Northern Ireland weekly market report

and live on Freeview channel 276

26 February 2024

Grains

Wheat

Short-term, pressure from competitive Black Sea supplies and a heavy maize output is expected to continue. Longer-term, the EU wheat balance is still expected to be tighter, and the focus is on the condition of planted crops.

Maize

Improved weather in Argentina and fast paced plantings in Brazil weigh on prices short-term. Longer-term, expectations of heavy South American maize output will likely continue to weigh on prices.

Barley

Advertisement

Advertisement

Barley prices largely track movements in the wider grains complex. Longer-term, the focus is currently on upcoming spring planting conditions with speculation over the size of next year’s crop.

Global markets

Global wheat markets were overall supported last week, due to increased global purchasing, potential new US sanctions on Russia and concerns over Northern Hemisphere weather. Chicago wheat futures (May-24) gained 1.8% across the week, closing on Friday at $209.05/t. Paris milling wheat futures (May-24) were up 0.6% over the same period, ending Friday’s session at €199.50/t. On the other hand, Chicago maize futures (May-24) were down 3.7% last week, with rapid Brazilian planting progress and improved weather in Argentina.

Lowering prices as of late encouraged a slight pickup in global demand last week. Tenders for wheat were put out by Tunisia, Jordan and Bangladesh. The cheapest offer in the Bangladesh tender for 50 Kt was $279.95/t liner out (cost, freight and unloading) and is believed to be of Russian origin.

While competitive Russian supplies continue to limit any major gains in European grain markets, the impact of newly imposed sanctions will be monitored over the coming weeks. On Friday, in connection with the second anniversary of the invasion of Ukraine, both the US and EU imposed hundreds of new sanctions. It was the biggest round of penalties since the start of the war (LSEG).

Advertisement

Advertisement

For maize markets in particular, South American crop conditions and planting progress remain a key driver of prices. Last Monday, AgRural said that Safrinha maize plantings in Brazil were 59% complete, compared to 40% at the same time a year earlier. This pace is also the fastest planting progress since AgRural started tracking planting in 2013. Maize crop estimates for Argentina were revised down by the Rosario Grain Exchange last week following a heatwave at the end of January and beginning of February. However, over the next seven days, some needed rain is forecast over the key agricultural regions of the country, and the outlook for the crop is still well above last year’s level.

Northern Hemisphere weather is also a watchpoint in markets at the moment. FranceAgriMer said last week that 69% of the French soft wheat crop was in good/excellent condition, compared to 68% the previous week. However, French spring barley plantings are progressing slowly, at 26% complete versus 20% a week prior.

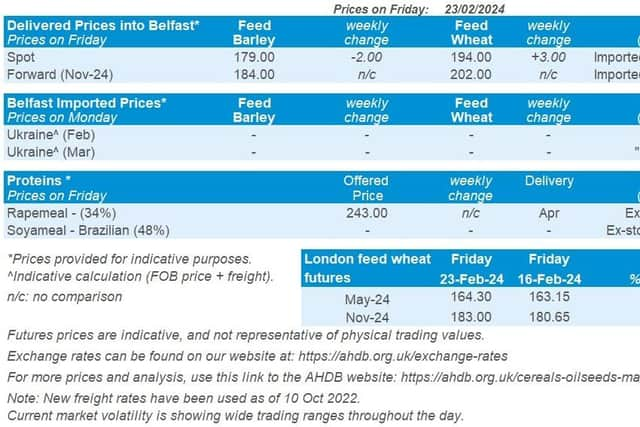

UK focus

Domestic feed wheat futures followed global wheat markets up last week. The May-24 contract closed at £164.30/t on Friday, up £1.15/t over the week. New crop (Nov-24) futures gained £2.35/t on the week, ending Friday’s session at £183.00/t.

UK delivered prices generally followed futures price movement Thursday to Thursday last week. Feed wheat into East Anglia for February delivery was quoted at £160/t on Thursday, with no weekly comparison. Bread wheat delivered into Northamptonshire was quoted at £240.50/t for February delivery, up £0.50/t over the week, with milling premiums remaining historically firm.

Advertisement

Advertisement

After an extremely challenging autumn, AHDB is re-running its Early Bird Survey of planting intentions to capture the potential cropped areas for harvest 2024. These results were originally due for release on Friday 8 March. However, the continued wet weather is making it difficult for farmers to finalise spring planting decisions. In these tough conditions, the survey is being delayed slightly to hopefully allow more plans to be finalised. The results are now provisionally due in mid-March, but we’ll continue to monitor the situation.

Oilseeds

Rapeseed

Current focus is on EU crop conditions as we enter spring, with the uncertainty over production potential offering some support. Longer-term, rapeseed markets could still follow the pressure in soyabean markets.

Soyabeans

Short-term, South American harvest pressure and lacklustre demand weighs on the market. Longer-term, a major weather event or unexpectedly high demand will be required to provide support to the market.

Global markets

Pressure continues for oilseed prices, notably soyabeans, as Chicago soyabean futures (May-24) fell by 2.9% across the week, closing Friday at $419.48/t. Pressure continues on soyabean markets as South American supplies come to the market, plus concerns over longer-term demand continue to weigh.

Advertisement

Advertisement

Brazil’s soyabean harvest continues at a fast pace. It was reported last Friday that the harvest is 38% complete, ahead of the same point last year of 34.5% complete (Patria Agronegocios). Despite periods of stressful weather in Brazil, plentiful supplies are still expected. In Argentina, the Rosario Grain Exchange marginally cut its soyabean production estimate to 49.5 Mt last week, down from the 52.0 Mt previously forecast. It cited that the heat wave in late January and early February contributed to this cut.

Aside from South American crop prospects being optimistic, rising stocks in the US combined with falling Chinese demand for animal feed are further contributing to the bearish outlook. This is spurring speculators to build net-short positions in soyabean futures.

US export sales for 2023/24 (to Feb 15) were reported at 55.9 Kt, a marketing year low, and down 84% from the previous week. This data fell way below trade expectations, which ranged from 300 – 800 Kt (LSEG). Further pressuring the market was the news that three cargo ships, which are preparing to be loaded with soyabeans in two ports in Northern Brazil, are bound for the US.

Rapeseed focus

The continued pressure on soyabean prices filtered into rapeseed. Paris rapeseed futures (May-24) closed Friday at €408.25/t, down €19.25/t across the week.

Advertisement

Advertisement

Delivered rapeseed (into Erith, Feb-24) was quoted at £351.50/t on Friday, down £5.00/t across the week. Pressure continued on Paris rapeseed futures after the AHDB delivered survey was undertaken mid-morning on Friday.