MI Northern Ireland Market Report

The bearish tone to global cereal markets continued last week.

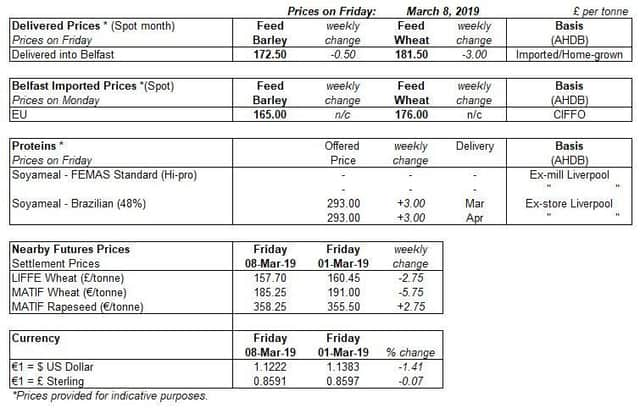

Old crop Chicago wheat futures recorded a loss, as did Paris milling wheat futures and UK feed wheat futures.

Advertisement

Advertisement

May-19 UK feed wheat futures fell £2.70/t Friday-Friday to close at £159.55/t. Nov-19 futures gained £0.75/t in the same period. Meanwhile, the discount from old crop wheat (May-19) into new crop (Nov-19) currently stands at £13.55/t, narrowing £3.45/t on the week.

Global prices are still pressured as the Black Sea, US and EU origins compete for export markets. Additionally, there are only four months left before the northern hemisphere harvest is within sight. As such, there will likely continue to be a bearish tone to wheat markets as exporters compete on price for the remaining tenders.

UK physical rapeseed values lost more ground last week. On Friday, UK OSR for spot delivery to Erith was £310.00/t, a fall of £3.50/t on the week. The latest moves in physical markets are against movements in Paris rapeseed futures. Trade conversations last week indicated that domestic prices had come down with a lack of demand for UK supplies. The well supplied vegetable oil market has continued to push lower with crude rapeseed oil prices losing $50.00/t since the end of January.

Record high canola stocks in Canada are also keeping pressure on the oilseed rape market. Canadian canola stocks are at a record level, up 4.9% on the year according to Statistics Canada.

Advertisement

Advertisement

The EU OSR crop is forecast to be tighter year-on-year, which is generally supportive. But, increases in Black Sea and Eastern European areas will keep markets subdued. Moreover, Canada is forecast for a larger crop in 2019/20 as is Australia.