MI Northern Ireland Market Report

Global markets followed a downward trend last week, partly in anticipation of the bearish USDA reports released last Friday.

The reports contained US planting intentions for 2019/20 as well as US old-crop stocks held. Chicago wheat futures fell $3.03/t over the week, with this decline extended to other wheat markets.

Advertisement

Advertisement

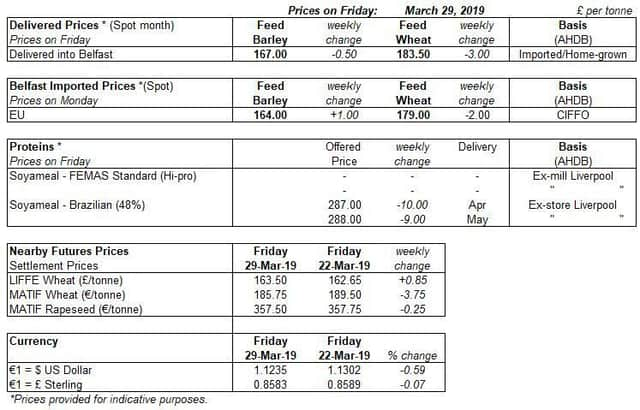

Nearby futures (May-19) closed at £163.50/t, falling £1.05/t. The decline lessened in new crop futures (Nov-19), which fell £0.75/t to close at £147.50/t. Belfast delivered feed wheat for Apr-19 quoted at £167.00/t, a decrease of £0.50/t week-on-week.

EU export forecasts have responded to the faster pace of wheat exports over the past month. The EU forecast for 2018/19 soft wheat exports has been extended to 19Mt, from 18Mt.

The US area planted to wheat is expected to be down around 4% from last year. The forecast of 18.51Mha is the lowest on record. Given the sluggish US export pace so far this season, wheat stocks held on March 1 rose 6% on last year.

The USDA plantings report also highlighted a significant pickup in the area planted to maize for 2019/20. Furthermore, the USDA quarterly stocks report also highlighted maize stocks to be down by 3% year-on-year. Maize stocks were forecast above the average of trade estimates from a pre-report Reuter’s poll.

Advertisement

Advertisement

Further pressure has been added to the maize market, as South American harvests continue to progress well.

Global oilseed futures markets declined last week, albeit to varying degrees. Old and new crop Paris rapeseed futures dropped just €0.25/t Friday-Friday. Chicago soyabeans lost $7.17/t (May-19) and $6.80/t (Nov-19) with harvest pressure from South America.

The rapeseed market is currently lacking support. The area planted to OSR in Western Europe has declined for 2019/20. Furthermore, the crop struggled with a poor establishment period and pest pressure.

Despite the reduction in Western European OSR area, increases in the area of OSR in Eastern Europe have been seen for 2019/20. This adds pressure to the global S&D for new crop, which also includes pressure from the ongoing trade dispute between China and Canada.

Advertisement

Advertisement

The derivative markets for OSR had seen some support in recent weeks, with the value of crude rapeseed oil rising. Yet prices for physical rapeseed oil appear to have dropped off considerably last week. This could be following declines in soyabean oil and palm oil, which have felt pressure from building oilseed supply levels.