Northern Ireland weekly market report: 20 February 2023

and live on Freeview channel 276

20 February 2023

Grains

Wheat

Volatility is expected short term as we await news on the Ukrainian export corridor. Should we see an extension, this could add to a slightly bearish price outlook longer term. Longer term, increasing focus is on new-crop condition.

Maize

Markets stay supported by concerns for the Argentinian crop short term. Longer term, the Brazilian crop is forecasted large which limits price gains. Global demand will remain a watchpoint too.

Barley

Barley prices continue to follow the wider grains complex.

Global markets

Advertisement

Advertisement

Global wheat markets felt some weakness overall last week. US wheat futures (May-23) especially fell on concerns for the US economy, regarding hikes in interest rates. Paris wheat markets (May 23) also felt pressure, from lower US prices and competitive Black Sea supplies. However, ongoing concerns about whether the grain export corridor in Ukraine will be renewed capped losses.

The renewal of the Black Sea Initiative, the Ukrainian grain export corridor, remains a key supportive factor in global grain markets. As the 19 March deadline approaches, markets are building some risk into prices due to concerns whether this deal is extended, with Russia unhappy with current sanctions and Ukrainian ships currently queuing for inspections. Expect volatility to continue in the run up to this date. Leaders from Russia and Turkey are due to discuss the deal soon, but no date is yet known.

Ukrainian consultancy, UkrAgroConsult, currently peg the most likely scenario (55%) as an extension of the grain deal, but that we will not see any change in pace of inspections, which could limit grain exports to 4-5Mt/month.

In relation to Russia, their grain export quota came into force on 15 February, set to 30 June for this marketing season.

Advertisement

Advertisement

This season’s quota is 2.5 times larger than last season, at 25.5Mt (APK Inform).

FranceAgriMer reduced their French soft wheat export forecast by 150Kt to 10.45Mt for this season, due to slower demand since January on competitive Black Sea supplies especially into North Africa. However, they increased their barley export forecast, on strong Chinese demand.

Looking to maize markets, Chicago maize futures (May-23) were relatively unchanged last week.

Looking ahead to price movement, rain is due in the next seven days across much of the northern agricultural areas of Argentina, but is this rain enough?

Advertisement

Advertisement

As at 15 February, 45% of the Argentinian maize crop was pegged as ‘poor/very poor’, up 11 percentage points (pp) from the previous week.

IGC released their latest report last week, lowering total grain world production by 8.2Mt this month, to 2,248Mt for 2022/23 due mostly to cuts to maize crops in the US and Argentina.

Total consumption was also cut, down 8.9Mt from January, boosting the end-season carry out figure slightly (though this remains smallest in eight years).

UK focus

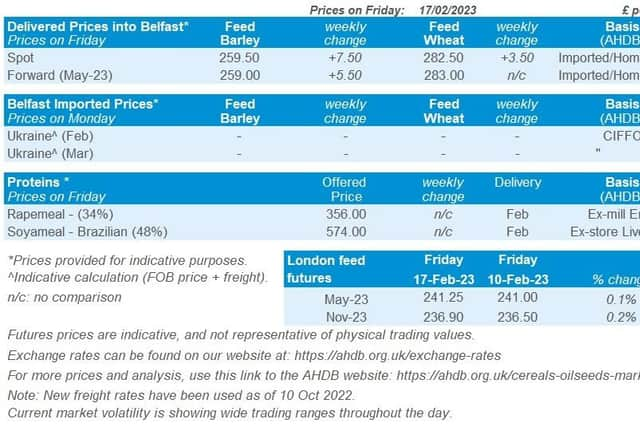

UK feed wheat futures have remained relatively stable week-on-week, with May-23 futures increasing £0.25/t last week (Friday-Friday), closing at £241.25/t. Whilst both Paris and Chicago wheat futures saw small declines in old crop prices (May-23). New crop futures (Nov-23) closed at £236.90/t on Friday, up £0.40/t over the same period.

Advertisement

Advertisement

The sterling has weakened slightly against the euro and the US dollar last week, down 0.4% and 0.2% respectively Friday to Friday.

Domestic delivered prices followed the direction of UK feed wheat futures movements Thursday to Thursday, which was of some overall support.

Feed wheat delivered into East Anglia (Feb-23 delivery) was quoted at £238.00/t on Thursday, up £1.50/t. Bread wheat delivered into the North West (Feb-23 delivery) was quoted at £317.50/t, up £1.00/t over the same period.

Oilseeds

Rapeseed

In the short-term rapeseed prices will be reactive to both palm and soyabean oil prices. Longer-term EU crop conditions are faring well, and the market is forecast to be well supplied.

Soyabeans

Advertisement

Advertisement

Short-term bearish news from Brazil’s harvest weighing on the market, but drought persisting in Argentina is supporting the market. Longer-term the large Brazil soyabean crop has the potential to weigh on the market.

Global markets

Chicago soyabean futures (May-23) were pressured by 1% across the week, closing Friday at $559.27/t. The market was weighing up the drought-hit crops in Argentina, but outweighing this was the record soyabean crop currently being harvested in Brazil and a stronger US dollar.

Last Thursday, Buenos Aires Grain Exchange announced that there will be additional cuts to their Argentina soyabean crop estimate, from the prolonged drought they are experiencing.

The Exchange currently estimate the soyabean crop at 38Mt. In Brazil, the soyabean harvest still lags last season, with 20.9% of the area harvested reported last Friday, down from 32.9% from the same point last year (Safras and Mercado).

Advertisement

Advertisement

Nearby Brent crude oil was pressured last week (-3.9%), closing Friday at $83.00/barrel.

Crude was pressured on worries that US interest rates hikes could weigh on demand. Further to that, mounting signs of ample crude oil and fuel supplies weighed on the market.

Malaysian palm oil futures (May-23) gained 5.1% across the week as a weaker Malaysian ringgit has been supporting the market, along with filtered support from gains in Chicago soyabean oil. Further to this, Indonesia plan to increase the tax and levy on palm oil exports from 16-28 February, which is supporting prices.

Over the next week focus will continue to be on these South American crops, notably for the harvest in Brazil and crop development in Argentina. The seven day forecasts shows widespread rains are expected over much of Argentina’s agricultural region but note this is minimal in areas.

Rapeseed focus

Advertisement

Advertisement

Rapeseed prices gained broadly in line with the support in soyabean oil and palm oil markets. Paris rapeseed futures (May-23) closed at €564.50/t on Friday, gaining €14.00/t across the week (Friday to Friday).

Delivered rapeseed (into Erith, Feb-23) was quoted at £484.00/t on Friday, up £8.00/t across the week.

The reason for the Paris market gaining more than our domestic physical market was due to the time of our delivered survey on Friday, which did not capture the late support on Friday afternoon.