Northern Ireland weekly market report – 16 October 2023

and live on Freeview channel 276

16 October 2023

Grains

Wheat

Southern Hemisphere crops remain in focus considering dry weather trimming the global supply outlook, a watchpoint for longer term price direction also.

Though competitive Black Sea supplies continue to cap gains and are still expected to fulfil global demand.

Maize

Advertisement

Advertisement

A key watchpoint will be South American crop sizes going forward, with weather developments supporting markets. Though, ample global maize supplies are still expected long term currently, despite a trim to the US crop last week.

Barley

Like other grains, dry weather especially in Australia remains in focus for global barley supply. Barley continues to follow the same influences as wider global grain markets, and as such, large, anticipated maize supplies will be important longer term for feed grains.

Global markets

Global grain prices for Chicago and Paris contracts (Dec-23) felt some support overall last week, buoyed by concerns over Southern Hemisphere maize and wheat crops, and the development of the ongoing Israel/Gaza war impacting energy markets.

Though availability and competitiveness of Black Sea supply continues to cap large gains in wheat markets.

Advertisement

Advertisement

Last week, the latest World Agricultural Supply and Demand Estimates (WASDE) were released. The global wheat crop was trimmed slightly for this season on account of smaller crops for Australia, Kazakhstan and Ethiopia, and global ending stock forecasts tightened a little further.

For maize, the USDA trimmed the US maize crop for this season. Though this reduction was offset by larger crops anticipated in Argentina and France.

Southern Hemisphere crops remain in focus. Despite some rain falling, dry weather continues to present a watchpoint for Australian grain crops considering September was the driest on record (since 1900). In September, Australian grain prices saw some gains from the dry weather and with the removal of Chinese tariffs for Chinese imports (boosting barley prices).

As harvest looks to begin, the outlook looks to remain dry in the upcoming months - watch out for any yield information emerging in the coming months.

Advertisement

Advertisement

In Argentina, dry weather is also in focus for wheat crops and maize planting. According to the Buenos Aries Grain Exchange (BAGE) rainfall across key areas will be a clear watchpoint to help planting meet planned acreage. This week, some rain is due across areas of Northern Argentina, though remains below average for many areas.

Despite this supporting news, Black Sea availability remains in the background of wheat markets capping gains.

Egypt again bought Black Sea wheat in its latest tender, with the state buying agency GASC, purchasing 470 Kt of wheat last week. This included 300 Kt of Russian, 120 Kt of Romanian and 50 Kt of Bulgarian wheat (Refinitiv).

UK focus

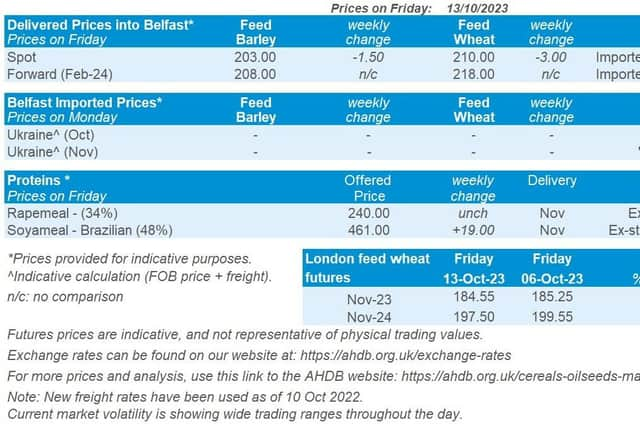

UK feed wheat futures (Nov-23) saw a slight fall last week overall, despite some overall strength for global markets. The Nov-23 contract closed on Friday at £184.55/t, down £0.70/t over the week.

Advertisement

Advertisement

Nov-24 futures closed on Friday at £197.50/t, down £2.05/t over the same period. UK futures saw a little rise on Friday, though Thursday saw more muted gains for UK futures compared to US markets, with the USDA report released near the end of the day’s session .

UK delivered prices followed futures movements last week, Thursday to Thursday. Feed wheat delivered into East Anglia (October delivery) was quoted on Thursday at £179.50/t, down £2.00/t from the week before.

Bread prices continue to hold firm, rising on the week.

On Thursday, bread wheat delivered into the North West (October delivery) was quoted at £268.00/t, up £3.00/t over the week.

Feed barley delivered into East Anglia (October delivery) was quoted on Thursday at £161.00/t. A discount to wheat for same delivery month and destination of £18.50/t.

Advertisement

Advertisement

Last week saw the release of Defra and Scottish government provisional data crop areas, yields and production for 2023. Using this data, UK production for wheat, total barley and oats are estimated at 14.1 Mt, 7.0 Mt and 841 Kt respectively.

Last week saw the release of the latest GB fertiliser prices. Imported AN (34.5%) was quoted for September at £362/t, unchanged from August.

Oilseeds

Rapeseed

Short-term support in crude oil markets could outweigh the well supplied rapeseed market. Longer-term, rapeseed will be pressured with an expected larger soyabean supply.

Soyabeans

Short-term focus is on the US soyabean harvest. Large soyabean areas in South America for 2023/24 combined with no major weather event yet will likely cause pressure on the market longer term.

Global markets

Advertisement

Advertisement

Oilseed markets were mixed last week with an array of both bullish and bearish news.

However, Chicago soyabean futures (Nov-23) gained overall across the week by 1% to close Friday at $470.36/t.

At the start of the week the market felt support from the latest USDA crop progress report, which marginally revised down US soyabean crop conditions. 51% of the crop is now rated good-to-excellent to 08 October, down 1 percentage point from the week before. In the report, the US soyabean harvest is now estimated at 43% complete, this is up on the 5-year average of 37%. A further update will be released this evening.

Other support came to the market after the latest USDA World Agricultural Supply and Demand Estimates (WASDE) were released.

Advertisement

Advertisement

The report cut US soyabean production by 1.1 Mt, with the crop now estimated at 111.7 Mt, which triggered a price rise in Chicago soyabean markets. More information on the WASDE can be found here.

Further bullish news feeding into both the oilseed and vegetable oil complex is the conflict in the Middle East, from the military clash between Israel and Hamas which is deepening political uncertainty and supporting crude oil markets, which is adding some short-term support.

Nearby Brent crude oil futures closed Friday at $90.89/barrel, gaining 7.5% across the week.

However, oilseed markets have been kept in check as bearish news from South America continues to dictate longer-term sentiment. Argentina’s Rosario Stock Exchange upped their soyabean production estimate by 2 Mt for 2023/24, Argentina is now expected to produce 50 Mt of soyabeans.