Northern Ireland weekly market report, 22 April 2024

and live on Freeview channel 276

22 April 2024

Grains

Wheat

Sluggish export demand for US and EU wheat continues, with competitive Black Sea supplies continuing to dominate the market. However, concerns over new crop conditions limited any losses.

Maize

The global maize markets looks well supplied longer term. However, updates on South American crop conditions remains a key factor driving prices short-term.

Barley

Advertisement

Advertisement

Concerns over European barley crops continues as French spring planting nears completion. Conditions in other key barley producing regions will also be important for longer term price direction.

Global markets

Movement in global grain markets was relatively minimal last week (Friday to Friday), though European and US prices moved in opposite directions. Chicago wheat futures (May-24) were pressured 1.03%, while Paris milling wheat futures (May-24) ended the week up 1.47%. Chicago maize futures were also pressured on the week, while Paris maize futures gained. The overall sideways movement over the last couple of weeks comes as concerns over new crop conditions weigh against continued competition from the Black Sea region, and lacklustre global export demand.

Competitive Black Sea supplies continue to flow. On Friday, the Institute for Agricultural Market Studies predicted that Russia’s wheat exports will reach a record high in the 2023/24 season and exceed half of last year’s (2023) harvest. However, looking ahead to harvest 2024, SovEcon cut its estimate of Russia’s wheat crop to 93.0 Mt, from 94.0 Mt in late March. This follows concerns over dryness in key producing regions, something to watch out for over the next few weeks.

Crop conditions in western Europe remain in focus. FranceAgriMer reported on Friday that as at 15 April, 64% of French soft wheat was in good/excellent condition, unchanged on the previous week, and remaining well below 93% a year earlier. French spring barley planting is nearing completion, at 98% complete compared to 91% the week prior.

Advertisement

Advertisement

Uncertainty over the Argentinian maize crop is on the rise. Last Wednesday, the Rosario Grain Exchange reported that its estimate of the crop will likely be cut significantly further due to a stunt disease spread by leafhopper insects. The Exchange currently estimates the crop at 50.5 Mt, down from 57.0 Mt the week before last. Further cuts to this will be a key watchpoint as the global grain outlook looks to be tightening.

UK focus

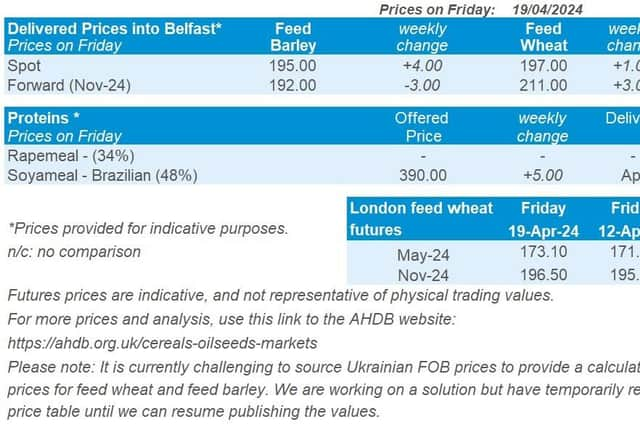

Domestic wheat futures generally followed European price direction last week (Friday to Friday). The May-24 contract closed on Friday at £173.10/t, gaining 0.79% on the week. The Nov-24 contract was up 0.74% over the same period, ending Friday’s session at £196.50/t.

UK delivered prices followed futures price movement Thursday to Thursday. Feed wheat delivered into East Anglia for April delivery was quoted at £175.50/t, up £4.00/t on the week. Bread wheat delivered into the North West for May delivery was quoted at £259.50/t, with no weekly comparison.

Analysis last week showed that following a strong pace over the autumn/winter period, UK oat exports are beginning to slow. According to HMRC, exports of oats this season to date (Jul-Feb) totalled 94.2 Kt. This sits 48% above the five-year average for this period, but 27% below the same point last season.

Oilseeds

Rapeseed

Advertisement

Advertisement

Weakening prices across the vegetable oils complex weighs. However unfavourable growing conditions in Europe continue to offset any losses on new crop prices.

Soyabeans

Pressured vegetable oils prices, and above average yields in Argentina weigh on short term outlook, while current planting progress in the U.S. offers minimal support for new crop prices.

Global markets

Chicago soyabean futures (May-24) were pressured over the week (Friday – Friday), falling 2.0% to close at $422.69/t on Friday. The fifth consecutive weekly fall for soyabeans came as a result of continued US dollar strength, spurred soyabean selling in Brazil, and reports of easing tension in the Middle East. However, losses for soyabean futures were partially offset following a technical bounce midweek and some support in the vegetable meal markets in response to strong global demand.

Last week, the US dollar reached a five and a half month high on the US dollar index, an index that tracks US dollar strength against other key global currencies. Strength comes from recent U.S. data which showed a likely delay in any change to interest rates. In contrast, the considerable depreciation of the Brazilian real spurred farm selling in Brazil and consequently pressured global soyabean prices.

Advertisement

Advertisement

Palm oil prices also weighed on the vegetable oils complex as it fell under strong pressure due to rising production as well as falling demand with cultural festivities coming to an end. In addition, more pressure came in response to the moderate fall in crude oil markets, as concerns of further escalation eased regarding tension in the Middle East.

US soyabean plantings are now underway. As at week ending 14 April, planting progress sat at 3%, above the five-year average of 1%. In particular, in Illinois, the largest producer of soybeans in the US by state for 2023, planting is 4% complete, ahead of this point last season (3%) and the five-year average (1%).

Soyabean harvest in Argentina has slowed primarily due to recent heavy rainfall. As at 17 April, progress is 22 percentage points behind the five-year average. However, despite harvest delays, the national average yield is forecast up 14% on the five-year average, supporting the 51 Mt production estimate (Buenos Aires Exchange).

Rapeseed focus

Paris rapeseed markets were also under pressure over the week (Friday – Friday). Old crop futures fell €10.00/t to close at €449.00/t on Friday, while new crop (Nov-24) futures fell €13.50/t to close at €455.50/t. Although demonstrating a mild disconnect to Chicago soyabean futures for the previous two weeks, weakening prices seen across rival oilseeds and crude oil prices weighed on rapeseed prices last week.

Advertisement

Advertisement

Rapeseed delivered into Erith for April 2024 delivery was quoted at £373.00/t, falling £4.50/t over the week (Friday – Friday). While for new crop, rapeseed delivered into Erith for November delivery was quoted at £389.00/t, with no comparison on the week. Please note, the delivered prices survey was undertaken on Friday morning, and therefore will not take into account the price movement for Paris rapeseed futures across the whole day on Friday.

Agreste published estimated field crop areas in France for 2024 last week. For rapeseed, Agreste forecast 1.328 Mha, down 1.3% on the year, however up 14.9% over the five-year average (2019 – 2023). Europe’s rapeseed crop remains under pressure from heavy rainfall in western countries and a lack of rainfall in the east, something to monitor.

A key watchpoint is the Canadian Supply and Demand balance sheet for April, due to be released this week, offering insight into the outlook of the country’s field crops, including rapeseed.