Where now for Northern Ireland milk prices?

and live on Freeview channel 276

Improving dairy commodity prices

- GDT New Zealand

GDT was up 4.3% last week. We need to go back to early 2022 for the last time it rose for four consecutive auctions.

- European commodity prices

Dutch butter has been rising for eight successive weeks, now at €5,000/tonne, its highest price since the end of December 2022. Skimmed milk powder (SMP) has increased to €2,600, its highest since mid-January. Butter and SMP now convert to a milk price equivalent of over 33p. Whole milk powder (WMP) rose this week by €120/tonne to €3,570, the largest increase since August 2022.

- Futures prices

Advertisement

Advertisement

EU butter futures continue to rise, 2024 Q1 prices are now averaging €5,160 which is up €500 compared to a month ago. EU SMP is up by an average of €80 across the next six months. In milk price terms, October to December contracts convert to over 30p and 34p for Q1 2024.

Cause for caution

UK mild cheddar cheese price negativity is hanging over the market. Although rising this week by €50, UK cheddar prices have been as low as £3,150/tonne. Mozzarella prices are picking up and whilst rising gouda and curd prices should lift the mild cheddar price, this could take a while to filter through as there is a lot of stock in stores.

We also need to consider sluggish price signals which could curb a quick recovery in local farmgate prices. Our concerns are that any recovery in prices could be masked by the fact that we are entering bonus season, and this could hide true market returns being passed back to producers in actual improved base milk prices.

There is another concern which needs to be addressed, the UK economy and the growing crisis in the Middle East.

Advertisement

Advertisement

- UK Economy – The fall in Inflation stalled in September on the back of rising fuel prices. What this means is that borrowing rates may have to rise again, which in turn will increase overdraft costs for local dairy farmers.

- Middle East - Middle East crisis means oil could get more expensive. Therefore, other farm costs could rise too, as well as creating upward pressure on inflation.

Current situation

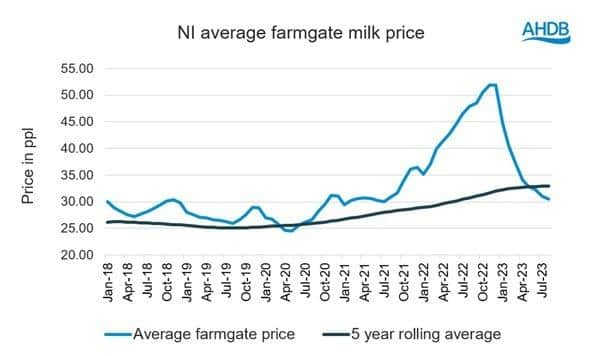

The return Northern Ireland (NI) farmers are receiving for milk is down 40% compared to this time last year, and despite food price inflation falling for the first time in two years, it has not fallen at the same rate as farmgate prices. This led to the Ulster Farmers’ Union (UFU) calling out the failing dynamics within the food supply system. Many NI dairy farmers are not earning enough to cover production costs while profits are being made further up the supply chain.

The September 2023 base milk price average was 28.47p/l, unchanged from August. To break even, farmers needed to be receiving at least 35p/l – 36p/l, so on this basis many dairy farmers in NI are continuing to lose money.

Advertisement

Advertisement

We have already drawn attention to the fact that NI has the third lowest milk price in Europe, but latest statistics show that our average farmgate milk price has now dipped below the five-year rolling average.

UFU position

The UFU are urging local processors to recognise the continuing improvement in commodity dairy markets and pass these improved prices to the farmer. Local dairy farmers urgently need to see a sustained improvement in actual base milk prices to narrow the gap in breakeven and improve cash flows.