NI Weekly Report

and live on Freeview channel 276

10 July 2023

Grains

Wheat

Uncertainty over the future of the Black Sea Initiative is still in focus, with the deal due to expire in a week’s time. Weather in the Northern Hemisphere also remains a watchpoint as harvest progresses and is likely to keep prices volatile.

Maize

Improved weather across the US has stabilised prices as of late, with more rain forecast over the coming days. Any unexpected revisions to the USDA’s WASDE report on Wednesday could see some market reaction.

Barley

Advertisement

Advertisement

Due to adverse weather earlier in the season, the European barley outlook is looking tighter. However, barley prices continue to follow the wider grains complex.

Global markets

Global grain markets in general were slightly pressured last week. Chicago wheat futures (Dec-23) were down 0.4% Friday to Friday, while Chicago maize futures (Dec-23) were relatively unchanged over the week. While uncertainty over the future of the Black Sea Initiative continues, pressure from improved weather across parts of the US maize belt last week outweighed any support in grain markets.

According to Russia’s RIA news agency, talks between Putin and Turkish President Erdogan are the only hope when it comes to extending the Black Sea Initiative deal that is due to expire in a week’s time. However, the Kremlin said over the weekend that there was no phone call scheduled, causing doubt over whether discussions would proceed.

It’s also thought tensions rose last week with Russia accusing Turkey of violating agreements when releasing five detained Ukrainian commanders, who according to RIA news agency, were supposed to remain in Turkey until the end of the war. Grain markets will continue to react to any news on the Black Sea Initiative deal and it will again be an important watchpoint this week.

Advertisement

Advertisement

As more US maize enters its critical pollination phase, US weather remains a key market driver. Over the next seven days, more rain is forecast across key maize-producing states. Up to 5 inches is forecast in some of Illinois, with most of the state receiving at least 1 inch. There is up to 2 inches due in many parts of Iowa and Nebraska also. As at the week ending 02 July, 51% of the US maize crop was rated good/excellent by the USDA, much lower than at the same point last year when that figure was 64%.

The USDA is due to publish its July World Agricultural Supply and Demand Estimates (WASDE) on Wednesday. Analysts currently expect US maize yields to be revised down from 11.4 t/ha to 11.08 t/ha (Refinitiv). Any unexpected changes in Wednesday’s report could lead to a change in market sentiment. However, it’s important to remember that even with lower yield potential, the US is still due a big crop with a larger area year-on-year.

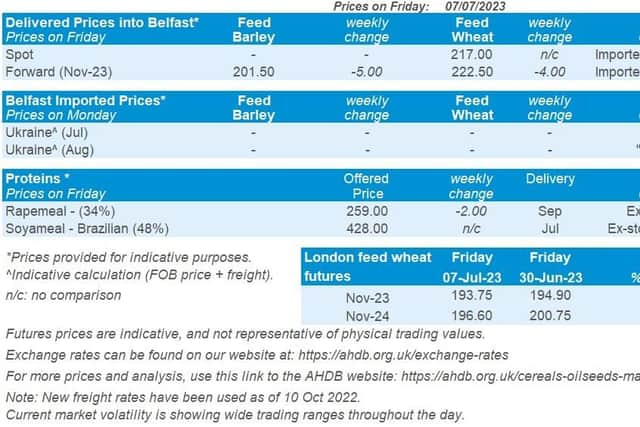

UK focus

UK feed wheat futures followed global prices down slightly last week. The Nov-23 UK feed wheat futures contract lost £1.15/t over the week, closing at £193.75/t on Friday. The Nov-24 contract was down £4.15/t over the same period, closing at £196.60/t.

In the UK delivered prices survey, bread wheat delivered into the North West for harvest delivery was quoted at £269.50/t, with no comparison on the week. Feed wheat delivered into East Anglia for July delivery was quoted at £178.50/t on Thursday, with no weekly comparison. Feed barley delivered into East Anglia was quoted at £152.00/t for July delivery, at a £26.50/t discount to feed wheat.

Advertisement

Advertisement

On Friday, AHDB published the final GB crop development report for harvest 2023, using data as at the week ending Tuesday 04 July. The end of June saw unsettled conditions and cooler temperatures. This cooler weather has reportedly slowed senescence, and grain filling is looking good for winter wheat. In total, 76% of the GB winter wheat crop was rated good/excellent, unchanged from last month. Spring cereal crops remain variable in development, down to drilling date and soil type especially. Later sown crops are reportedly struggling from dry weather, something to watch closely for yield prospects.

Oilseeds

Rapeseed

Weather continues to be watched closely for rapeseed crops, though short-term, harvesting of the EU crop could add pressure to prices. Longer-term, global rapeseed markets look to be well-supplied.

Soyabeans

US weather and supply remain in focus for global availability, with the latest WASDE due this week. Large South American crops still look to pressure global prices longer term.

Global markets

Last week, Chicago soyabean futures (Nov-23) fell 2%, to close on Friday at $484.14/t. Despite seeing some support at the start of the week, prices felt pressure over Thursday and Friday. This followed welcome rains across the US Midwest easing some concerns about the drought impacts on the US soyabean crop.

Advertisement

Advertisement

60% of soyabean crops are affected by drought, according to the USDA’s latest data to 4 July. This is a slight improvement (3 percentage points (pp) less) on the previous week. Going forward, widespread rains in some form across the Midwest are due at the end of this week, which should bring more moisture for soyabean crops. In data to 2 July, the USDA estimated 24% of soyabean crops to be blooming and 4% setting pods.

The next release of the USDA’s World Agricultural Supply and Demand Estimates (WASDE) is due on Wednesday (12 June). US soyabean supply for 2023/24 will be key to watch for price direction. This is considering US acreage numbers came in smaller than expected by the market in the latest update, plus current market expectations of a small cut to the US yield forecast. In the IGC’s latest global report, US soyabean production was trimmed slightly for 2023/24.

Looking to the wider oil and vegetable oil picture, nearby Brent crude oil futures gained 4% last week, to close on Friday at $78.47/barrel. This support came from supply concerns, with Saudi Arabia and Russia announcing fresh output cuts. Malaysian palm oil futures (benchmark contract, delivery 3-months from now) also closed higher last week. Monday (today) has also seen some price gains on data showing Malaysian exports surged so far in July, as well as a slower rise in June inventories.

Rapeseed focus

Paris rapeseed futures (Nov-23) closed on Friday at €448.25/t, down €8.00/t on the week. Paris futures fell following pressure on soyabean markets and slight falls on Friday on Winnipeg canola futures (nearby). Winnipeg canola futures saw some strengthening mid-week on dryness concerns, though we did not see this support filter into Paris markets.

Advertisement

Advertisement

Delivered rapeseed into Erith (harvest delivery) was quoted on Friday at £366.50/t, down £5.50/t from the week before.

Weather continues to be followed closely across the EU for rapeseed crop prospects. The European Commission reduced its EU rapeseed production forecast to 19.91 Mt, from 20.22 Mt in May, on the dry weather impact. However, this production forecast remains higher than last year and ahead of the 5-year average.

On Friday, the AHDB released the latest crop development report. As at week ending Tuesday 04 July, 63% of winter oilseed rape was in good/excellent condition. Winter OSR crops remain variable, especially from CSFB damage. Desiccation is beginning, and harvest is reportedly expected to begin across regions in the south, east and midlands in w/c 17 July.