NI weekly market report – 12 December 2023

and live on Freeview channel 276

12 December 2023

Grains

Wheat

Heavy maize supplies this season are still expected to weigh down on prices in 2024, subject to the Brazilian crop remaining large. Short-term, the market focus will be on export demand as well as Northern Hemisphere weather, new crop plantings and conditions.

Maize

Brazilian weather remains in focus short-term. With a large Brazilian maize crop currently forecast, heavy global supplies are expected to pressure prices in 2024.

Barley

Advertisement

Advertisement

Barley prices continue to follow the wider grains complex, with European new crop conditions in focus too.

Global markets

Global grain markets were supported last week, largely on the back of increased US export demand, as well as delays to Northern Hemisphere plantings. However, gains in European markets especially were capped by competitive Black Sea supplies and sluggish demand for EU wheat. Expectations of heavy maize supplies later in the season also remain, with further increases in global production in the latest USDA World Agricultural Supply and Demand Estimates (WASDE).

From 4-8 December, the USDA reported 1.12 Mt of US soft wheat had been purchased by China for delivery during the 2023/24 marketing year. With increased Chinese demand, US soft wheat exports were revised up to their highest level since 2013/14 in Friday’s WASDE. The USDA also cut its forecast of US wheat ending stocks, now at 17.9 Mt compared to 18.6 Mt last month.

In contrast to the US, EU export demand has remained fairly weak as of late. According to the EU Commission, by 3 December, soft wheat exports from the EU were down 18% this season to date from last season. Demand for EU wheat is particularly being impacted by the availability of competitively priced Russian wheat. On Thursday, Egypt’s state grain buyer GASC reported that it had bought 420 Kt of Russian wheat in an international tender for January delivery (Refinitiv).

Advertisement

Advertisement

Focus continues to turn to Northern Hemisphere new crop plantings, with wet weather across key producing countries across Europe. FranceAgriMer reported on Friday that by 4 December, French farmers had sown 89% of the intended soft wheat (exc. Durum) area. This is compared to 83% a week earlier, but still lagging on the 5-year average of 96% at this point in the season. Crop conditions have also worsened, with 77% of the soft wheat crop rated good or very good as at 4 December, compared to 80% the week prior and the lowest score for this period since 2019. European conditions will remain a watchpoint over the next few weeks.

UK focus

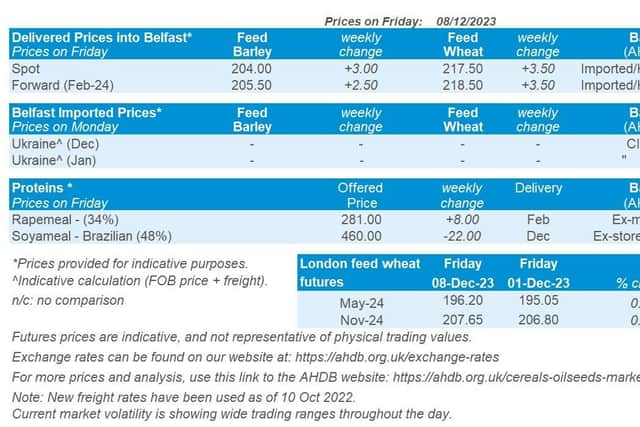

Domestic wheat futures followed global market movement up last week (Friday to Friday). UK feed wheat futures (May-24) closed at £196.20/t on Friday, up £1.15/t on the week. The Nov-24 contract gained £0.85/t over the same period, ending Friday’s session at £207.65/t.

Delivered prices followed futures up last week (Thursday to Thursday). Feed wheat delivered into East Anglia for December delivery was quoted at £186.00/t, up £2.50/t from the previous week.

Bread wheat delivered into the North West for December delivery was quoted at £269.50/t on Thursday, up £3.00/t on the week. Domestic bread wheat prices continue to hold a strong premium over feed wheat prices relative to historical levels, reflecting the poorer quality grain from harvest 2023.

Oilseeds

Rapeseed

Advertisement

Advertisement

Short-term, the larger Australian harvest adds to the ample global rapeseed availability, keeping rapeseed prices capped. The market also continues to be influenced by soyabean progress in South America and crude oil prices.

Soyabeans

Favourable growing conditions in Argentina have helped to improve the crop outlook. However, weather conditions in Brazil remain a key watchpoint for Brazilian crop size, as well as the continuity of Chinese demand.

Global markets

Chicago soyabean futures (May-24) closed at $491.31/t on Friday, falling $8.54/t on the week (Friday – Friday). Although Chinese soyabean purchasing limited some losses on the market last week, more favourable weather over some of Brazil’s soyabean producing regions easing some concerns weighed on prices. Weakening prices in the wider vegetable oil and crude complex were also factors.

Despite rain falling in Brazil last week, easing some production concerns and in turn pressuring prices, Brazilian crop agency Conab reduced its estimate for Brazilian soyabean production for 2023/24 by 2.24 Mt to 160.18 Mt. However, this is still a record crop and is up from last year’s soyabean harvest, estimated at 155.74 Mt.

Advertisement

Advertisement

While the El Niño weather event means challenges for Brazil’s soyabean crop, in Argentina soyabean production is being supported by increased rainfalls, according to the Buenos Aires Grain Exchange last week. The Exchange forecast production for 2023/24 at 50.0 Mt up from the drought impacted crop last year which they pegged at 21.0 Mt.

The latest World Agricultural Supply and Demand Estimates (WASDE) report was published on Friday. It saw a small reduction to the Brazilian 2023/24 crop forecast (down 2.0 Mt to 161.0 Mt) and a rise of 2.0 Mt for 2023/24 Chinese imports, now forecast at 102.0 Mt. China imported 7.8% more soyabeans year-on-year in November 2023, reaching 7.9 Mt, according to customs data (LSEG), despite ongoing challenges within its domestic pig market.

Pressure was also seen in the wider oil complex last week. While a weaker Malaysian ringgit helped to mitigate some losses earlier in the week, Malaysian palm oil futures continued to be pressured on oil weakness. The benchmark Malaysian palm oil contract reached a six-week low. Oversupply concerns have been pressuring global oil markets and Brent Crude reported its seventh consecutive weekly loss, which has not occurred since 2018.

Rapeseed focus

Paris rapeseed futures (May-24) closed at €444.25/t on Friday, falling €0.75/t over the week, following pressure on Chicago soyabeans, wider vegetable oil and crude oil markets. However, some of the pressure from global markets was offset by the euro weakening against the US dollar.

Advertisement

Advertisement

Rapeseed delivered into Erith for January 2024 delivery was quoted at £373.50/t, falling £8.00/t over the week (Friday to Friday). The survey was taken around midday, and therefore will not take into account full movements on Friday on Paris rapeseed futures where prices closed up.