Northern Ireland weekly market report – 20 November 2023

and live on Freeview channel 276

20 November 2023

Grains

Wheat

News on South American weather is still an important factor for market direction. The potential for heavy maize supplies later in the season keeps a bearish sentiment in the market longer-term. Focus is also beginning to turn to Northern Hemisphere crops with concerns over conditions and plantings for harvest 2024.

Maize

Despite unfavourable conditions as of late, South America is still expected to contribute heavily to a global grain surplus in 2023/24, keeping a bearish outlook into 2024. Short-term, Brazilian weather is the key watchpoint.

Barley

Advertisement

Advertisement

Barley markets continue to follow movements in the wider grains complex.

Global markets

Chicago wheat futures (May-24) fell 3.7% last week (Friday-Friday), while Chicago maize futures (May-24) gained 2% over the same period. Both US maize and wheat futures saw gains at the beginning of the week on the back of a weaker US dollar. That said demand for US wheat is thought to be relatively lacklustre, and grain markets were pressured towards the end of the week with an improved weather outlook in Brazil.

Forecasts of much needed rain in Brazil over the next seven days is expected to ease concerns over the area of the Safrinha maize crop due to be planted early next year. With the Safrinha crop, which follows the soyabean harvest, making up for roughly three-quarters of the country’s total maize production, weather over the coming months will remain a watchpoint.

Despite the expiration of the UN-brokered Black Sea grain deal in July, Ukrainian exports continue to flow from the Black Sea. On Friday, the Interfax-Ukraine news agency reported that an estimated 151 ships have used the new ‘humanitarian corridor’ since it was set up in August.

Advertisement

Advertisement

With focus beginning to turn to Northern Hemisphere new crops, officials suggest Ukraine could potentially harvest between 18 Mt to 20 Mt of winter wheat in harvest 2024. This is in comparison to the 22.2 Mt harvested in 2023.

Elsewhere in Europe, much like in the UK, wet weather in France is delaying planting progression of winter wheat. On Friday, FranceAgiMer reported that 71% of the expected soft wheat area had been planted by 13 November and stated that the continuous rainfall over the past month will likely lead to a drop in area and damaged yields. European plantings and crop conditions over the next few weeks will be a key factor to watch.

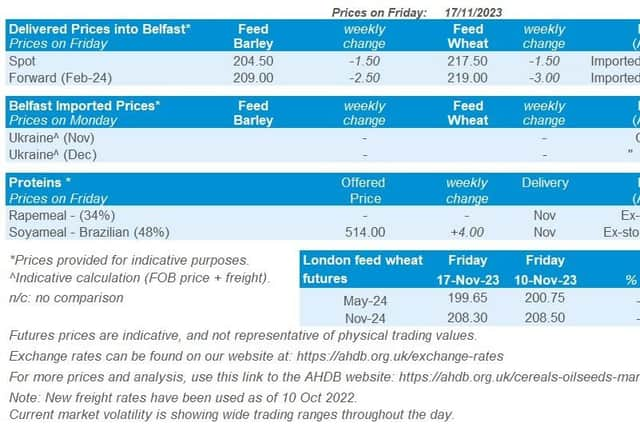

UK focus

Domestic wheat futures followed the overall bearish sentiment in global wheat markets last week. UK feed wheat futures (May-24) closed at £199.65/t on Friday, down £1.10/t across the week. Over the same period, the new crop futures (Nov-24) remained relatively unchanged, down £0.20/t to close on Friday at £208.30/t.

UK delivered prices followed the general downward pressure. February delivery of feed wheat into East Anglia was quoted at £192.50/t, down £4.00/t on the week. Bread wheat delivered into the North West for February was quoted at £276.50/t, down £2.50/t on the week.

Advertisement

Advertisement

Last week, AHDB published the provisional release of the AHDB Early Bird Survey (EBS) of early plantings and planting intentions for harvest 2024. The key takeaways from the survey on the grains side are expected declines in winter wheat and winter barley areas on the year due to the poor autumn conditions, but a rise in spring wheat, spring barley and oat area.

Last week also saw the release of the first crop development report for harvest 2024. The report showed that most winter barley had been sown in reasonable conditions at the end of September and therefore in general looked to be in good condition. On the other hand, perhaps unsurprisingly, the more recently sown winter wheat in the UK is looking poor, with the wheat that is already drilled but not established that is of most concern.

Oilseeds

Rapeseed

Soyabeans are largely going to drive the sentiment of oilseed markets, including rapeseed, going into 2024 and longer-term pressure is expected. However, focus turns towards rapeseed areas being planted for harvest 2024, initial estimates suggest area reductions in the EU.

Soyabeans

Brazilian weather is still the hot topic driving market sentiment, though forecast rains have eased concerns on production outlooks. The recent cuts to forecasts from adverse dry weather will not be enough to change long-term sentiment yet.

Global markets

Advertisement

Advertisement

Chicago soyabean futures (May-24) closed Friday at $502.97/t, down 0.2% across the week. Mid-week the May-24 contract hit its highest point since the end of August on Brazilian weather concerns and Chinese demand. However, prices reduced later in the week as weather outlooks in Brazil improved.

Dryness in the north of Brazil, a typical impact of El Niño weather events, is still dominating this market and the El Niño is expected to continue into 2024. The Brazilian soyabean crop is expected to be a record currently, however, the dry weather in the north means some forecasts have been cut. The consultancy AgRural lowered its forecast for 2023/24 to 163.5 Mt, down from Octobers forecast of 164.6 Mt and announced that new cuts were possible at the end of this month depending on the weather. It is also reported that in parts of Mato Grosso some farmers have turned from soyabeans to alternative crops like cotton (LSEG).

In Argentina, it’s the opposite. Recent rainfall across the North means the soyabean area is increasing. The Buenos Aires Grain Exchange last Thursday increased its soyabean area projection to 17.3 Mha, up from the previous 17.1 Mha forecast.

Demand is strong for soyabeans in the US, the National Oilseed Processors Association estimated October soyabean crush at 5.2 Mt, the largest crush on record. This is up 14.7% from September and up 2.9% year-on-year. The end of month US soy oil stocks also fell to the lowest point in nearly nine years. Soaring demand of feedstock for biofuels has ensued a large expansion in crushing capacity.

Advertisement

Advertisement

Furthermore, there was large export demand for US soyabeans. The USDA reported sales (to week ending 09 Nov) at 3.9 Mt, this the highest weekly volumes sales since 2012, with a surge in Chinese buying.

Rapeseed focus

Rapeseed futures followed a similar pattern to Chicago soyabean futures last week. Surging support across the early part of the week was followed by pressure. However, Paris rapeseed futures (May-24) did marginally gain by €2.75/t across the week, to close Friday at €441.25/t.