Northern Ireland weekly market report - 13 February 2023

and live on Freeview channel 276

13 February 2023

Grains

Wheat

The escalation of the war between Russia and Ukraine threatens to curb supplies from the Black Sea region in the short-term. Longer-term, the focus turns to weather and impact on new crop conditions.

Maize

Maize markets are feeling support from ongoing dry weather in Argentina, though US exports look to have weakened slightly. Longer-term, plentiful South American supplies will also limit any major gains.

Barley

Advertisement

Advertisement

Barley prices continue to follow trends in the wider grains complex.

Global markets

Global grain markets continued to climb last week, as the escalating war between Russia and Ukraine threatened to curb supplies from the Black Sea region. Chicago wheat futures (May-23) were up 3.6% over the week (Friday-Friday). Chicago maize futures (May-23) were up 0.4% over the same period, following the rally in wheat markets, as well as limited rain in Argentina. However, gains in maize markets were capped by sluggish US export demand.

According to Hightower, global grain markets have become accustomed to aggressive exports from Russia and Ukraine over the past few months, but recent escalations are putting the UN-brokered deal at risk (Refinitiv). Russian missiles targeted power facilities on Friday in Ukraine, with Ukrainian officials saying that a long-awaited Russian offensive was underway in the east.

Ukraine’s Agriculture Ministry said this morning that, so far this season, grain exports are at 29.2Mt, down 28.7% on the year (Refinitiv). Last week, the Ministry called for increased minimal tonnage of ships carrying grain and vegetable oil from the country, after accusing Russia of delaying inspections of ships carrying Ukrainian goods. On Thursday, it was reported that a queue of 108 vessels formed in the Bosphorus due to the slowdown in inspections, something to watch moving forward.

Advertisement

Advertisement

While overall global wheat markets climbed last week, prices saw slight losses on Thursday after Stratégie Grains increased the EU wheat crop forecast again. The French consultancy now expects EU soft wheat production to be at 129.7Mt in the 2023/24 season, up from last month’s forecast of 129.3Mt, and if realised, up 3% on the year.

Global maize markets followed the upward movement in wheat markets last week. Maize prices were also supported by the ongoing dry weather in Argentina, and the larger-than-expected cuts to production estimates in the latest WASDE released on Thursday. Looking over the next seven days, while rains are forecast in northern regions of Argentina, the southern parts of key agricultural production regions are still not forecast any rain, which could see some support for prices.

Having said this, any major gains in global maize prices were limited last week as US export demand weakened. The weekly US export data released by the USDA on Thursday showed US maize exports for the week ending 02 February (2022/23), were down 27% on the week at 1.16Mt. Global maize demand will be something to monitor over the next few weeks considering Chinese demand especially.

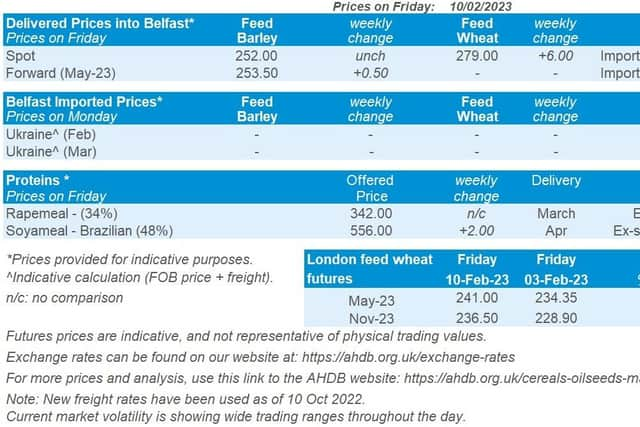

UK focus

UK feed wheat futures followed the upward price movement seen in global wheat futures last week. The May-23 contract gained 2.8% (£6.65/t) Friday – Friday, and new crop futures (Nov-23) climbed 3.3% (£7.60/t) over the same period.

Advertisement

Advertisement

Feed wheat delivered into East Anglia (Feb-23 delivery) was quoted at £236.50/t on Thursday, up £6.00/t over the week. Bread wheat delivered into the North West (Feb-23 delivery) was quoted at £316.50/t on Thursday, up £5.50/t over the same period.

On Friday, AHDB published its annual Agri Market Outlook: Winter 2023. The latest Cereals and Oilseeds Agri-Outlooks take stock of the current situation and look forward to what we might expect in the coming months, for supply availability, trade and demand.