NI Weekly Report - 17 July 2023

and live on Freeview channel 276

17 July 2023

Grains

Wheat

News of the Black Sea Initiative likely not seeing an extension looks to support prices short term, though this situation continues to evolve. Longer term, global supply still looks to satisfy current demand. Though, Northern Hemisphere harvest will be watched closely, considering a more finely balanced global wheat S&D picture.

Maize

Short term, US weather will be important for whether we see further cuts to US yield forecasts, as well as the impact of the Black Sea Initiative. Though the US area is large. Longer term, globally the maize market still looks to be well supplied to meet demand.

Barley

Advertisement

Advertisement

The EU’s barley outlook is tighter for 2023/24, considering drought conditions in Spain. Though barley prices continue to follow the wider grains complex.

Global markets

Last week, global wheat and maize markets felt some support overall, closing higher Friday to Friday. Despite some mid-week losses after the release of the latest USDA World Agricultural Supply and Demand Estimates (WASDE) report, concerns over whether the Black Sea Initiative will be renewed, and dry US Midwest weather forecasts pushed prices higher at the end of last week.

The Black Sea Initiative (Ukraine export corridor) is set to expire today (17 July) (14:00). Earlier today, Russia said it had halted participation in the deal hours after Moscow said Ukraine had attacked the Crimean Bridge, though the Kremlin say there is no link between the two. Russia have expressed they are unhappy with the current agreement, wanting easing restrictions on payments, logistics and insurance for their grain and fertiliser exports. The last ship left Ukraine under the deal on Sunday (Refinitiv). Turkey’s President Erdogan, facilitator in the deal with the UN, said he believed Putin wanted the deal to continue, and Russian and Turkish foreign ministers would talk later today (Refinitiv). It looks likely there will be no extension at the time of writing, as the news evolves expect price volatility. What happens if the deal is not extended? Read our analysis on Ukrainian exports through the Danube ports.

US Midwest weather continues to be followed closely by the maize market, with near a quarter of US maize entering its key formation phase (silking) and 64% of maize still in drought conditions (to 11 July). The forecast shows patches of rain through this week into next week, though remains below average for much of the Midwest.

Advertisement

Advertisement

The USDA released the latest WASDE last week, which was reviewed in detail in Thursday’s analysis. Though the USDA reduced the US maize yields slightly, with the larger planted area (published on 30 June), the forecast US maize crop for 2023/24 was higher on the month. For wheat, despite a larger US crop forecast on higher yields for 2023/24, this was offset by smaller crops in the EU-27, Canada, and Argentina, leading to a cut in global production. This creates a more finely balanced global supply and demand picture for wheat, with tightened stocks in major exporters.

EU supply remains in focus. Stratégie Grains, in their latest report, trimmed their EU production outlook for soft wheat, barley, and maize for 2023/24. Though production remains higher year on year, the consultancy caveated these forecasts could still fall further. Extreme weather warnings for a heatwave have been issued across large parts of Europe, with thunderstorms due in France and the UK.

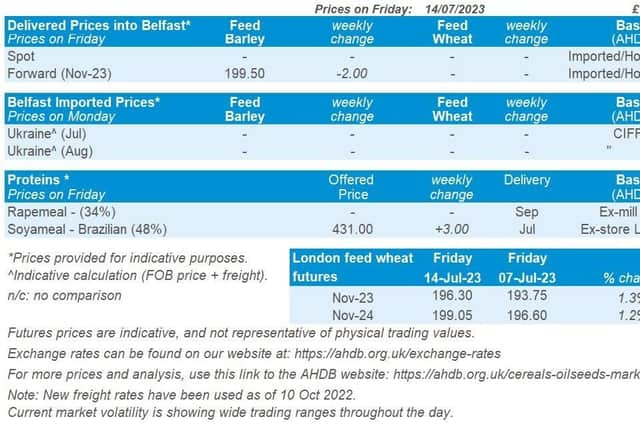

UK focus

UK feed wheat futures (Nov-23) gained £2.55/t last week, to close on Friday at £196.30/t. Nov-24 futures gained £2.45/t over the same period, to close at £199.05/t on Friday. Support came on Friday, in line with global markets.

On Thursday, delivered feed wheat (into East Anglia) for September delivery gained £0.50/t on the week, to be quoted at £192.00/t. Bread wheat delivered into the North West for September delivery, was quoted on Thursday at £268.50/t, down £1.00/t on the week following UK feed wheat futures movements.

Advertisement

Advertisement

Feed barley delivered into East Anglia (July delivery) was quoted on Thursday at £151.00/t, down £1.00/t on the week.

There have been anecdotal reports that the harvesting of winter barley has started for many across the UK, though rain over the coming days will certainly be a watchpoint.

Last week saw the release of the latest HMRC trade data, to the end of May. Last season, July to May, the UK exported 1.477 Mt of total wheat (including durum), the largest volume exported up to that point in the season since 2015/16. For the full data, you can find this here.

The latest GB fertiliser prices were also released last week. Spot prices for UK produced Ammonium Nitrate (AN) averaged £344/t in June, down 12% from May. This is down 55% from the same time last year but remains 16% higher than in June 2021.

Oilseeds

Rapeseed

Advertisement

Advertisement

Weather remains a watchpoint in both the EU and Canada. Some support from soyabean markets could feed through into rapeseed prices, though will likely be balanced out by harvest pressure in the EU. Longer-term, global rapeseed markets look to be well-supplied.

Soyabeans

US weather remains a key driver at the moment. However, longer term a bumper Brazilian new crop will likely weigh on demand for US soyabeans.

Global markets

Last week, Chicago soyabean futures (Nov-23) climbed 4% to close on Friday at $503.61/t. Prices were pressured on Wednesday after the USDA estimated a higher than anticipated US soyabean production figure. However, generally prices were supported across the week on the back of adverse weather in key producing regions of the US, as well as support in the wider vegetable oil complex.

Wednesday’s USDA World Agricultural Supply and Demand Estimates (WASDE) saw the US soyabean crop forecast 5.7 Mt lower than last months estimate on the back of a smaller planted area (published on 30 June). However, the cut was not as big as was expected, and the estimated yield was left unchanged at 3.5 t/ha, a record level. Read more analysis on this in Thursday’s grain market daily.

Advertisement

Advertisement

US weather remains a key watch point in soyabean markets as the key growth stage for the US crop still lies ahead in August. Drought conditions have been improving over the past few weeks with increased rainfall, though as at 11 July, 57% of the soyabean crop was still reportedly affected by drought. Looking ahead, there is minimal rain due across much of the key producing states next week which could bring some support short term.

According to trade sources, it’s thought that China, the world’s biggest importer of soyabeans, will buy a larger volume than usual from Brazil between September and December this season. While ordinarily newly harvested US soyabeans would dominate the market at that point in the year, given the recent bumper Brazilian crop and doubts over the US crop it’s thought Chinese importers are seeking Brazilian cargoes (Refinitiv).

Rapeseed focus

Support in soyabean markets fed into rapeseed prices last week, with concerns over dryness in Canada also adding some support. Paris rapeseed futures (Nov-23) ended the week up 5%, closing on Friday at €471.25/t. Domestic delivered rapeseed for harvest delivery into Erith was quoted at £392.00/t on Friday, up £25.50/t over the week.

EU weather remains a watchpoint as rapeseed harvest progresses across the continent. On Thursday, Germany’s association of farm cooperatives kept their rapeseed crop pegged at 4.14 Mt, unchanged from their previous estimate, but down 3.3% on the year.

Advertisement

Advertisement

On Friday, HMRC released the latest trade data, including volumes exported and imported up to the end of May. Between the months of July and May, the UK imported 689.99 Kt of rapeseed, down 28.2% on the year. During the same period, the UK exported 29.91 Kt of rapeseed, down 42.9% on the year.