Northern Ireland Weekly Market Report

11 May 2020

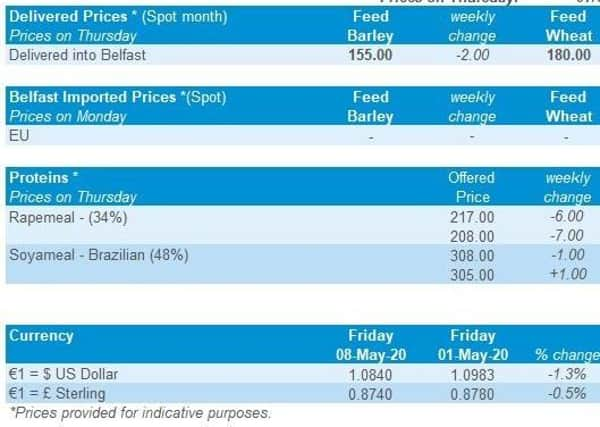

Grains

Wheat

Weather prospects for European and Black Sea wheat remain similar to last week, and provide a somewhat bullish sentiment for markets. Pressures remain in the longer term from a build-up in global wheat stocks.

Maize

China opting to purchase large volumes of US maize provides support for maize markets. However, the WASDE report tomorrow could offer a bearish sentiment with very high US new-crop maize stock figures expected.

Barley

Advertisement

Advertisement

Pressure continues with large supplies expected domestically and globally. Some support is gained from China proposing hefty tariffs on imports of Australian barley.

Global Markets

Global new-crop wheat futures gained slightly over last week, finding support from a frost across the US Midwest. News of some European countries starting to ease lock-down measures also lent support. However, markets will likely see pressure this week from the USDA supply and demand estimates report released tomorrow.

The report could detail the low demand for US ethanol with an increase to maize ending stocks for old crop. In addition, this will be the first USDA report to estimate global ending stocks for the 2020/21 season. Industry pre-release polls by Reuters predict maize ending stocks at a 30-year high for the 2020/21 season. In anticipation, US managed money funds extended net-short positions in US maize to their highest point since May last year. There is upside potential, should stock estimates come in lower than expected.

European wheat futures climbed last week as the weather market continued. Extensive frosts across the US Midwest at the end of last week created concerns for slower spring plantings and damage to winter wheat and emerging maize crops. Improving rainfall figures for Black sea and European regions offer some pressure, though more rainfall will be needed across key producing regions.

Advertisement

Advertisement

The weekly update to French crop ratings left soft wheat and winter barley conditions unchanged at 57% and 53% “good” or “excellent” respectively.

UK focus

New-crop wheat futures (Nov-20) gained in the run-up to the bank holiday, last week, increasing £2.70/t (Fri – Thurs) to close at £163.70/t on Thursday.

Last week, the AHDB end-Feb UK cereal stocks held by merchants, ports and co-ops estimates were released. The report detailed home-grown wheat stocks as at 21 Feb, were 25.9% higher than the same period last year, at 1.28Mt. Stocks of home-grown barley were at 931.3Kt, relatively unchanged (-0.3%) from last February.

Defra released its estimate of on-farm stock at end of February, last week. Figures detail wheat stocks at 4.4Mt, an 11% increase on last year. Barley stocks however, are estimated at 1.2Mt, a 62% increase on last year. When added to potential new crop barley production figures, this reinforces the notion of a large supply overhanging grain markets.

Advertisement

Advertisement

Sterling largely tracked sideways over last week in the run-up to yesterday’s government announcement. News that UK restaurants, pubs and other hospitality providers will not re- open until July at the earliest, should pressure grain markets. Against the Euro, Sterling had fallen 0.5% as of 1pm GMT this afternoon to be at £1=€1.1374.

Oilseeds

Rapeseed

A decreased Canadian canola area, dry conditions in parts of the EU and Ukraine, combined with expectations that the EU will remain in deficit continues to maintain oilseed rape at a premium in the oilseed complex.

Soyabeans

While improved Chinese purchases of US soyabeans provided some positive news, it is not enough to outweigh large US stocks and depressed global demand.

Global Markets

Crude oil markets recorded a small degree of support last week, recovering from the April $20/bbl lows, to trade near $30/bbl again by the end of last week. However, with global fuel demand still minimal and storage capacity remaining a concern, crude oil markets are likely to remain under pressure until demand returns and storage is unwound.

Advertisement

Advertisement

In a small reprieve from the continued bearish outlooks for US soyabeans, continued sales to China have provided some positive news. In the week ending 23 April, China purchased 619Kt of current crop US soyabeans and again in the week ending 30 April, a further 288Kt. However, while the purchases provided some positive news, US accumulated exports of 34.2Mt are falling short of the current 48.0Mt USDA end-season forecast.

Tomorrow will see the release of the next USDA World Agricultural Supply and Demand Estimates, including the first estimates for the 2020/21 season. With current season US exports unlikely to reach the previous estimate, global pandemic demand falls, and a large South American crop being harvested, a bearish report is likely.

Rapeseed focus

New crop Paris rapeseed futures (Nov-20) closed at €376.50/t on Thursday 7 May, up €6.00/t from Thursday 30 April, the highest close since the first week in March. In sterling terms over last week, with currency volatility, the same new crop contract gained £7.60/t, closing at £329.93/t.

Meanwhile as old crop demand remains subdued, domestic delivered oilseed rape recorded minimal gains, with May delivery to Erith gaining just £0.50/t week-on-week at £320.00/t

Advertisement

Advertisement

The Canadian canola area is set for a second consecutive year of declines, and at 8.34Mha this would be the lowest since 2013. Following multiple years of drought in Australia, an increased importance has been placed upon Canadian canola imports. At 1.5Mt, Canadian canola has represented 29% of EU rapeseed imports in 2019/20.

However, planting conditions in the east of Australia are much-improved positive with replenished soil moisture, and although Western Australia moisture remains below average, more rainfall is forecast.