NI Weekly report - 5 February 2024

and live on Freeview channel 276

5 February 2024

Grains

Wheat

Black Sea grain continues to pressure global markets amid ample supplies and improved export capability. While EU 2023/24 ending stocks have been revised up since December, stocks are still forecasted below last year’s levels.

Maize

The market will remain reactive to weather in South America short-term. However, the anticipated bumper harvest in Argentina looks to weigh on prices longer-term, along with strong planting progress of the Safrinha crop in Brazil.

Barley

Advertisement

Advertisement

While barley will continue to track the movement of the wider grains market, an expected increase of domestic closing stocks and potential larger 2024 area pressures the longer-term outlook.

Global markets

Global grain markets were under pressure from Black Sea supplies, plus an improved year-on-year outlook for US winter wheat. Chicago and Paris milling wheat futures both fell (Friday to Friday). This is despite Paris milling wheat being supported by a weakening euro and potential Chinese purchasing later in the week.

Bearish pressure from the Black Sea region continues to impact global markets. Russian wheat exports are 7.7% down in January relative to last year (SovEcon), causing export prices to remain globally competitive. The Russian Federation are said to be purchasing domestic grain in attempt to reduce the surplus. Furthermore, the Russian Agricultural Minister increased Russia’s 2024 wheat harvest area estimation by 300 Kha to 84.5 Mha. At end-January, 96% of winter sown crops were in good or satisfactory condition, supporting the outlook of the crop.

The UN’s Food and Agriculture Organisation’s cereal price index was 120.1 points for January. This is its lowest level since December 2020 following strong global competition for exports and ample supplies.

Advertisement

Advertisement

As well as improved export capacity via the Danube River, Ukraine’s key sea ports are operational, supporting Ukrainian export capability. Pressure on the continent from Ukrainian grain can be seen in EU-27 trade data; soft wheat imports from Ukraine are up 14.0% from last year.

EU-27 soft wheat production for 2023/24 has been revised up by 0.2 Mt to 125.9 Mt, 1.3% above the five-year average (EU Commission). Ending stocks are forecast at 19.1 Mt, up 3.8% from December’s estimate following increased imports and harvest production figures, though still below last season.

Argentina faces an ongoing heat wave, which poses a risk to the upcoming bumper maize harvest. Last week, 89.3% of the crop was in a ‘normal’ to ‘excellent’ state, but down from 94.5% the previous week (Buenos Aires Grain Exchange). Meanwhile, planting of Brazil’s Safrinha crop was 10.3% complete by 27 January, outpacing the progress of this time last year, which was 3.9% complete.

UK focus

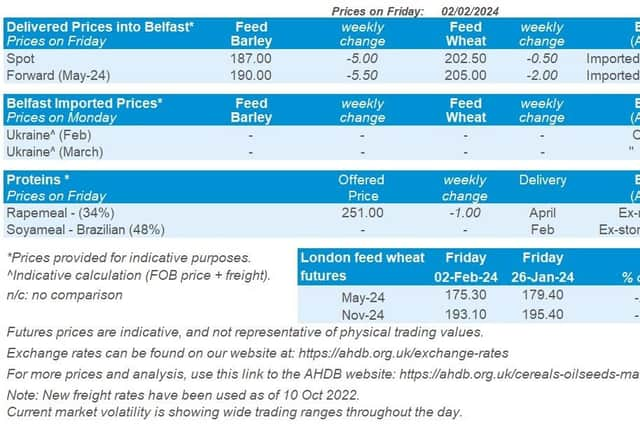

UK feed wheat futures continued to slide under the pressure of global markets, and weaker domestic animal feed demand. The May-24 contract closed at £175.30/t on Friday, down £4.10/t on the week (Friday to Friday). The Nov-24 contract lost £2.30/t over the same period, to close at £193.10/t on Friday.

Advertisement

Advertisement

Delivered prices followed futures down last week (Thursday to Thursday). Feed wheat delivered into East Anglia for May delivery was quoted at £175.50/t, down £4.50/t on the week. Bread wheat delivered into Northamptonshire for February delivery was quoted at £245.00/t, down £5.50/t over the week. While feed wheat continues to be under pressure, bread wheat premiums remain strong.

UK human and industrial cereals usage shows milling demand for wheat declined from Jul-Sep to Oct-Dec 2023 by 2.3%. Over the same period, the use of domestic wheat for milling fell while demand for imported wheat increased. Barley closing stocks for December are up 4% on the year as brewing, malting and distilling demand dipped in the Oct-Dec quarter by 3% year-on-year to 485 Kt. For oats, milling demand was up 1.2% in Oct-Dec 2023 on the same period in 2022 at 131 Kt.

In July to December 2023, GB animal feed production including Integrated Poultry Units (IPUs), was down 1% on the same period in 2022. A 2% rise in total poultry feed production partly offset year-on-year falls for cattle, pigs, and sheep.

Following the difficult autumn drilling conditions, AHDB is running an update to its Early Bird Survey to offer insight into the potential cropped area for harvest 2024. The results of this survey are due to be released on Friday 8 March, subject to spring weather allowing sufficient planting progress to be made.

Oilseeds

Rapeseed

Advertisement

Advertisement

Short-term, rapeseed futures continue to follow price movement in the US soyabean market, as well as any news on EU export demand. Longer term, expectations of a smaller 2024 EU rapeseed crop support the outlook.

Soyabeans

Short-term, market focus is still on South American production as well as US export demand, with more rain needed in Argentina. Longer-term, South American supplies are currently expected to be plentiful, likely weighing on global prices.

Global markets

Chicago soyabean futures (May-24) were pressured last week, falling $6.61/t to close at $440.24/t on Friday. The Nov-24 contract fell by $5.14/t during the same period, ending Friday’s session at $430.23/t. Despite some support mid-week, a fluctuating US dollar, weak US export demand and expectations of heavy South American supplies continued to pressure prices overall.

Export demand for US soyabeans remains sluggish. On Thursday, US 2023/24 soyabean export sales unexpectedly came in at a season low (LSEG). This data echoes demand concerns from top importer China, where the economy is still struggling post-covid. China’s manufacturing activity contracted for the fourth consecutive month in January, reflecting the country’s inability to regain economic momentum.

Advertisement

Advertisement

Another factor impacting US exports of soyabeans is a volatile US dollar. While there was some weakening mid-week for the US dollar against the euro, on Friday the value strengthened again hindering export prospects. This is due to the news that the US Federal Reserve would not proceed with a reduction in interest rates earlier than the summer, due to positive labour sector data.

Hot and dry weather in Argentina is raising concerns over the bumper soyabean crop. The Buenos Aires Grain Exchange currently estimates that this season’s crop will reach 52.5 Mt, up from last year’s drought-stricken crop of 21.0 Mt. The Argentinian soyabean crop is now in its flowering stage, making it sensitive to moisture and temperature stresses. As such, the crop will need more rain for the quality and size of the crop to be realised. Over the next seven days, there is some rain due, however temperatures are forecast to remain abnormally high.

According to a Reuters survey published today, Malaysian palm oil stocks likely fell for a third consecutive month in January. Stocks are estimated to have fallen to 2.14 Mt in January, down 6.6 % from December. Crude palm oil production is also projected to fall between January and March, contributing towards a tighter outlook moving forward. While this could lead to some support, lacklustre export demand and weaker rival oils will likely limit any gains.

Rapeseed focus

Despite a weakening of the euro against the US dollar at the end of the week, and some potential support from Malaysian palm oil futures, Paris rapeseed futures were pressured overall last week.

Advertisement

Advertisement

The May-24 contract ended Friday’s session at €416.00/t, down €16.00/t on the week. The Nov-24 contract fell €9.50/t over the same period, ending Friday’s session at €419.50/t.

Domestic delivered prices followed Paris futures movement last week. Rapeseed delivered into Erith for February delivery was quoted at £358.50/t on Friday, down £10.00/t on the week.

Stratégie Grains released its latest oilseed crop report on Friday. Rapeseed production in the EU-27 is expected to fall to 18.4 Mt for harvest 2024, from a 19.8 Mt crop in 2023, reflecting a sharp decline in planted area (LSEG).