Northern Ireland weekly market report 18 March 2024

and live on Freeview channel 276

18 March 2024

Grains

Wheat

While large Russian supplies hang over the market, there’s uncertainty about the outlook for the global wheat market in 2024/25. Weather is likely to be a key influence in the coming weeks.

Maize

Current forecasts continue to show large global maize supplies this season – dependent on a large Brazilian Safrinha crop, which will be harvested from June through to September. US maize areas will be important to the outlook for 2024/25 – planting intentions data is out next Thursday (28 March).

Barley

Advertisement

Advertisement

Farmers intending to plant less acres in Canada, and planting delays in parts of Europe mean uncertainty for the longer-term outlook.

Global markets

It was a mixed week for global grain prices, with week-on-week falls in the US markets but rises for Paris wheat and maize futures.

Grain futures markets rose in the early part of last week due to technical trading and speculative traders covering short positions. Expectations of a smaller Ukrainian harvest in 2024 and ongoing rain in Europe’s top exporter, France, were also factors. The Ukrainian Grain Association forecasts an 18% drop in Ukraine grains and oilseeds exports in 2024/25 to 43.7 Mt. Conab also trimmed 0.9 Mt from its 2023/24 Brazilian maize crop forecast, though the key growing periods are still to come.

However, later in the week the markets eased back, with competition for exports still a factor. LSEG reported that Chinese importer cancelled or postponed imports of about 1.0 Mt of wheat from Australia, due to recent price falls. On Thursday, data also confirmed the cancellation of 504 Kt of wheat imports by China from the US. A stronger US dollar exacerbated the falls in the US futures markets, while a weaker euro helped reduce the losses for the Paris futures.

Advertisement

Advertisement

The International Grains Council (IGC) forecasts global grain production will rise 28 Mt year-on-year to 2,332 Mt in 2024/25. This is driven by larger Brazilian and Chinese maize crops, plus recoveries in wheat production in Australia and Argentina; but tempered by lower US maize and EU wheat production. However, due to rising global demand the IGC predicts total grain supply and demand will be finely balanced in 2024/25, with another year-on-year fall in global wheat stocks.

Stratégie Grains reduced its forecasts for EU-27 wheat and barley production in 2024 last week due to wet weather, particularly France. Maize output could rise as a result.

The wheat crop (exc. Durum) is now seen at 121.6 Mt, down 1.0 Mt from February and 4% below 2023. Total barley is now seen at 51.8 Mt, 1.3 Mt lower than in February but still 4% higher than 2023.

French soft wheat crop rating slipped two percentage points last week with 66% of the crop now rated good/very good. This is the lowest rating since 2020 when it sat at 63%. Continued rainfall has impacted the crop, though there are hopes for a dry spell over the next few weeks.

UK focus

Advertisement

Advertisement

Old crop UK feed wheat futures saw some support last week from the Paris futures market and sterling weakening against the US dollar.

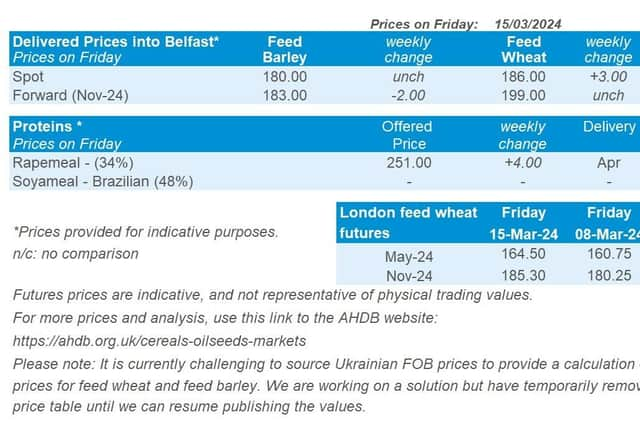

The May-24 contract closed at £164.50/t on Friday, up £3.75/t over the week. However, New crop (Nov-24) futures were up over the same period by £5.05/t, closing at £185.30/t.

UK delivered prices generally followed futures movements Thursday to Thursday. Feed wheat delivered into East Anglia for March delivery was quoted at £162.00/t on Thursday, up £4.00/t over the week. Bread wheat delivered into the Northamptonshire for March delivery was quoted at £241.00/t on Thursday, up £2.50/t on the week.

After an extremely challenging autumn, AHDB has released the results of the re-run of the Early Bird Survey to capture the potential cropped areas for harvest 2024. The wet autumn was followed by severe weather throughout the winter impacting crops and resulting in winter losses. The survey results have revealed a large reduction in winter crop areas and more spring crops, including the following changes year-on-year:

Advertisement

Advertisement

- Wheat down 15% to 1.463 Mha

- Oilseed rape down 28% to 280 Kha

- Winter barley down 22% to 355 Kha

- Spring barley up 29% to 881 Kha

- Oats up 26% to 209 Kha.

There is still a window for planting spring crops, but if the rain persists and this window narrows crops could become economically unviable.

Oilseeds

Rapeseed

In the short-term, rapeseed prices are supported from anticipated reductions to the Canadian area for harvest 2024. But, longer-term, rapeseed markets will largely follow the sentiment of soyabeans.

Soyabeans

The on-going South American soyabean harvests could continue to weigh on the market, with substantial crops still expected. US plantings and Chinese demand are key for market direction longer-term.

Global markets

It was yet another week of support for Chicago soyabean futures (May-24); the market closed Friday at $440.24/t, gaining 1.2% across the week. Supporting the market was strong domestic demand in the US, short-covering by speculative traders and technical trading.

Advertisement

Advertisement

This comes as speculators are still heavily betting on lower soyabean prices. The fundamentals in the oilseed markets still show a bearish outlook as a record South American soyabean production comes to market. Further to that, there are questions over Chinese demand, which is expected to be substantial, going forward.

Brazil’s soyabean harvest is still on-going, it was reported last Friday that the harvest is 62.3% complete. Despite the rapid start this year, progress is now marginally behind the same point last year of 62.9% (Patria Agronegocios). Conab lowered its production forecasts of Brazil’s soyabean crop by 2.6 Mt last week, with the crop now estimated at 146.9 Mt and a lot lower than the USDA’s estimate of 155 Mt. This crop is still substantial, plus recent rains in Argentina have boosted production outlooks.

The Rosario Grain Exchange upped its production estimate by 0.5 Mt last week, with the soyabean crop now estimated at 50.0 Mt.

US domestic demand remains strong as the National Oilseed Processors Association (NOPA) estimated that the US February 2024 soyabean crush was 5.1 Mt, up 0.2% from January’s figure, and up 12.6% from February 2023. This is the highest February crush ever recorded.