Northern Ireland weekly market report – 2 January, 2024

and live on Freeview channel 276

2 January 2024

Wheat

Short-term, delays to planting in western Europe and escalations in the Black Sea are keeping prices elevated, though lacklustre global demand for European wheat limits any gains. Longer-term, prices are expected to remain steady with a tighter EU new crop outlook.

Maize

Longer-term, despite weather concerns, plentiful South American supplies of maize are expected to weigh on the market. Short-term, unstable weather conditions and the planting of the Brazilian Safrinha crop will remain a watchpoint.

Barley

Advertisement

Advertisement

Barley markets continue to track the wider grains complex with heavy maize supplies expected to weigh on prices longer-term.

Global markets

From 22 December to 29 December, Chicago wheat futures (May-24) gained $4.41/t, closing at $234.95/t on Friday. Paris milling wheat futures (May-24) gained €1.25/t over the same period, ending Friday’s session at €228.00/t. Chicago maize futures (May-24) and Paris maize futures (Jun-24) were down 0.4% and 0.8% respectively over the same period. South American weather and production, Black Sea trade, and global export demand remain key drivers in global grain markets.

Concerns surrounding Black Sea exports rose again last week after a bulk carrier heading to a River Danube port to load grain hit a Russian mine on Wednesday. According to the Ministry of Agrarian Policy and Food of Ukraine, as at 29 December, this season to date, Ukraine has exported 17.93 Mt of grain and pulses, almost 1.3 times less than at the same point last season.

EU export demand remains relatively lacklustre with a rally in the euro against the dollar hindering global competitiveness. Egypt’s cancellation of an international tender for wheat last week also dampened hopes of any fresh demand.

Advertisement

Advertisement

South American weather remains a key watchpoint in Brazil with farmers preparing to plant the Safrinha maize crop. Conab currently estimates Brazil’s total maize area for the 2023/24 season to be down 5.3% on the year, though some analysts think we will see greater declines. Delays in soyabean plantings will make it too late to plant some of the maize crop, and even what is planted could be impacted by variable weather conditions. In mid-December fertiliser and seed companies were reporting as much as a 20% decline in sales compared to last year (Soybean and Corn Advisor).

Having said this, plentiful rain in the Mato Grosso region of Brazil over the last two weeks limited any losses in global maize markets as soil moisture conditions improved. Looking ahead, more rain is due in the region over the next seven days, something to watch out for.

UK focus

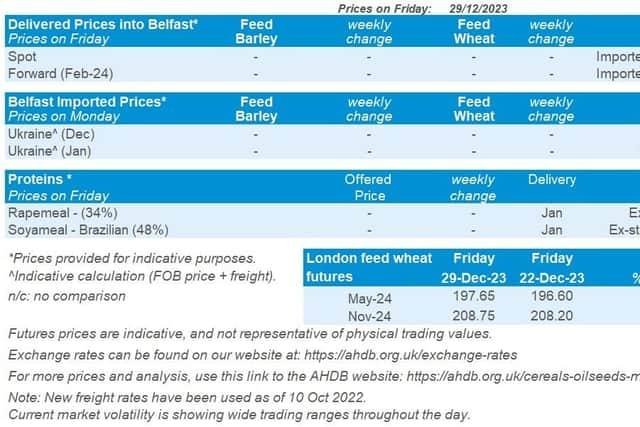

Domestic wheat futures followed global price movement up last week. UK feed wheat futures (May-24) closed on Friday at £197.65/t, up £1.05/t from 22 December. The Nov-24 contract gained £0.55/t over the same period, ending Friday’s session at £208.75/t.

On 18 December, AHDB’s latest GB fertiliser prices were published. Imported ammonium nitrate (AN) for November was quoted at £359/t, near unchanged (down £2/t) from October, and relatively in line with values since August. Read more analysis on this here.

Advertisement

Advertisement

Following the release of the final 2023 planted areas by Defra, AHDB were able to release the regional results of the Early Bird Survey (EBS) on 19 December. The results show a reduction in estimated wheat and oilseed rape area, but a rise in barley and oat area. Though continued wet weather since the survey was first carried out means many farmers may not have been able to plant what they intended. As such, AHDB will be providing an update on planting intentions in the spring.

Oilseeds

Rapeseed

Rapeseed markets have gained over Christmas as there could be reductions to Europe’s output for harvest 2024. Longer-term soyabean markets are going to weigh on overall sentiment.

Soyabeans

Brazilian weather continues to dominate soyabean markets. Some of the soyabean harvest has started in Mato Grosso but yields from Brazil will be a key watchpoint for longer-term market movements.

Global markets

In the run up to the festive period, Brazilian weather continued to dominate the soyabean market. Chicago soyabeans futures were pressured from drought alleviating rains forecast in Brazil, which aided early crop development.

Advertisement

Advertisement

From 22 December to 29 December, Chicago soybeans futures (May-24) fell $3.49/t, to close at $480.28/t on Friday. Entering the festive period, the soyabean market slightly gained from lighter trading as there was repositioning in the market. However, forecast rains in Northern Brazil’s drought impacted areas and technical selling outweighed the slight uptick.

There has been reports last week that the Brazilian soyabean harvest has started in the Mato Grosso region, as hot and dry weather has accelerated the crop cycle and impacted yields, around 121 Kha has been harvested, the data suggests this is the earliest known start of the soyabean harvest (Imea). This will become a critical watchpoint over the next couple of months, as these yields will continue to be market drivers on how the drought has impacted this Brazilian soyabean crop.

After last year’s disastrous crop, Argentina are progressing with their soyabean plantings following recent abundant rainfall. It was reported last Thursday (28 December) that soyabean plantings are 78.6% complete, advancing 9.5% on the week (Buenos Aires Grain Exchange).

For Malaysian palm oil futures, there were lower traded volumes over the festive period, which limited market movements. However, weakness in Chinese vegetable oil futures and a stronger Malaysian ringgit pressured futures. Although, Malaysia’s palm oil production was estimated to have fallen by 8.6% during 01 - 20 December which mitigated some pressure on the palm oil market (Malaysian Palm Oil Association).

Rapeseed focus

Advertisement

Advertisement

Paris rapeseed futures (May-24) closed last Friday (29 Dec) at €440.75/t, up 1.2% from 22 December. The Nov-24 contract was more limited, gaining 0.4% over the same period, closing Friday at €444.00/t.

Despite falls in Chicago soyabeans, Malaysian palm oil and crude oil over this period, Paris rapeseed futures have marginally gained. There are some expectations of tighter rapeseed supplies heading into the new season (2024/25). The German national statistics agency estimated that Germany’s OSR area for 2024 will reduce by 4.7% from harvest 2023, with the area estimated at 1.1 Mha (LSEG).