NI weekly market report - 4 December 2023

and live on Freeview channel 276

4 December 2023

Grains

Wheat

Expectations of heavy maize supplies later this season keeps a bearish longer-term sentiment. Focus is beginning to turn to harvest 24 Northern Hemisphere crops, something to watch out for.

Maize

Maize markets continue to monitor Brazilian weather with the majority of the crop yet to go in the ground. Though ultimately there are still expectations of heavy supplies later this marketing year.

Barley

Advertisement

Advertisement

Barley prices continue to follow the wider grains complex, though conditions in Europe are a watchpoint.

Global markets

Global wheat markets were generally supported last week (Friday-Friday). Chicago wheat futures (May-24) gained 4.3%, ending Friday’s session at $226.69/t. Paris milling wheat futures (May-24) were up 1.3% over the same period, closing at €233.00/t on Friday. US grain markets in particular saw climbs last week on the back of an export-fuelled rally. Global wheat markets also continue to react to Black Sea exports, Brazilian weather updates, as well as slow French planting progress.

The USDA reported last week that net export sales of 2023/24 wheat in the week ending 23 November totalled 622.8 Kt, up noticeably from the previous week and the previous 4-week average. Increases were primarily for China who purchased 197.3 Kt. Net sales of US 2023/24 maize were also up last week, totalling 1.928 Mt, a marketing year high, and up 35% from the previous week.

Ukraine’s agriculture ministry reported this morning that the country’s grain exports have fallen to about 13.4 Mt this season to date. By 5 December last year, Ukraine had exported 18.3 Mt. The volume exported this season includes 5.9 Mt of wheat and 6.5 Mt of maize. Traders and farmers’ unions in the country have blamed blocked Black Sea ports and Russian attacks for the drop in exports (LSEG).

Advertisement

Advertisement

FranceAgriMer published data on Friday that showed that heavy rainfall over the last month has taken a toll on crop condition and cereal planting progression. By 27 November, farmers had planted 82% of the expected soft wheat area, up from 74% the previous week, but well behind the 99% sown by the same point last season and the 5-year average of 95%. Winter barley sowings are further ahead at 92% complete. However, crop conditions of winter barley fell to 82% in good-to-excellent condition, compared to 97% at the same time last year. The French crops will be something to watch over the next few weeks.

UK focus

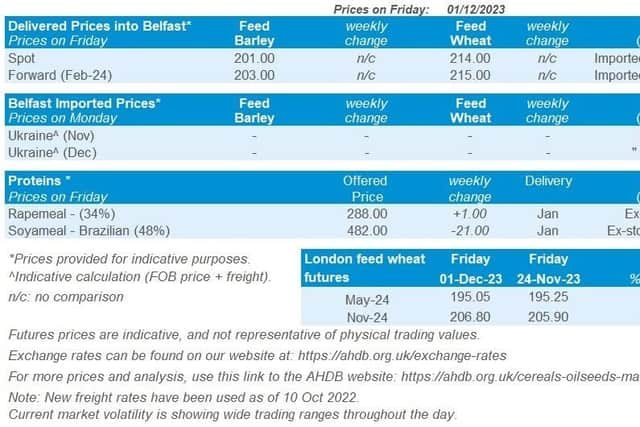

The May-24 UK feed wheat futures contract felt slight pressure last week, down £0.20/t to close on Friday at £195.05/t. However, the Nov-24 contract was supported on the week, closing at £206.80/t, up £0.90/t over the same period.

Delivered prices followed futures movement last week (Thursday-Thursday). Feed wheat delivered into East Anglia for December delivery was quoted at £183.50/t, down £2.00/t across the week. Bread wheat delivered into the North West in December was quoted at £266.50/t, down £3.00/t on the week, but continuing to hold a historically firm premium over feed wheat prices.

On Thursday, data on cereals usage in October by the GB animal feed and UK human and industrial sectors was published. The data shows more imported wheat being used by UK flour millers (incl. for starch and ethanol production) in October, while GB animal feed production remains below 2022 levels. A year-on-year increase in wheat imports driven by the lower quality of the 2023 harvest is reflected in the UK cereal supply and demand estimates, released on Tuesday last week.

Advertisement

Advertisement

Also last Tuesday, AHDB held our annual Grain Market Outlook (GMO) conference in York. The day focused on optimising business potential, with featured sessions looking at a grain and oilseed market outlook, latest insights into the characteristics of top performing farms, a mindset session with Becki Leach, and an afternoon panel discussion, bringing theory into practice on decision making.

Oilseeds

Rapeseed

Short-term, rapeseed markets will be impacted by Ukrainian rapeseed exports and Australian canola harvest pressure, as well as global soyabean market movements. Brazil’s soyabean production still carries significant weight on the oilseed complex longer-term.

Soyabeans

Short-term, unfavourable growing conditions are impacting the Brazilian soyabean crop such that production has been forecast down, limiting any price losses. Longer-term, the Brazilian soyabean crop is still forecast above the 5-year average and so supply looks ample.

Global markets

Chicago soybeans futures (May-24) fell on the week (Friday to Friday) by $0.55, closing at $499.85/t on Friday. Although the soyabean crop in Brazil continues to be the key watchpoint, OPEC+ oil production and palm oil markets contributed to some price movement in the oilseed complex across the week.

Advertisement

Advertisement

Yields have been reduced in key soyabean producing regions of Brazil (e.g. Mato Grosso) due to water stress and poor germination quality following high temperatures. Last Friday, it was reported that Brazil’s soyabean planting progression was at 83.3% complete vs 93.4% at the same point last year, with field work progressing after the return of some rains (Patria Agronegocios). However, following unfavourable growing conditions, Patria Agronegocios is now estimating Brazil’s soyabean crop down 2.2% on the year at 150.67 Mt. Though production is still above the 5-year average, and Argentina could offset any drop-off in Brazilian output.

US soyabean export sales (to week ending 23 November) were estimated at 1.89 Mt for 2023/24, up 97% from the week prior while also being 10% greater than the 4-week average. This exceeded trade expectations which were estimated between 850 Kt to 1.5 Mt.

While there has been no target to cut oil production by OPEC+ for 2024, a voluntary output cut by eight OPEC+ countries is expected to reduce production by 2.2 million barrels per day in the new year.

This created some stir in the markets as while a reduction in supply could see oil prices rise, the voluntary nature of this output cut has led to some scepticism of whether it will be upheld. Despite some support at the start of the week, nearby Brent crude futures closed at $78.88/barrel on Friday, falling near 2% over the week.

Although Malaysian palm oil experienced some weakening on the week, it gained for the month of November, offsetting a two-month decline.