Northern Ireland market report

Grains

Wheat - Tight demand and supply keeps prices elevated, despite new Omicron variant news. Australian quality remains a watchpoint. The market awaits news from world supply and demand estimates this week.

Maize - Wheat prices and ethanol demand supports for the short-term. Longer-term, large South American crops are expected. Weather in South America will be a watchpoint, with La Niña in play.

Advertisement

Advertisement

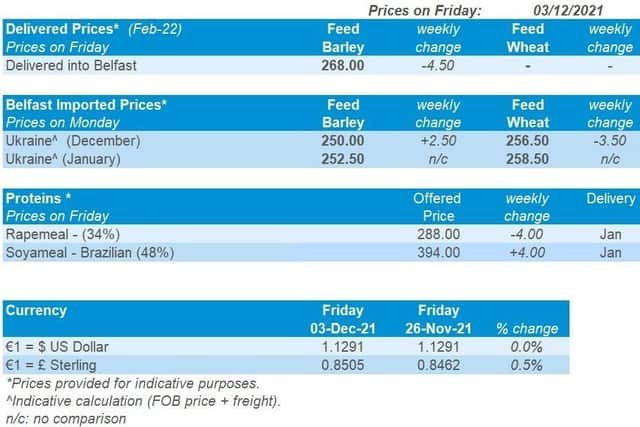

Barley - Barley prices continue to follow wheat markets, with global supplies tight. Into Avonrange (Jan-22 delivery) the discount of feed barley to feed wheat was £10.00/t on Thursday (02 Dec).

Global markets - News of the spreading Covid-19 variant Omicron pressured the markets early last week, leading to some speculators loosening their positions. Despite wheat markets re-gaining ground on Thursday, supported by tight supply and demand fundamentals, global wheat contracts ended the week lower.

Last week, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) raised their 2021 wheat forecast to a record 34.4Mt. Higher than expected yields are raising production estimates 3% higher than last season. This said, quality concerns remain. November has been the wettest on record for most regions within New South Wales, causing flooding.

Statistics Canada wheat estimate for harvest 2021 decreased slightly, but remained rounded at 21.7Mt (down 38.5% from last year). The market expected a fall to 21.2Mt. Though the durum wheat forecast was cut 0.8Mt to 2.7Mt.

Advertisement

Advertisement

Strong demand may have capped further wheat losses last week, with tenders from the Middle East and North African countries. With pricing competitive in global tenders, EU exports remain strong, especially given Russian export prices continue to rise.

Russia is considering a wheat export quota between 15 Feb to 30 Jun 2022 at 9.0Mt, to tackle domestic inflation. This figure is larger than trade expectations, but no final decision has been made.

Chicago maize futures (May-22) also eased back last week, closing on Friday at $230.81/t. This is down $3.64/t from the previous Friday.

News is expected on US renewable fuel mandates and eligibility for credits in the coming days. Recent ethanol production has been strong, supporting maize prices.

Advertisement

Advertisement

2021/22 Argentinian maize plantings estimates are up 0.2Mha to 7.3Mha, according to the Bolsa de Cereales. Crops are in good condition from recent rainfall. Production is forecast at a record 57Mt.

UK focus - UK feed wheat futures (May-22) closed Friday at £231.25/t, down £5.35/t week-on-week.

Delivered prices in the UK followed futures movements (Thursday to Thursday). Into Avonrange (Jan-22 delivery), feed wheat was down £3.00/t to £233.00/t and feed barley down £1.50/t to £223.00/t.

On Friday, AHDB released their first crop condition report for the 2021/22 growing season. In November 2021, mild and settled weather lead to good crop establishment.

Advertisement

Advertisement

The latest AHDB human and industrial (H&I) and animal feed usage figures were also released last week. With many livestock sector’s margins under strain, compound feed demand is starting to feel the pressure.

Further sharp increases in fertiliser prices were confirmed for October, in the AHDB’s fertiliser price survey results.

Oilseeds - The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Rapeseed - Rapeseed markets will likely remain volatile, but somewhat supported in the short-term. Global supplies remain tight until harvest-22. However, any news on increased covid-19 concerns could cause demand worries. Longer-term, soyabean markets and new-crop prospects may add price pressure.

Advertisement

Advertisement

Soyabeans - Short-term, soyabeans will likely find support from relatively elevated oil markets, but will continue to sit in volatile territory. Longer-term, prospects continue to look good in South America and slowing Chinese US purchasing could weigh on the market.

Global markets - Global oilseeds and oil markets experienced a volatile week last week. Many markets experienced sharp losses at the start of the week as Omicron news flooded the media. Concerns around travel restrictions and reduced demand for fuel and subsequently oil, weighed heavily on the oils and oilseeds market. Since then, key oil and oilseed markets have generally recovered some of the losses.

Export sales of US soyabeans are down year-on-year. Data to 25 November 2021, shows total commitments at 37.17Mt versus 52.27Mt the same time last year. However, last year saw exceptionally high exports at this stage. Reduced Chinese purchasing has contributed to slower exports, down 9.28Mt from the same time last year. Sources suggest Chinese importers are opting for “more than normal” Brazilian purchases, driven by high US prices and a stronger dollar.

Bearish news on long-term soyabean market sentiment is the South American prospects.

Advertisement

Advertisement

Recent rain in Argentina has boosted crop conditions (Bolsa de Cereales). As at 1 December, 88% of the crop was classified as good-excellent condition compared to 67% a week earlier.

Moisture has also improved significantly, jumping from 78% optimal/favourable to 98% in this category week-on-week. This continues to support the idea of a record soyabean crop currently anticipated.

Rapeseed focus - After a €29.75/t dip in the market (Friday-to-Tuesday), Paris rapeseed futures (May-22) closed just €0.50/t down Friday-to-Friday at €648.00/t (c.£551/t).

Initial drops followed the wider oilseed/oil complex on the back of increased concerns of the spread of the Omicron covid-19 variant.

Advertisement

Advertisement

On Friday, Statistics Canada released revised estimates for their 2021 harvest, which trimmed the countries canola production by 0.19Mt. Now pegged at 12.59Mt, it is the smallest crop since 2007. This adds further concerns for the current marketing year, already anticipated to be very tight.

Looking ahead to harvest 2022, Stratégie Grains has revised down (from the previous report) the EU rapeseed area by 30Kha, to 5.6Mha. 2021/22 production is forecast up 6% from harvest-21, to 17.98Mt.

In the UK, the first AHDB crop conditions report stated 78% of planted OSR crops are in good-excellent condition. A small proportion of crops failed during September due to dryness, but establishment was generally good. Growth continued well as October and November conditions were mostly favourable, resulting in fair canopies and leaf cover.

Domestic old-crop (harvest-21) prices recovered somewhat from the previous two weeks of losses. Delivered rapeseed into Erith (Dec-21 delivery) was quoted at £592.50/t, up £13.50/t from the previous week.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.