The NI Weekly Market Report

and live on Freeview channel 276

07 August 2023

Grains

Wheat – Access to Black Sea wheat remains in focus, due to the latest developments in the war. Wheat stocks in many major wheat exporting countries are already expected to fall; any further depletion could push up wheat prices relative to other grains.

But projections for ample global maize supplies could weight on the longer-term outlook for grain prices.

Advertisement

Advertisement

Maize – Uncertainty remains until the US maize crop is harvested. But, with confidence in the US crop increasing and a positive outlook for South America, the long-term outlook for maize is turning bearish.

Barley – Feed barley prices could find some support relative to other grains, due to the tightness of global barley supplies.

However, projections for ample global maize supplies could weight on the longer-term outlook for grain prices.

Global markets – Global grain futures weakened steadily last week until Thursday night. Markets focused on favourable weather forecasts for US maize, plus the competitiveness of Russian wheat. Prices rose on Friday after Ukrainian drones attacked and damaged a Russian warship in the important Russian port of Novorossiysk. However, the market still lost ground Friday-Friday.

Advertisement

Advertisement

As earlier planted US maize crops start to move out of their reproductive stage, confidence in the crop is starting to grow. Last week, StoneX forecast the US average yield very close to the official USDA figure, released in July. The USDA releases its updated World Agricultural Supply and Demand Estimates (WASDE) out on Friday. These will include the first survey-based forecast for the 2023 US maize yield.

Meanwhile, yields from the second (Safrinha) Brazilian maize crop of the 2022/23 season are high, with over half the crop now harvested (AgRural). Plus, an early projection by local analysts Celeres suggests that 2023/24 total Brazilian maize output could be even bigger than in 2022/23.

Wet weather is hampering harvesting across northern Europe. In particular, there are growing concerns about yields and quality in Germany. More showers are forecast in Germany and parts of eastern Europe in the week ahead.

India is considering reducing or removing its tariffs on wheat imports. The country restricted exports of rice last month to curb domestic food price inflation. Any Indian wheat imports could further deplete stocks in major exporting countries.

Advertisement

Advertisement

China lifted its anti-dumping tariffs on imports of Australian barley last week. This is likely to see Australian barley return to China at the expense of French, Canadian, and Argentine exports.

UK focus

UK feed wheat futures (Nov-23) fell £4.30/t over the week (Fri-Fri). The contract followed global markets lower at the start of last week but gained slightly on Wednesday as sterling weakened against both the euro and US dollar. Sterling weakened ahead of the Bank of England's interest rate decision; the rate rose by 0.25% to 5.25%. The Nov-23 wheat price dropped again on Thursday, closing as low as £195.15/t, before lifting on Friday to end the week at £198.30/t.

In AHDB’s delivered price survey feed wheat prices fell largely in line with the futures prices (Thu-Thu). However, bread wheat prices showed smaller falls, as wet weather continued to hamper harvest progress.

Last week’s Analyst’s Insight looked at the costs of drying grain from different moisture levels to 15% and there’s also guidance on sampling, storage, contract tips, and more in AHDB’s harvest toolkit. Plus, look out for highlights from AHDB’s second GB harvest report of 2023 in next week’s Market Report.

Advertisement

Advertisement

Last week, AHDB published GB animal feed and UK human and industrial cereal usage statistics for the month of June 2023. There are now full season totals of usage for the 2022/23 marketing year (Jul-Jun):

GB compound animal feed production for 2022/23 totalled 11.16 Mt, down 5.7% year-on-year. AHDB analysts look at the outlook for the pig herd and pig feed demand in 2023/24 here.

UK flour millers (inc. bioethanol and starch) used a total of 6.13 Mt in 2022/23, up 2.1% year-on-year.

UK Brewers, Maltsters, and Distillers (BMDs) used 1.97 Mt of barley in 2022/23, 5.0% more than 2021/22. BMDs also used 1.06 Mt of wheat, up 6.4% year-on-year.

Advertisement

Advertisement

Oat millers in the UK milled a total of 492 Kt of oats, down 1.9% year-on-year.

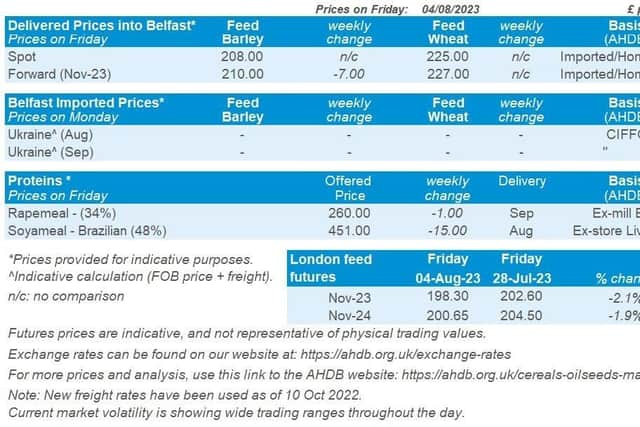

Futures prices are indicative, and not representative of physical trading values. The latest daily futures settlement prices are available on our website. You can view the full data series here and download your own customised report by selecting the commodity, timescale and currency. If you need any help please contact [email protected]

Oilseeds

Rapeseed – Short-term, the conflict in the Black Sea is adding to price volatility. Longer-term, the global rapeseed market looks well supplied, but Canadian weather is in focus currently as it has been dry.

Soyabeans – Short-term, US weather is pressuring the market, but strong demand and conflict in the Black Sea are filtering through into some support. Longer-term, South America is going to produce large crops going into 2024.

Advertisement

Advertisement

Global markets – There was pressure across the week for Chicago soyabean futures (Nov-23), which ended the week down 3.6% at $489.84/t.

Driving much of the pressure at the start of the week was expectations of cooler and wetter weather across the US Midwest in August. This is expected to bolster crop development and reduce concerns over heat damage to US crops. Despite strong demand for US soyabeans, the weather story outweighed this. There was a slight uptick for Chicago soyabean prices at the end of the week from stronger crude oil and vegetable oil markets, plus the concerns in the Black Sea. But the market was still down across the week.

At the start of last week, the USDA crop condition report (to 30 July) estimated that soyabeans were 52% good-to-excellent. This was down 2% from the week before, slightly more than trade expectations of a 1% fall. There will be another update this evening on crop conditions. Widespread rains over the US Midwest in the next seven days will improve the outlook for this crop.

The USDA reported strong demand for US soyabeans. Export sales (to week ending July 27) were estimated at 2.7 Mt, near the high end of trade expectations, which ranged from 1.1 Mt to 2.9 Mt (Refinitiv). Despite this strong demand, weather forecast mentioned above outweighed this news.

Looking longer term, Brazilian soyabean production is expected to grow by 3.7% to 163.5 Mt in 2023/24.