Farmland values across Great Britain are forecast to rise

and live on Freeview channel 276

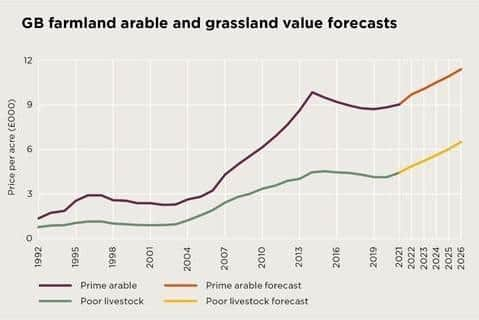

From 2022 to 2026 Savills believes poorer quality livestock land value growth (6 per cent per annum) will outperform prime arable land (2.5 per cent) excluding inflation against a backdrop of continued constrained supply.

These forecasts are included in the latest report from Savills rural research, ‘Spotlight: The Farmland Market’ which was published recently.

Advertisement

Advertisement

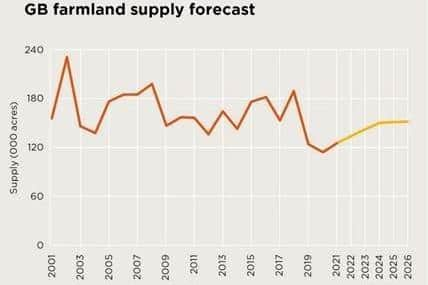

The supply of publicly marketed farmland during 2021 reflects a slower than excepted ‘bounce back’ in the number of acres available from the low volumes of 2019 and 2020, suggesting that supply levels are unlikely to recover to those seen historically in the short to medium term.

It was widely presumed the government’s Lump Sum Exit Scheme, designed to assist farmers in England with retirement by capitalising their subsidy payments, would lead to more supply.

However, the proposed scheme was met with little enthusiasm.

Emily Norton, head of Savills rural research, commented: “Many in the industry benefited from strong commodity prices this year, which cushioned farm profitability from the effects of the first fall in subsidy support.

Advertisement

Advertisement

“Whether this just delays the inevitable remains to be seen, however, the ongoing rise in input costs will put a dent in farm profitability this year.

“We expect some under diversified businesses may begin to feel the effects of the transition away from the direct subsidy environment.

“This may result in an increase in supply, as some choose to leave the sector, but not to an extent to impact on values.”

Their forecasts for GB farmland values build on the performance of this year’s market and reflect that the risk posed by uncertain trade and agricultural transition plans 12 months ago has now reduced.

Advertisement

Advertisement

In the 12 months to December 2021, average values for all land types rose by 6.2 per cent as a restricted supply coupled with a continued interest from the traditional sources of farmland buyers along with the newer ESG motivated buyer supported price growth.

Alex Lawson, head of Savills rural agency, stated: “From a macroeconomic perspective, farmland historically has acted as a good hedge against inflation and in the continuing low interest environment it has increased appeal as an asset class in a mixed portfolio.

“More recently its new value as a tangible store of authentic carbon and important environmental credentials has only added to its investor appeal, and we see no reason for this to change.”

This reinvigorated interest in farmland, coupled with a lack of supply, has led to a revision of their forecasts.

Advertisement

Advertisement

Savills anticipate that real values for poorer quality grassland will climb, on average, six per cent per annum in the short term (2022–2026) as the ability for pasture land to provide valuable carbon and water management services is increasing its demand over other land types.

Also woodland planting projects for carbon offsets are targeting grassland, seeking sites which do not have any limiting factors for tree planting.

For prime arable land, commodity prices in the short term look set to hold and an increasing interest in energy crops and renewables may continue to support profit from production and consolidation of the most productive businesses will drive competition for the best land.

They expect this to support growth, estimated at 2.5 per cent annually excluding inflation, in the short term.

Advertisement

Advertisement

As illustrated, there is now increasingly a divergence in performance between different land types – with grade 3 pasture land showing more growth than grade 3 arable land in the year to December 2021 (8.7 per cent versus 5.5 per cent), albeit from a lower base.

“It’s also clear demand for farms with a strong amenity or lifestyle appeal is expected to remain as a result of the pandemic’s long lasting impact on working practices,” Alex added.