Northern Ireland Weekly Market Report

Wheat - Further cuts to Australian wheat production, and increasingly poor outlooks for Southern Hemisphere production have been reducing the size of the forecast global surplus.

Maize - Continued dry weather in South America across Argentina and Brazil has been supporting markets. Early maize planting in Argentina by 9 October was 16 percentage points behind average, with a reducing moisture condition.

Advertisement

Advertisement

Barley - Upward revisions to EU production have further increased the outlook for global ending stocks. Greater European supplies of barley may require the discount to wheat to widen further.

Global Markets

US maize crop developmental delays have translated into harvest falling further behind average. With just 58% of the US crop now mature, 27 percentage points behind average, only 15% of the crop has been harvested. With adverse weather and snowfall in the northern plains, harvest will be hard-pressed to catch up, providing support to the underlying maize market.

Additionally, the harvest of US spring wheat had progressed by just 1% last week with 9% left still to cut as at 6 October. This time last year, the US wheat harvest had been completed for three weeks.

Conversely, the Southern Hemisphere has remained dry with little rain forecast, delaying maize planting in Argentina and further downgrading the condition of the wheat crop.

Advertisement

Advertisement

The combination of Northern and Southern Hemisphere delays, and further cuts to Australian production outlooks have reduced the size of the grain surplus in 2019/20, allowing a less bearish global outlook.

UK Focus

Defra provisional crop estimates for national wheat production came in at 16.283Mt. This is broadly in line with expectations, with a national yield of 9.0t/ha. With domestic consumption estimated at 14.809Mt in the Early Balance Sheet, the surplus available for export stands at 2.885Mt.

At 8.180Mt, total barley production was higher than market expectations, due to record spring barley yields. At 6.5t/ha, this would be the highest national spring barley yield on record. The AHDB Harvest Report findings were for a more modest year on year increase in spring barley yields, at 5.8-6.0t/ha.

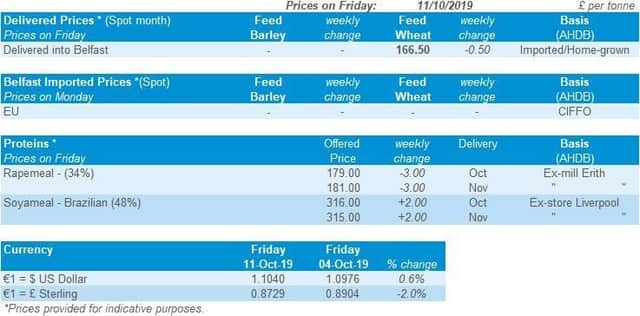

Ex-farm prices are available on the AHDB website.

Oilseeds

Rapeseed - Record EU rapeseed imports recorded but large volumes still required, with limited export origins. Delays and reducing production outlooks for Australian and Canadian supply. New crop plantings report pest issues in the UK.

Advertisement

Advertisement

Soyabeans - USDA WASDE report details reduced US soyabean production and US end-soyabean stocks. Blizzard weather delays crop maturity and harvest in northern US states. A more positive tone between the US and China as ‘initial deal’ reported.

Global Markets - US soyabean markets saw a boost at the end of last week. The latest USDA supply and demand estimates (WASDE) indicated significant cuts to both soyabean production figures and soyabean stocks estimates. On Friday, Chicago soyabean futures (Nov-19) closed the week at $343.89/t, up $7.63/t from Monday (07 Oct). Managed funds saw a turn to net-long positions in Chicago soyabeans at 1%, a first since February.

The large weight of US soyabeans is being gradually chipped away at, with improved purchases from China. The WASDE report highlighted a larger than expected reduction of 4.90Mt to US soyabean ending stocks from September’s release.

US markets saw additional support from the announcement of a ‘phase-one deal’ in the US trade dispute with China. It was announced that Chinese agricultural purchases could reach $50 billion, although this was met with some scepticism from market experts.

Advertisement

Advertisement

Weather remains a key watch point for oilseed markets. US northern states are currently heavily affected by snowstorms, with large volumes of snow delaying ongoing harvests and cold temperatures slowing soyabean maturity rates. In Brazil the picture is vastly different, with recent dryness slowing soyabean sowings. Recent planting estimates (08 Oct) put Brazilian progress at just 3%, the slowest rate in six years, according to AgRural.

Rapeseed Markets - A late uptick to sterling last week saw UK rapeseed prices fall overnight. Positivity regarding a Brexit deal saw sterling rise 3% from Thursday to close on Friday at £1=€1.143. On Friday, domestic delivered rapeseed (Erith - Oct) fell £5.00/t to £340.50/t, from the week before. Domestic trade was reportedly “quiet” with little current incentive for sellers, whilst crushers are reportedly “well-stocked”.

Imports of rapeseed into the EU have hit a record 2Mt so far this season, with Ukraine as the main origin. However, 70% of the Ukrainian rapeseed exportable surplus has been moved already in a front-loaded export schedule. The UK has imported 33Kt of Ukrainian rapeseed to September, according to UkrAgroconsult. Canadian origin could be an option for the New Year, however GM characteristics limit end-usage. Looking forward, there could be tightness in the EU later in the season.