NI Report – January 22nd, 2024

and live on Freeview channel 276

22 January 2024

Grains

Wheat

Global competitiveness steers price direction short term, though with French wheat pricing for tenders – could we see this pressure easing? Longer-term, the Northern Hemisphere supply remains in focus, but so too does an incoming large global maize supply.

Maize

Eyes remain on Brazilian weather for short-term price direction. Longer-term, ample maize supplies from South America and the US looks to weigh on markets.

Barley

Advertisement

Advertisement

Barley prices largely follow the wider grains direction. Like wheat, barley markets will closely follow Northern Hemisphere supply news, especially EU planting and expected large South American maize supplies.

Global markets

Last week, global grain markets saw mixed, smaller movements overall. With a lack of new news, markets looked back to bearish trends overall, as speculative traders still hold net-short positions in US grain futures. Chicago wheat and maize markets both saw small falls for both the old and new crop futures, whereas Paris wheat saw slight support on old-crop futures and small losses on the new-crop contracts.

Competitive Black Sea supplies for global tenders remains a key bearish factor in old-crop wheat markets, with EU wheat export pace slower than last season as a result of this. However, last week Egypt’s state buyer GASC, bought 360 Kt of wheat in a tender. Of this, 300 Kt was Russian origin, but 60 Kt French wheat, the first since late-August. The euro weakening against the US dollar is one factor that has helped EU wheat become more competitive. Could we see some relief from Black Sea supply price pressure short-term with French wheat competitive?

Another factor to consider is the value and global competitiveness of Ukrainian grain, considering the impact of re-routing of commercial shipping due to the war in the Middle East.

Advertisement

Advertisement

Also contributing to price pressure last week, on US markets particularly, was the expectation of higher global maize supplies this season. In the latest USDA report, the size of the US maize crop and global maize ending stocks were increased. US markets were closed last Monday for a federal holiday.

Finally, weather remains in focus ahead of the Northern Hemisphere harvest 2024. Limited damage is thought to have been caused to waterlogged grain fields after a cold snap in Germany and France (LSEG). However, rain remains a watchpoint for sowing, much like here in the UK. In the US, they have also seen a cold snap. Areas, such as the Northern Plains, with snow cover saw soil conditions stay constant. Meanwhile, areas further south in the central US with a lack of snow, saw topsoil drying out (US Wheat Associates).

For harvest 2024, Strategie Grains has cut over 2 Mt from its projection of the EU-27 wheat crop (exc. Durum) to 122.7 Mt due to a smaller German area. The company also increased its 2024 barley crop forecast by 0.7 Mt to 4 Mt, which would be up 13% from 2023.

UK focus

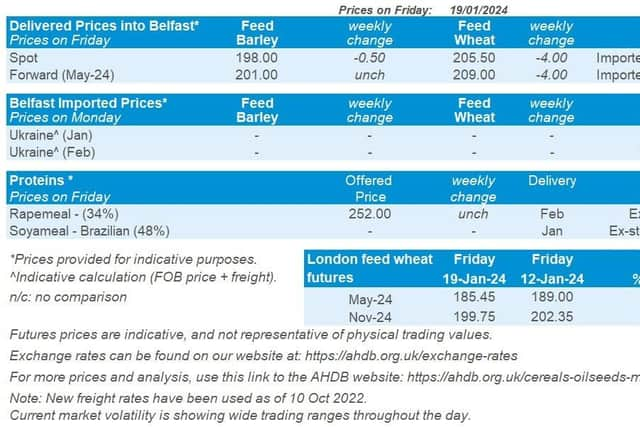

UK feed wheat futures felt some pressure overall last week from global markets, impacted too by movement of the sterling. The May-24 contract closed on Friday at £185.45/t, down £3.55/t Friday to Friday. New-crop (Nov-24) futures fell £2.60/t over the same period, to close at £199.75/t. The premium into the new season (May-24 to Nov-24) stands at £14.30/t as at Friday’s close.

Advertisement

Advertisement

Delivered feed wheat into East Anglia was quoted on Thursday last week at £184.50/t for May delivery, down £6.50/t from the week before.

Bread wheat delivered into the North West was quoted on Thursday at £264.00/t for January delivery. This is down £4.00/t from the previous week.

The next release of the UK supply and demand estimates is due this Thursday (25 January).

Oilseeds

Rapeseed

For the short term, rapeseed markets are buoyed by strength in the wider oil markets and slow EU imports. A forecast reduction in rapeseed planting for 2024/25 supports the longer-term outlook relative to other oilseeds, though ample soyabean supply could weigh overall.

Soyabeans

Advertisement

Advertisement

Short-term, strong US crush supports demand, although the forecast ample supply continues to weigh on both the short and longer-term outlooks. The size of the Brazilian crop remains a key watch-point.

Global markets

Bearish pressure on Chicago soyabeans futures continued last week, as the May-24 contract fell $4.68/t on the week to close at $449.33/t on Friday. This was the fifth consecutive week-on-week loss (Friday to Friday). This pressure is largely attributed to expected ample global supplies, outweighing strong crush demand in the US.

Global soyabean production for this season is currently forecast at 399 Mt, up 6.3% from last season (USDA), as stocks reach a five year high at 70 Mt. However, there have been numerous reports of consultancies trimming soyabean production forecasts for Brazil following poor growing conditions for many areas. While the USDA adjusted their forecast at just 1.9% below last year’s production, some revisions go as far as 15.6% below which could cause global stocks to fall year on year.

US soyabean sales improved since the previous report, plus recent crush data for the US offers some support. Soyabean processors crushed the greatest monthly volume on record in December, reaching 5.3 Mt (NOPA). This has predominantly been driven by an increased demand for vegetable oils for renewable fuel production.

Advertisement

Advertisement

Latest data for managed money shows that the recent net short position for soyabeans since the New Year has continued, reaching -11.6% as at 16 January. This is the largest net short position since March 2020.

Malaysian palm oil futures continued to gain last week, and the May-24 contract reached a seven-week high. In addition to tight supplies, prices felt support from strong Chinese demand ahead of the Chinese New Year (10 Feb) and stronger crude oil prices following disrupted oil production in the US and tensions in the Middle East.

Rapeseed focus

Despite a continued bearish soyabean production outlook, Paris rapeseed futures gained on the week, buoyed by gains in Malaysian palm oil and a moderate weakening of the euro.

Old crop (May-24) futures closed at €433.75/t on Friday, gaining €12.50/t Friday to Friday. While new crop (Nov-24) gained €5.25/t over the same period, closing at €433.50/t. Old crop has not held a premium over new old crop since 02 October 2023.

Rapeseed delivered into Erith for January 2024 delivery was quoted at £370.50/t, gaining £8.00/t over the week (Friday – Friday).