Northern Ireland weekly market report - 23 October 2023

and live on Freeview channel 276

23 October 2023

Grains

Wheat

Short-term, Southern Hemisphere crops remain in focus, with weather a key watchpoint. Longer-term, competitive Black Sea supplies and a heavy feed grain balance will likely weigh on prices.

Maize

Maize plantings in Argentina are something to watch over the coming weeks with ongoing dry weather causing concern. Longer-term, ample global supplies are still expected.

Barley

Advertisement

Advertisement

Much like wheat, Australian weather is a key driver in barley markets short-term. Longer-term, barley prices continue to follow the wider grains complex.

Global markets

Global grain markets were generally supported last week, with Chicago wheat futures (Dec-23) and Paris milling wheat futures (Dec-23) up 1.1% and 1.2% respectively Friday to Friday. European prices saw greater price climbs mid-week, with a weakening euro against the US dollar making EU origin more competitive on the global market.

Recent rains across parts of Australia are thought to have improved yield potential, and after cuts earlier in the season, production forecasts are on the rise. IKON commodities said on Friday that Australia was 3% through its harvest, and forecast wheat production is at 28 Mt, up from a month ago when less than 25 Mt was forecast.

Rains in Argentina are also improving planting conditions following concerns over a lack of soil moisture. Over the weekend, between 1.2 and 3.0 inches of rainfall was recorded in large areas of western Buenos Aires, southeastern Cordoba, and southwestern Santa Fe (Refinitiv). There are hopes that the rain will also improve conditions of the country’s wheat crop. On Thursday, the Buenos Aires Grain Exchange rated almost half of the wheat crop in fair to poor condition. As harvest is set to begin in the coming weeks, crop condition will remain something to watch moving forward.

Advertisement

Advertisement

Competitive Black Sea supplies continue to weigh on the market and limit any major gains. According to Refinitiv, agricultural producers in Ukraine believe that a new Black Sea grain corridor could enable exports of up to 2.5 Mt of food a month. While the deal set up by the UN and Turkey expired in July, Kyiv has since opened a temporary humanitarian corridor. So far, a total of 40 cargo vessels have entered the corridor, this will be something to monitor over the next few weeks.

UK focus

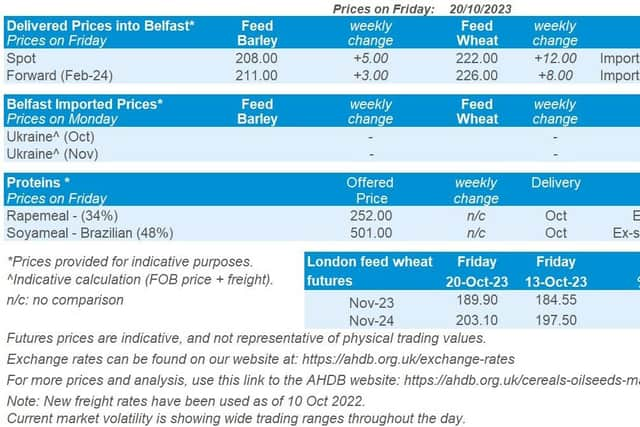

UK feed wheat futures (Nov-23) closed at £189.90/t on Friday, up £5.35/t from a week earlier following gains experienced in European wheat markets, despite pressure from Russian wheat exports.

UK delivered prices followed futures movements, with feed wheat delivered into East Anglia for October delivery up £7.00/t on the week, quoted at £186.50/t on Thursday.

Bread wheat delivered into the North West (Oct delivery) was quoted at £270.50/t, up £2.50/t Thursday to Thursday suggesting the premium of UK bread wheat over feed wheat futures remains strong.

Advertisement

Advertisement

Last Tuesday, the 2023/24 AHDB Early Balance Sheet estimates of wheat and barley were released, looking at domestic supply and demand for the season ahead. Wheat is forecast to have a tighter balance on the year following a 10% drop in production and increased domestic consumption from both the human and industrial (up 5%) and animal feed (up 3%) sectors. However, barley is expected to have a heavier balance this year as although production is forecast to fall by 5%, falls in consumption prevent a tight supply, with an estimated 3% decline in animal feed consumption.

Oilseeds

Rapeseed

Rapeseed markets are well supplied at the moment as Canadian canola harvest comes to a close. Longer-term fundamentals in the wider oilseed complex could weigh on prices.

Soyabeans

Short-term US harvest is being outweighed by strong demand. Longer-term, large South American crops are expected, but this next month is critical as plantings progress.

Global markets

Chicago soyabean futures continue to strengthen (+1.7%) across the week, closing Friday at $478.45/t. Despite the rapid US soyabean harvest progression, strong demand combined with some weather issues in Brazil outweighed this. There was marginal pressure at the end of the week from an element of profit taking.

Advertisement

Advertisement

At the start of the week the USDA estimated that 62% of US soyabeans had been harvested (to October 15th). This progress is ahead of the 5-year average of 52% and also exceeded trade expectations, which ranged from 54-60% - another update is expected this evening.

Strong demand continues for US soyabeans, at the start of last week the National Oilseed Processors Association estimated that US soyabean crush was 165.5 million bushels in the month of September, above expectations. It was also estimated that US soy oil stocks were at their lowest in 9 years. This supported Chicago soyabean markets at the start of the week.

Further to that, there are weather issues in Brazil as drought in the North part of the country is delaying the on-going soybean plantings. Despite the rapid start to the campaign, it was reported last Friday that Brazilian soyabean plantings were estimated at 29.9%, this is now below the same point last year when plantings were at 37.6% (Patria Agronegocios).

There is apprehension that scarce rains in the North combined with high temperatures could possibly lead to both lower yields and replanting of some areas. In the South of Brazil, excessive rains in areas like Rio Grande Do Sul is leading to planting delays.

Advertisement

Advertisement

This information right now is critical for long-term market direction. Markets have priced in this large Brazilian soyabean crop which is expected to weigh on oilseed prices longer-term. If abnormal adverse weather continues and there are significant changes to Brazilian production, this will feed into prices. For 2023/24, Brazil is expected to currently export 100 Mt of soyabeans (Abiove).

Rapeseed focus

Paris rapeseed futures (Nov-23) were pressured closing Friday at €394.00/t, down €31.50/t across the week. Paris rapeseed futures were pressured, despite gains in soyabean and palm oil futures. Across the week there was pressure on ICE canola futures (Nov-23), which fell sharply on a technical setback with heavy volumes, with many traders selling once the downturn begun.

Domestic delivered rapeseed (into Erith, Oct-23) was quoted at £356.50/t, up £2.00/t across the week. The pressure in the futures market means physical pricing is much more closely aligned.