The Northern Ireland Weekly Market Report

and live on Freeview channel 276

31 July 2023

Grains

Wheat – Tightness in global wheat supplies could bring support compared to maize prices. Uncertainty over Ukrainian exports puts more pressure on other major exporting nations to meet demand in the short-term. However, total grain supplies, especially US maize yields, will still influence the price direction.

Maize – Unless US maize yields are lower than the market currently expects, the market will gain confidence in total global grain supplies. Without lower yields, or other threats to supply, markets could return to a more bearish tone.

Advertisement

Advertisement

Barley - Global barley supplies remain tight and could tighten further if Canadian crop forecasts reduce. This could support barley prices relative to other grains, but price direction will still depend on the wider global grain outlook.

Global markets – Markets rose sharply after Russian air strikes damaged the Danube port of Reni. However, prices dropped back as the week progressed on forecasts of more favourable weather in the US Midwest and technical trading. There were also fewer reports of new air or missile strikes in Ukraine as the week went on. Refinitiv reports that the funds were net sellers of both Chicago wheat and maize futures from Wednesday onwards.

Ukraine’s central bank expects the Black Sea corridor to be closed while the war continues. With questions over shipping via the Danube and what capacity there is for land exports, it is unclear how much Ukraine could export. Also, NATO increased its surveillance of the Black Sea last week.

Much of the top US maize growing area, the Midwest, experienced a heatwave last week and the proportion of US maize crops experiencing drought expanded again from 55% to 59%. High temperatures and drought during the crops’ current growth stages can reduce yields. However, much of July has been cooler than average, so the impact on yields is uncertain. Rain and cooler temperatures were expected to return over the weekend and continue into August.

Advertisement

Advertisement

A crop tour by the Wheat Quality Council in North Dakota in the US found better-than-expected spring wheat yield prospects. This is despite hot and dry conditions and raised optimism that yields for other crops in the US could also be better than forecast.

Hot, dry conditions are weakening yield prospects in parts of Canada. In the top wheat-growing province of Saskatchewan, just 35% of spring wheat crops were rated good/excellent on 24 July, down from 50% on 10 July. Barley and oat ratings were also sharply lower.

The EU Commission reduced its forecasts for EU-27 wheat, barley, and maize crops. This follows lower yield potential in the latest MARS report, which also flagged concerns about quality due to ongoing rain in parts of Eastern Europe. As a result, EU-27 wheat end of 2023/24 stocks (exc. Durum) are now pegged 3.1 Mt lower than was forecast in June and 2.5 Mt lower than 2022/23. Barley stocks are also now expected to contract over 2023/24, instead of expanding.

UK focus

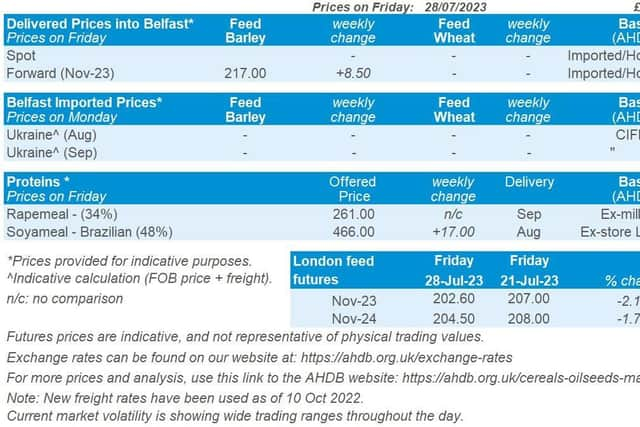

Despite gaining sharply last Monday, Nov-23 UK feed wheat futures ended last week at £202.60/t, down £4.40/t from Friday 21 July.

Advertisement

Advertisement

Full spec bread wheat delivered to the North West in Nov-23 was £281.00/t as at Thursday’s close in AHDB’s delivered price survey. This equated to a £75.00/t premium over Nov-23 futures. Full spec biscuit wheat for the same delivery (North West, Nov-23) was £228.50/t, equating to a £22.50/t premium over Nov-23 futures.

Farmers across the UK planted an estimated 1.746 Mha to wheat for harvest 2023, according to the AHDB Planting and Variety Survey. This is 1% less than for harvest 2022, with more barley and oilseed rape being grown. Across GB, Group 1 and 2 varieties account for an estimated 44% of the area.

At 1,154 Kha, the UK barley area is up 5% from 2022 and the largest since 2019. More winter and spring barley was planted. Scotland’s spring barley area is up 7% to 251 Kha, the largest area since 2020.

Meanwhile, the GB oat area is down 7% to 161 Kha, which is the smallest area since 2017.

Advertisement

Advertisement

Unsurprisingly, AHDB’s first harvest report of 2023 showed that recent wet weather slowed the start of the GB harvest. As of 25 July, 48% of the winter barley area was cut, behind last year’s rapid pace (93% complete) and slightly behind the five-year average (56%). So far, yields are ranging from 5.0 – 11.0 t/ha. Better yields have been reported on heavier soils, whereas lighter land suffered more from water stress during grain fill.

Very small areas of winter wheat, spring barley and oats have also been harvested, in mostly southern regions.

Oilseeds

Rapeseed – Short-term, an improved US soyabean outlook could pressure rapeseed prices. However, Black Sea exports remain in focus and any escalation could balance out any pressure in prices.

Longer term, global and EU rapeseed markets look well supplied this season.

Advertisement

Advertisement

Soyabeans – US weather remains in focus short term, with the crop in its critical growth stage. Longer-term, abundant South American supplies are likely to weigh on prices in 2024.

Global markets – Last week, Chicago soyabean futures (Nov-23) fell 1.4% Friday to Friday. Despite climbs at the beginning of the week, an improved weather outlook across the US Midwest for August brought a bearish sentiment to the market.

The wider market volatility due to escalations between Russia and Ukraine also seemed to settle towards the end of the week.

As of the week ending 23 July, 70% of the US soyabean crop was in its ‘blooming’ stage. This means that over the next few weeks, the crop will be particularly sensitive to moisture and temperature stress.

Advertisement

Advertisement

The weather forecast for 8-14 days’ time is for cooler temperatures and ‘normal’ precipitation leading to an improved crop outlook.

However, in the next seven days limited rain is forecast in some of the key soyabean producing states, with parts of Minnesota and Iowa not due any at all. This will be something to watch throughout the week.

The ongoing conflict in the Black Sea region will also be a watchpoint in oilseed markets. Ukrainian oilseed prices remain competitive against rivals and attractive to European buyers.

This means that oilseed markets will likely be reactive to further news on export routes and/or any destruction of infrastructure on the Danube.

Rapeseed focus

Paris rapeseed futures (Nov-23) were down 4.5% last week (Friday to Friday) as pressure filtered through from soyabean markets and the market reactions surrounding the Black Sea situation stabilised.