The Northern Ireland weekly market report

and live on Freeview channel 276

11 April 2023

Grains

Wheat – Competitive Black Sea supplies continue to keep pressure on short and longer-term prices.

However, the renewal of the Ukrainian export deal (Black Sea Initiative) in May will be a key watchpoint going forward, creating volatility and potentially some short-term gains/capping large losses, in the run up.

Advertisement

Advertisement

Maize – Lower US stocks and a smaller Argentinian crop keeps some price support, and demand will be a key watchpoint for price direction short term. Longer term, the large Brazilian crop, as well as the large US crop forecast, could pressure the market. US weather and planting progress will be closely followed.

Barley – Barley prices continue to track the wider grains markets. The discount of ex-farm UK feed barley to UK feed wheat stood at £15.10/t as at 30 March, down on the week.

Global markets – Global grain markets felt overall pressure last week, on competitive Black Sea supplies picking up global demand, some favourable US weather outlooks, as well as some positioning ahead of a long weekend. Though Chicago wheat and maize markets were open yesterday, and felt some support from poor US winter wheat conditions, wet weather arriving in the US and concern over Russia’s threat to bypass the Black Sea Initiative.

US winter wheat condition was pegged at 27% good to excellent as at 9 April, down 1 percentage point from the previous week.

Advertisement

Advertisement

Attention is also on spring planting progress, which has started, despite cold temperatures and snow cover across key areas of the Midwest having limited fieldwork windows (Refinitiv). Using most recent forecasts, some rain is due in the next week across Montana and North Dakota (key spring wheat states), as well as the Midwest for maize plantings (World Ag Weather and COLA).

On Thursday last week, Egypt’s state buyer GASC bought 600Kt of Russia wheat at a FOB price of $275/t, for shipment in May. This reflected the ample supplies still available from Russia. It was reported in March, that Russia wants to ensure a fair price for their farmers, keeping FOB prices at or above $275/t to $280/t which looks to be taking effect.

European prices continue to be capped by Ukrainian grain prices. On Wednesday, Poland’s Agriculture Minister resigned due to the decision by the European Commission to extend duty free imports until June 2024 for Ukrainian grain. This follows concerns raised by Poland, Hungary, Bulgaria, and Slovakia on increased volumes of low prices Ukrainian grain flooding the market and pulling prices down for local farmers.

Something to watch going forward remains the Black Sea Initiative renewal (Ukrainian grain export corridor). This provides some floor for prices currently, with the uncertainty of whether Russia will renew the deal (which previously was extended for only 60 days) on 17 May. On Friday, Russia threatened to bypass the deal unless agricultural export obstacles were removed. Turkey agreed to this easing of obstacles too, as key to the deal’s continuation too.

UK focus

Advertisement

Advertisement

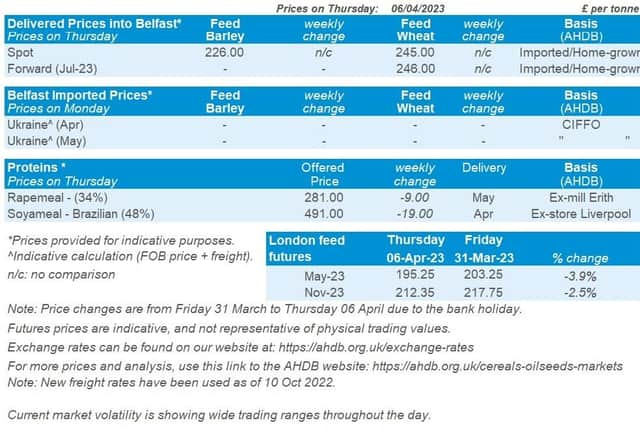

Old crop UK feed wheat futures (May-23) fell £8.00/t last week, Friday to Thursday (with Friday 7th and Monday 10th April both bank holidays), to close at £195.25/t. New crop futures (Nov-23), fell £5.40/t over the same period, to close at £212.35/t. This means the carry into the new year between these two contracts has grown to £17.10/t, as at Thursday. This movement followed Paris and Chicago wheat markets down last week. As our domestic market opened today, May-23 remains unchanged from Thursday’s close, and Nov-23 is trading at £211.50/t (11:30).

Domestic delivered prices followed futures movements Thursday to Wednesday, published early for the bank holiday. On Wednesday, feed wheat into East Anglia (April delivery) was quoted at £198.00/t, down £6.50/t on the week.

Bread wheat into North West, for April delivery was quoted on Wednesday at £274.50/t, down £6.00/t from the previous week.

Feed barley delivered into East Anglia was quoted on Wednesday at £176.00/t, for April delivery.

Oilseeds

Advertisement

Advertisement

Rapeseed – Crude oil price has stabilised over the past week, which has meant fundamentals have continued to pressure rapeseed prices, as ample supplies are forecast in Europe which will weigh on the market longer term too.

Soyabeans – With the South American crops accounted for, a record Brazilian crop is now being exported.

Focus will now turn towards US plantings of new crop soyabeans, which currently is pressuring the market.

Global markets – Chicago soyabean futures (May-23) ended down 1% across the week (Fri-Thurs) closing Thursday at $548.34/t.

Advertisement

Advertisement

However, the US market was open yesterday and this contract closed at $546.42/t, down $1.92/t on Friday’s close.

Much of the recent pressure for soyabeans has been from improved weather conditions across the US Midwest, which is aiding fieldwork.

There was an element of support for soyabeans at the start of last week from forecast storms and blizzards across parts of the US Midwest, which put anxieties over field work.

However, from that point, forecast turned towards warmer and drier conditions later into the week which improved situations.

Advertisement

Advertisement

This pressured prices, also combined with poor US soyabean export sales for 2022/23 (to week ending 30 Mar), which were pegged at 155Kt. This is down 42% from the prior four-week average and below analysts’ expectations of 200Kt – 600Kt.

Further to that, agribusiness consultancy Safras & Mercado has raised its estimate for Brazil 2022/23 soyabean crop from their previous forecast of 152.4Mt, to 155.1Mt on Thursday. This will compensate for some of the losses from Argentina.

With much of South American soyabean crops accounted for now, the market’s eyes will turn towards the production of the US 2023/24 soyabean crop, as planting will start to commence in the coming weeks.

Weather and planting progress will be followed closely.

Rapeseed focus – The pressure in soyabean filtered into rapeseed markets, as well as continued pressure from ample supplies forecast in Europe.

Advertisement

Advertisement

Also, Canadian canola has been under pressure too, from selling by Canadian farmers to the cash market, and speculators easing off short covering.

Paris rapeseed futures (May-23) closed Thursday at €461.50/t, down €14.25/t from the Friday before.

Delivered rapeseed prices (into Erith, Apr-23) were quoted at £387.50/t on Thursday, down £20.00/t on the Friday before.