Advertisement

Changes to the Defra June Survey have altered forecasts for the 2019 planted area. However, owing to favourable conditions, average yields would give a 15Mt wheat crop and over 7Mt barley crop.

Both old and new-crop physical feed wheat markets fell back last week as the rally in the global futures markets came to an end.

There is now a minimal discount from old to new-crop feed wheat prices, and both have fallen.

Feed barley prices for both old and new-crop have also converged owing to limited demand for feed barley.

Oilseeds

(Week ending 7 June)

Advertisement

Advertisement

• Oilseed Rape, delivered to Erith (Jun-19) is down £2.50/t, at £323.00/t

• Rapemeal (34%), ex-mill Erith (June-19) is down £4.00/t, at £187.00/t

Oilseed markets moved lower last week. The fall in Paris rapeseed futures filtered into the domestic market, with UK rapeseed delivered into Erith for June, falling by £2.50/t to £323.00/t on Friday. The move lower was limited by a weakening of sterling.

Rapeseed

Bullish - Rapeseed in isolation has a largely bullish outlook. Both crop sizes and crop conditions have been called into question in recent weeks for the UK, EU and Canada.

Advertisement

Advertisement

Bearish - The EU rapeseed crop is expected by the EU commission to fall to its lowest since 2007/08 (18.7Mt), while the Canadian crop is expected by Oilworld to fall by 840Kt, to 19.5Mt (www.oilworld.de).

Bearish - Despite its generally bullish outlook, rapeseed is being moved down by the weight of the soyabean market pulling the vegetable oil complex lower and by large Canadian canola stocks.