Northern Ireland Weekly Market Report

Grains

Wheat

Global wheat markets continued to fall last week as the potential impact of a global coronavirus pandemic has further weighed on consumption outlooks.

Maize

Competing factors of global coronavirus fears are at odds with dry weather in Argentina and Brazil creating conflicting global supply and demand outlooks.

Barley

Advertisement

Advertisement

Domestic feed barley prices continue to price at a heavy discount to wheat, barley will remain under pressure as large domestic supplies persist, and large new crop expectations remain.

Global Markets

Global wheat markets continued to fall last week as the potential impact of a global coronavirus pandemic has weighed on consumption outlooks while new crop conditions in the Black Sea remain positive. Following a prolonged period of net Managed Money long positions in Chicago wheat, a large sell off has reduced the long position by over 25% and old-crop Chicago wheat futures (May-20) fell a further $3.40/t. With funds remaining in a long position, there could be further downward pressure should the sell off continue.

Maize recorded a more volatile week, with mid-week gains in Chicago futures, followed by a sell off in line with other commodity markets. There remains uncertainty for southern hemisphere maize production, with dryness in Argentina and Brazil posing questions about yield outlooks, supporting domestic prices.

Tomorrow will see the next release of the USDA world agricultural supply and demand estimates (WASDE). Amid uncertainty regarding global consumption and trade outlooks, many will look to the USDA WASDE. However with so much uncertainty, and a traditionally conservative approach, there are unlikely to be any major changes to wheat and maize supply and demand estimates.

UK focus

Advertisement

Advertisement

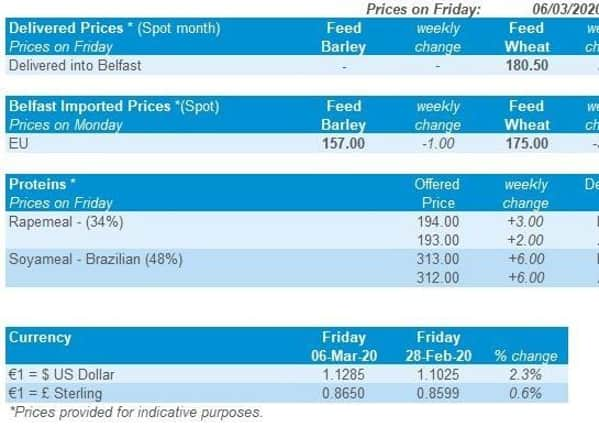

From Friday 28 February to Friday 6 March, UK feed wheat futures gained £0.50/t, the initial gains happened early on in the week, supported by a weakened value of the pound. Falling from a high of £1=€1.1733 on Friday 28, the pound fell to a low of £1=€1.1433 on Wednesday 4 March, down over 2.5%.

The value of the pound will remain vulnerable to the global economic outlook and Brexit negotiations. However, as global commodity markets continued to fall away on coronavirus fears, and with the value of the pound stabilising, both old and new crop futures were unable to maintain gains recorded from early last week.

Oilseeds

Rapeseed

Support in the middle of the week for rapeseed was driven by crude oil. However, volatility within Brent crude oil will pressure rapeseed markets for the foreseeable future.

Soyabeans

Economic fallout from the coronavirus is not helping soyabean markets at the moment. Furthermore, plentiful supplies from the ongoing Brazilian harvest is providing a long-term bearish outlook.

Global Markets

Advertisement

Advertisement

Chicago soyabean futures (May-20) closed on Friday at $327.49/t, down $0.55/t on the Friday before. Lacklustre export demand and broad-based selling from the global economic downturn has pressured prices.

Nearby Malaysian palm oil futures gained 5.7% across the week, despite global commodities taking a downturn from the coronavirus, palm oil gained off the back of increased demand from Africa and the Middle East ahead of Ramadan. However, both soyabean and palm oil have started this week drastically pressured as Brent crude oil trades down.

Official data released on Saturday from the general administration shows that Chinese imports of US soyabeans for Jan/Feb increased 14.2% year-on-year. This increase was in part from vessels arriving from the US that were booked at the end of 2019 officially clearing customs.

It’s reported that China has granted a tariff-free exemption to some crushers to import US soyabeans. However, the US are less price competitive at the moment as Brazil’s exports increase as they are halfway through their soyabean harvest. The US could gain competitiveness later into the season as Brazilian exports reduce.

Rapeseed focus

Advertisement

Advertisement

Paris rapeseed futures (May-20) closed on Friday at €337.75/t, up €2.50/t on the week before. Despite closing up across the week from successive gains at the start of the week, there is a degree of volatility at the moment, as rapeseed starts this week pressured, like all global commodities.

Brent crude oil futures contract lost 10.4% across the week, the contract fell below $50.00/barrel and closed on Friday at $45.27/barrel. A

s of 13:00 today the contract had traded as low as $34.70/barrel.

A decline in oil prices adds concerning demands for agricultural commodities especially those are used in renewable fuels.

Last week’s delivered rapeseed (Erith, Mar-20) gained £4.00/t, to be quoted at £333.50/t.

Some of this gain was from sterling weakening 0.6 % against the euro Friday to Friday to close at £1 = €1.156.