Northern Ireland weekly market report

and live on Freeview channel 276

12 February 2024

Grains

Wheat

Competitive Black Sea supplies continue to weigh on European and domestic prices short-term. Longer-term, the EU wheat balance is expected to be tighter year-on-year, and plantings and conditions of next season’s crop remains a watchpoint.

Maize

The market continues to react to any weather news in South America short-term. However, longer-term combined Brazilian and Argentinian maize supplies are still expected to be heavy and will likely weigh on global prices.

Barley

Advertisement

Advertisement

Barley prices continue to track movements in the wider grains complex. Though expectations of an increase in domestic closing stocks and potential for a larger 2024 crop could see some pressure longer-term.

Global markets

Global grain markets were overall pressured last week. Chicago wheat futures (May-24) ended the week down $3.22/t, closing on Friday at $220.16/t. Chicago maize futures (May-24) ended Friday’s session at $173.82/t, down $4.72/t over the same period. European markets moved in the same direction. This global pressure comes from improved South American weather and ongoing expectations of abundant global feed grain supplies.

On Thursday, the USDA released this month’s World Agricultural Supply and Demand Estimates (WASDE), with negligible revisions expected by analysts for global maize and wheat stocks. In the report, global ending stocks for maize and wheat fell by 3.2 Mt and 0.6 Mt respectively, though US ending stocks for both grains rose unexpectedly. Further to this, as anticipated, the Brazilian maize crop was revised down, though not to the same extent as Conab’s latest estimate, adding a bearish sentiment to the market.

In Conab’s latest estimates published on Thursday, Brazilian maize production this season (2023/24) was revised down 3.3% from January’s estimate to 113.69 Mt.

Advertisement

Advertisement

Speculation that the country’s Safrinha crop would fall due to delayed planting and lower maize prices was confirmed in the latest figures. The Safrinha maize area is now estimated at 15.88 Mha, down 3.2% from January’s estimate and down 7.6% on the year.

South American weather will remain a watchpoint for any further revisions to both the Brazilian and Argentinian maize crops. Following an abnormally warm and dry spell over the last couple of weeks, the temperature in Argentina is expected to remain at seasonable levels with some rain forecast too.

European markets continue to feel pressure from competitive Russian supplies. Some traders have also suggested that the semi-official Russian price floor may have been lowered to $235/t FOB compared to $250/t previously (LSEG).

Ukrainian wheat is also continuing to flow into the EU market, with Italian buyers purchasing new crop Ukrainian 11% protein wheat at €205/t-€210/t for August and September delivery last week.

UK focus

Advertisement

Advertisement

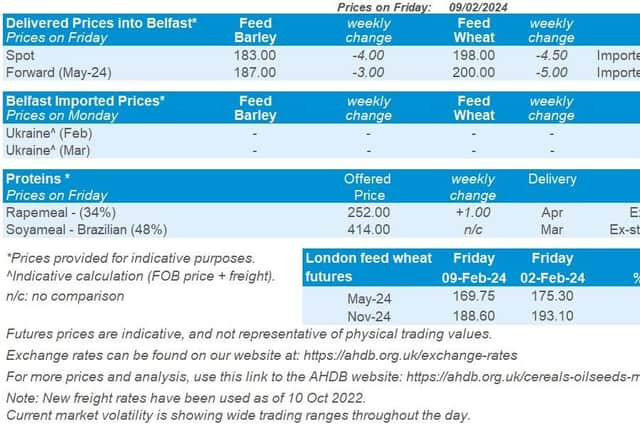

Domestic wheat futures followed global price movement down last week. UK feed wheat futures (May-24) closed on Friday at £169.75/t, down £5.55/t on the week. The Nov-24 contract was down £4.50/t over the week, ending Friday’s session at £188.60/t.

Delivered prices followed futures movement Thursday-Thursday. Feed wheat delivered into East Anglia for July delivery was quoted at £175.50/t on Thursday, down £4.00/t on the week. Bread wheat delivered into the North West for February delivery was quoted at £256.50/t, with no weekly comparison.

While feed wheat continues to be under pressure, with limited demand from the GB animal feed industry, milling wheat premiums remain historically firm.

Last week, AHDB published its Agri-market outlook for 2024. The outlook covers cereals and oilseeds, as well as livestock and input markets, and is designed to point to the key factors expected to influence prices though the coming year.

Oilseeds

Rapeseed

Advertisement

Advertisement

Rapeseed prices could follow the sentiment of the bearish soyabean market. However, new crop prices losses could be limited due to lower rapeseed production from EU-27 for harvest 2024.

Soyabeans

South American soyabean crops are near secured. With harvest starting, there will be on-going pressure as a record South American soyabean crop comes to market. Long-term, US planted area is a key watchpoint.

Global markets

Pressure across the week for Chicago soyabean futures (May-24) as the contract ended down 0.7% closing Friday at $437.21/t.

Despite there being monthly cuts to Brazil’s soyabean crop, estimated reduced Chinese demand combined with record high world ending stocks of soyabeans, continues to weigh on the oilseed complex.

Advertisement

Advertisement

Over the last week several Ag consultancies have revised Brazil’s soyabean crop down, with several now estimating the crop at sub 150 Mt. Brazil’s government agency revised the crop down to 149.4 Mt, from 155.2 Mt previously forecast (Conab).

In the latest World Agricultural Supply and Demand Estimates (WASDE) the trade expected the Brazilian crop to be cut to 153.15Mt.

However, in Friday’s report It was estimated at 156 Mt. Furthermore, the February WASDE raised global soyabean ending stocks for 2023/24 to a record 116 Mt, click here for more information.

Much of the downward revisions to Brazil’s soyabean crop has been priced into the market, with nearby Chicago soyabean futures supported in October/ November from the hot and dry weather in Northern Brazil.

Advertisement

Advertisement

With South American yields near secured, focus is now on Brazilian soyabean harvest. On Friday harvest was reported to be at 23.8% complete way ahead of last year when it was 17.4% (Patria Agronegocios).

Further to that, critical focus is on the US soyabean area estimate this spring.

This could add to the global bearish sentiment if soy is favoured over maize. Also, reported last week, there is the potential for a La Nina weather event in the South Pacific at the end of 2024, read more information here.

Rapeseed focus

A volatile week for Paris rapeseed futures (May-24) with the contract closing at €418.00/t, up €2.00/t across the week. However, the contract closed as high as €421.25/t on Tuesday and as low as €410.75/t on Wednesday.

Domestically delivered rapeseed (into Erith, Feb-24) was quoted at £348.50/t, down £10.00/t across the week. New crop (into Erith, Hvst-24) was quoted at £348.50/t also, but this is down £6.00/t.